Bitcoin (BTC) worth is within the six-figure territory, with institutional capital flooding the market. With this, analysts now cope with the query: May Satoshi Nakamoto, the elusive creator of Bitcoin, develop into the wealthiest particular person on the planet earlier than the yr ends?

With roughly 1.1 million BTC attributed to Satoshi, his holdings at the moment are price over $130 billion at present market costs.

$320,000 BTC or Bust: What Would It Take for Satoshi to Eclipse Elon Musk in 2025?

With the precise situations, Satoshi may develop into the richest particular person on Earth earlier than the yr ends. It will imply eclipsing Elon Musk’s estimated $350–400 billion fortune, largely tied to Tesla, SpaceX, and X (Twitter).

For Satoshi to overhaul him, Bitcoin would want to hit between $320,000 and $370,000, a 2.7x to three.1x enhance from present ranges.

Nonetheless, reaching that milestone means greater than only a worth goal. It’s a referendum on Bitcoin’s world adoption, macroeconomic upheaval, and the mainstreaming of digital property in how traders, together with institutional or TradFi, measure wealth.

Chatting with BeInCrypto, a number of consultants mentioned it’s not impossible for Satoshi Nakamoto to develop into the richest particular person by the tip of 2025, however they acknowledged that the timeline is simply too compressed.

“If not in 2025, 2026 appears to be a certain guess,” Vikrant Sharma, CEO of Cake Pockets creator Cake Labs, advised BeInCrypto.

Which means whereas speculative, this worth stage just isn’t inconceivable, with the timeline demanding aggressive capital inflows, macro tailwinds, and regulatory breakthroughs.

Can Establishments Push BTC to $320,000 by Yr-Finish?

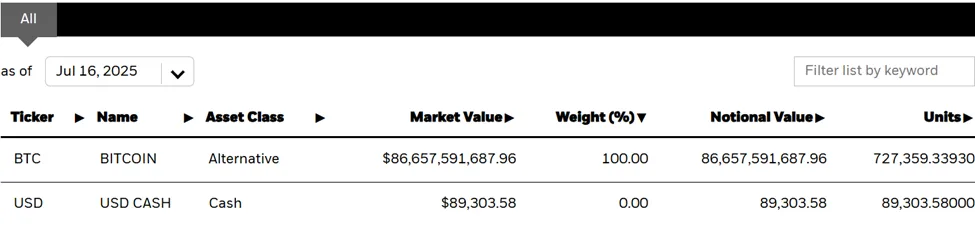

For the reason that approval of Bitcoin ETFs (exchange-traded funds), institutional momentum has surged. BlackRock’s IBIT now holds roughly 727,359 BTC.

Capital inflows into spot ETFs are outpacing many analysts’ expectations, with studies suggesting BlackRock’s IBIT ETF may hit $100 billion in property this month.

But Bitcoin’s transfer from $118,000 to $320,000 in 5 months requires extra than simply continuation. It requires acceleration on a historic scale.

“For Bitcoin to succeed in $320,000 in 5 months, institutional shopping for should exceed every part witnessed up to now. That may take one thing enormous — just like the US saying a Bitcoin strategic reserve or sovereign wealth funds going all-in,” mentioned Maksym Sakharov, co-founder and CEO of decentralized on-chain financial institution WeFi, in a press release to BeInCrypto.

Even with Treasury stress, dovish pivots, and geopolitical instability appearing as tailwinds, the percentages of every part aligning inside 2025 are slim, however not unimaginable.

“It will require the alternative of a black swan occasion…Relentless institutional inflows, bullish regulatory information, main central banks easing coverage, and large firms aggressively including BTC,” mentioned OKX International CCO Lennix Lai.

