Company Bitcoin adoption continues its proliferation as extra firms pursue accumulation methods for his or her treasuries. Corporations can profit from capital appreciation, diversification, and an inflation hedge if executed correctly.

Nonetheless, not all Bitcoin acquisition methods are created equal. If an organization’s sole objective is to carry BTC with out ample assets or scale, it could actually threat whole collapse throughout prolonged bear market durations. A sequence response might additional amplify downward stress that might show catastrophic.

Various Approaches to Company Bitcoin Holdings

Institutional Bitcoin adoption is rising worldwide, with Bitcoin Treasuries information indicating that holdings have doubled since 2024. Public firms now collectively personal over 4% of the whole Bitcoin provide.

Apparently, this enhance in quantity additionally represents a broadening vary of causes for doing so.

Some firms, most notably Technique (previously MicroStrategy), deliberately pursue such a playbook to grow to be a Bitcoin treasury holding firm. The transfer labored nicely for Technique, whose provide accounts for 53% of whole firm holdings with over 580,000 BTC.

Different companies, like GameStop or PublicSquare, have taken a distinct strategy, prioritizing publicity over aggressive accumulation. This state of affairs is perfect for companies that merely wish to add BTC to their steadiness sheets whereas persevering with to concentrate on their core companies.

Initiatives like this carry far much less threat than firms whose core enterprise solely holds Bitcoin.

Nonetheless, the growing pattern of firms including Bitcoin to their monetary reserves solely to dedicate themselves to holding Bitcoin carries profound implications for his or her companies and Bitcoin’s future.

How Do Bitcoin-Targeted Firms Entice Buyers?

Constructing a profitable Bitcoin treasury holding firm includes rather more than simply aggressively shopping for Bitcoin. When a enterprise’s sole objective turns into Bitcoin holding, it will likely be solely valued based mostly on the Bitcoin it holds.

To draw traders to purchase their inventory relatively than simply holding Bitcoin immediately, these firms should outperform Bitcoin itself, reaching a premium often called A number of on Internet Asset Worth (MNAV).

In different phrases, they need to persuade the market that their inventory is value greater than the sum of its Bitcoin holdings.

Technique implements this, for instance, by convincing traders that by shopping for MSTR inventory, they aren’t simply buying a set quantity of Bitcoin. As an alternative, they’re investing in a method the place administration actively works to extend the quantity of Bitcoin attributed to every share.

If traders imagine MicroStrategy can persistently develop its Bitcoin per share, they may pay a premium for that twin capacity.

Nonetheless, that’s only one a part of the equation. If traders purchase into that promise, Technique has to ship by elevating capital to purchase extra Bitcoin.

The MNAV Premium: How It’s Constructed, How It Breaks

An organization can solely ship an MNAV premium if it will increase the whole quantity of Bitcoin it holds. Technique does this by issuing convertible debt, which permits it to borrow funds at low rates of interest.

It additionally leverages At-The-Market (ATM) fairness choices by promoting new shares when their inventory trades at a premium to its underlying Bitcoin worth. Such a transfer allows Technique to amass extra Bitcoin per greenback raised than present shares, growing Bitcoin per share for present holders.

This self-reinforcing cycle—the place a premium permits environment friendly capital raises, which fund extra Bitcoin, strengthening the narrative—helps maintain the elevated inventory valuation past Technique’s direct Bitcoin holdings.

Nonetheless, such a course of includes a number of dangers. For a lot of firms, the mannequin is immediately unsustainable. Even a pioneer like Technique endured heightened stress when Bitcoin’s worth dropped.

Nonetheless, over 60 firms have already adopted a Bitcoin-accumulating playbook through the first half of 2025. As that quantity grows, new treasury firms will face the related dangers much more acutely.

Aggressive BTC Accumulation Dangers for Small Gamers

Not like Technique, most firms lack scale, a longtime repute, and the “guru standing” of a pacesetter like Michael Saylor. These traits are essential for attracting and retaining the investor confidence wanted for a premium.

In addition they don’t usually have the identical creditworthiness or market energy. Understanding this, smaller gamers will doubtless incur increased rates of interest on their debt and face extra restrictive covenants, making the debt costlier and tougher to handle.

If their debt is collateralized by Bitcoin in a bear market, a worth drop can shortly set off margin calls. Throughout an prolonged interval of downward stress, refinancing maturing debt turns into extraordinarily troublesome and dear for already overburdened firms.

To make issues worse, if these firms have shifted their core operations to focus solely on Bitcoin acquisition, they haven’t any various enterprise cushion that generates a secure and separate money circulate. They grow to be fully depending on capital raises and Bitcoin’s worth appreciation.

When a number of firms take such a transfer concurrently, the results for the larger market can go south dramatically.

Does Company Bitcoin Adoption Danger a “Demise Spiral”?