The Exclusion Paradox: Why Satoshi Isn’t on the Wealthy Checklist

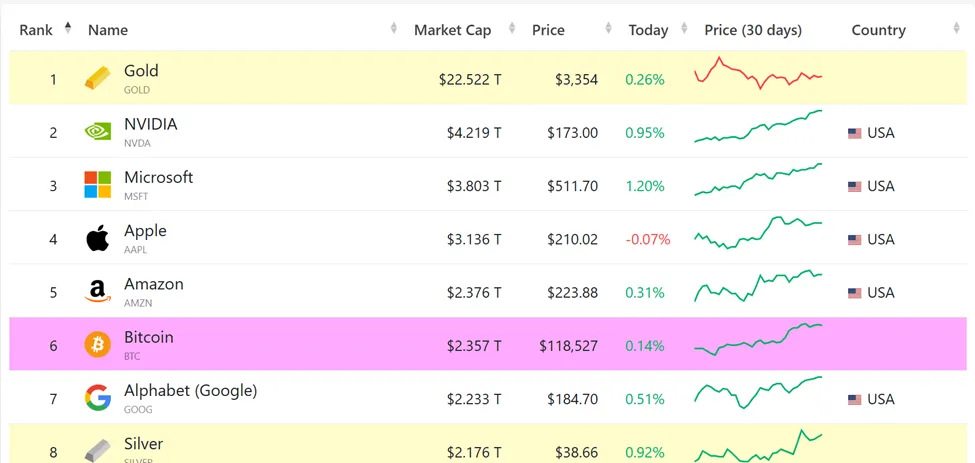

Regardless of holding sufficient Bitcoin to rival nation-states, Satoshi doesn’t seem on the Forbes or Bloomberg billionaire lists. Crypto, although a $3.9 trillion asset class, stays underrepresented in mainstream wealth rankings. Specialists largely ascribe this to custody, attribution, and transparency points.

“Satoshi would rank eleventh globally in the event that they included his Bitcoin holdings,” Sakharov identified.

Whereas alternate founders like Binance’s Changpeng Zhao (CZ) or Coinbase CEO Brian Armstrong have made the lower, a lot of their wealth is counted by way of firm valuations and never self-custodied crypto.

“It’s absurd at this level…Their methodology appears to be like more and more outdated,” he added.

In the meantime, Sharma famous that holding Bitcoin in self-custody is warranted given its heft among the many largest asset class by market cap.

Sharma additionally ascribed this option to central banks’ fixed strikes to depreciate fiat, which makes Bitcoin extra enticing.

“Why wouldn’t you maintain the fifth largest asset class by market cap? With central banks always making strikes to depreciate fiat, a transfer to sound cash appears inevitable,” Sharma advised BeInCrypto.

Custody, Disclosure, and the Way forward for Billionaire Wealth Rankings

Infrastructure must catch up for crypto to be handled on par with shares or actual property. Custodial audits, self-custody verification, and reporting requirements are nonetheless creating.

In response to Sakharov, procedural challenges now overshadow technical considerations, with wealth managers nonetheless missing reporting requirements that give crypto the identical belief as equities.

“If wealth is held by way of ETFs or Bitcoin treasury firms, it’s simple to report, however self-custody complicates disclosure — and Forbes isn’t but outfitted for that nuance,” Sharma added.

Nonetheless, the winds are shifting, with audits turning into extra widespread. Wealth managers are warming as much as recommending 5–10% crypto allocations.

Sovereign wealth funds are additionally eyeing BTC, which may culminate within the integration of crypto holdings into world billionaire rankings.

The Billionaire No person Can Discover

In the meantime, Bitcoin is not fringe. From ETFs to treasuries to central financial institution gold comparisons, the pioneer crypto has totally entered the institutional period.

But its most enigmatic holder, Satoshi Nakamoto, stays an anomaly, holding a fortune bigger than complete nations, however nonetheless absent from each wealthy listing.

Whether or not Bitcoin hits $320,000 this yr or subsequent, some might discover it fascinating to know who Satoshi truly is fairly than whether or not he turns into the world’s richest particular person.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.