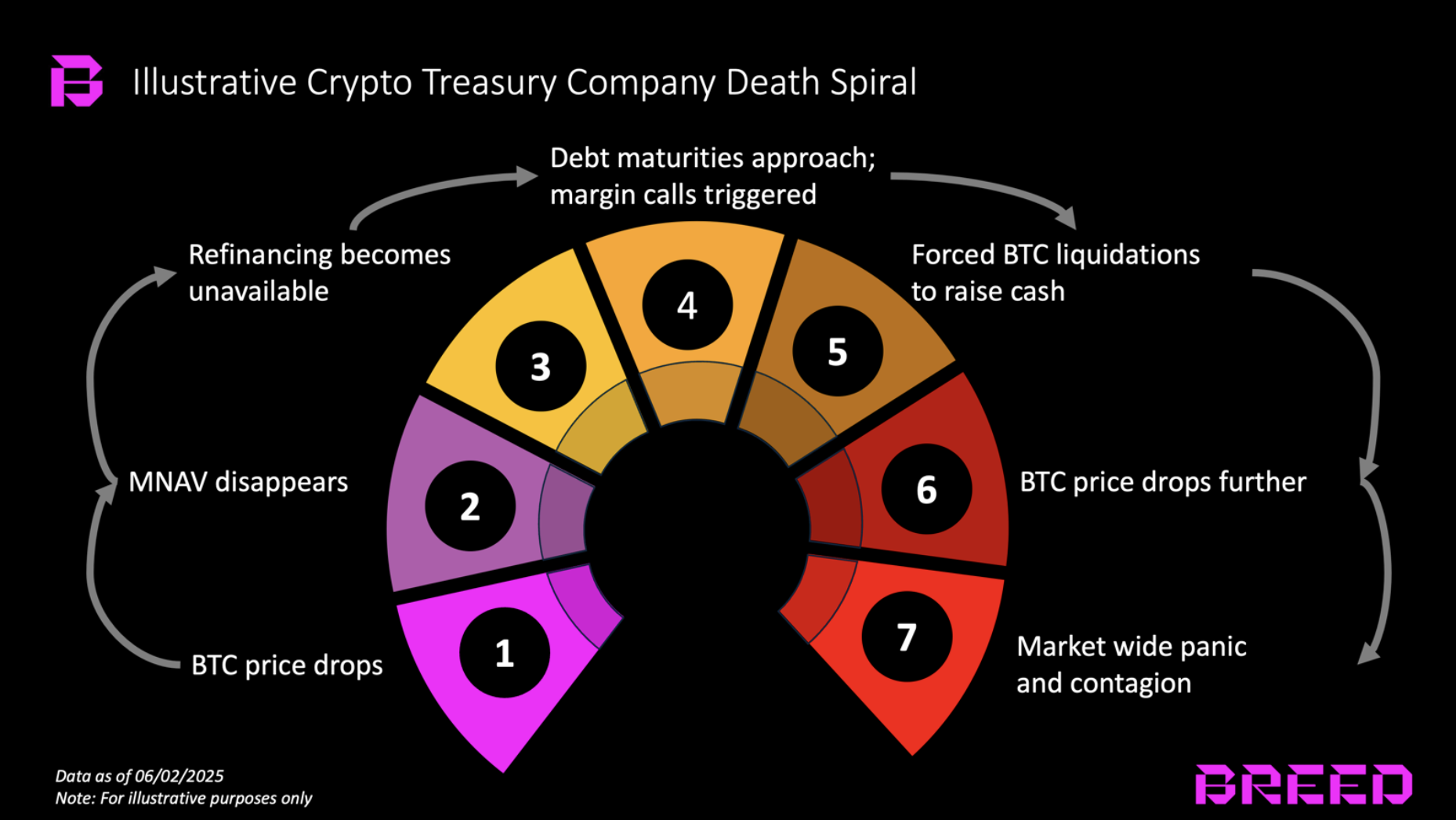

If many smaller companies pursue a Bitcoin accumulation technique, the market penalties throughout a downturn will be extreme. If Bitcoin’s worth falls, these firms could run out of choices and be pressured to promote their holdings.

This widespread, distressed promoting would inject an unlimited provide into the market, considerably amplifying downward stress. As seen through the 2022 crypto winter, such occasions can set off a “reflexive loss of life spiral.”

The pressured promoting by one distressed firm can additional drive Bitcoin’s worth down, triggering pressured liquidations for different companies in an identical place. Such a damaging suggestions loop can provoke an accelerated market decline.

In flip, extremely publicized failures might harm broader investor confidence. This “risk-off” sentiment might result in widespread promoting throughout different cryptocurrencies resulting from market correlations and a normal flight to security.

Such a transfer would additionally inevitably put regulators on excessive alert and spook off traders who could have thought-about investing in Bitcoin at one level.

Past Technique: The Dangers of Going “All-In” on Bitcoin

Technique’s place as a Bitcoin treasury holding firm is exclusive as a result of it was a primary mover. Solely a handful of firms match Saylor’s assets, market affect, and aggressive benefit.

The dangers related to such a playbook are numerous and, if proliferated, will be detrimental to the larger market. As extra public firms transfer so as to add Bitcoin to their steadiness sheets, they need to fastidiously determine between getting some publicity or going all-in.

In the event that they select the latter, they need to cautiously and totally weigh the results. Although Bitcoin is at present at all-time highs, a bear market isn’t fully out of the query.

Disclaimer

Following the Belief Undertaking tips, this function article presents opinions and views from trade consultants or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially replicate these of BeInCrypto or its employees. Readers ought to confirm info independently and seek the advice of with an expert earlier than making choices based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.