Information exhibits the Ethereum futures quantity has flipped that of Bitcoin, an indication that robust speculative curiosity is flooding into the asset.

Ethereum Futures Quantity Has Shot Up Alongside Value Rally

Based on information from the analytics agency Glassnode, Ethereum has managed to surpass Bitcoin by way of futures buying and selling quantity once more. The buying and selling quantity right here naturally refers back to the quantity of buying and selling {that a} given asset noticed on the totally different centralized exchanges throughout the previous day. Within the context of the present matter, the amount related to the futures market particularly is of curiosity.

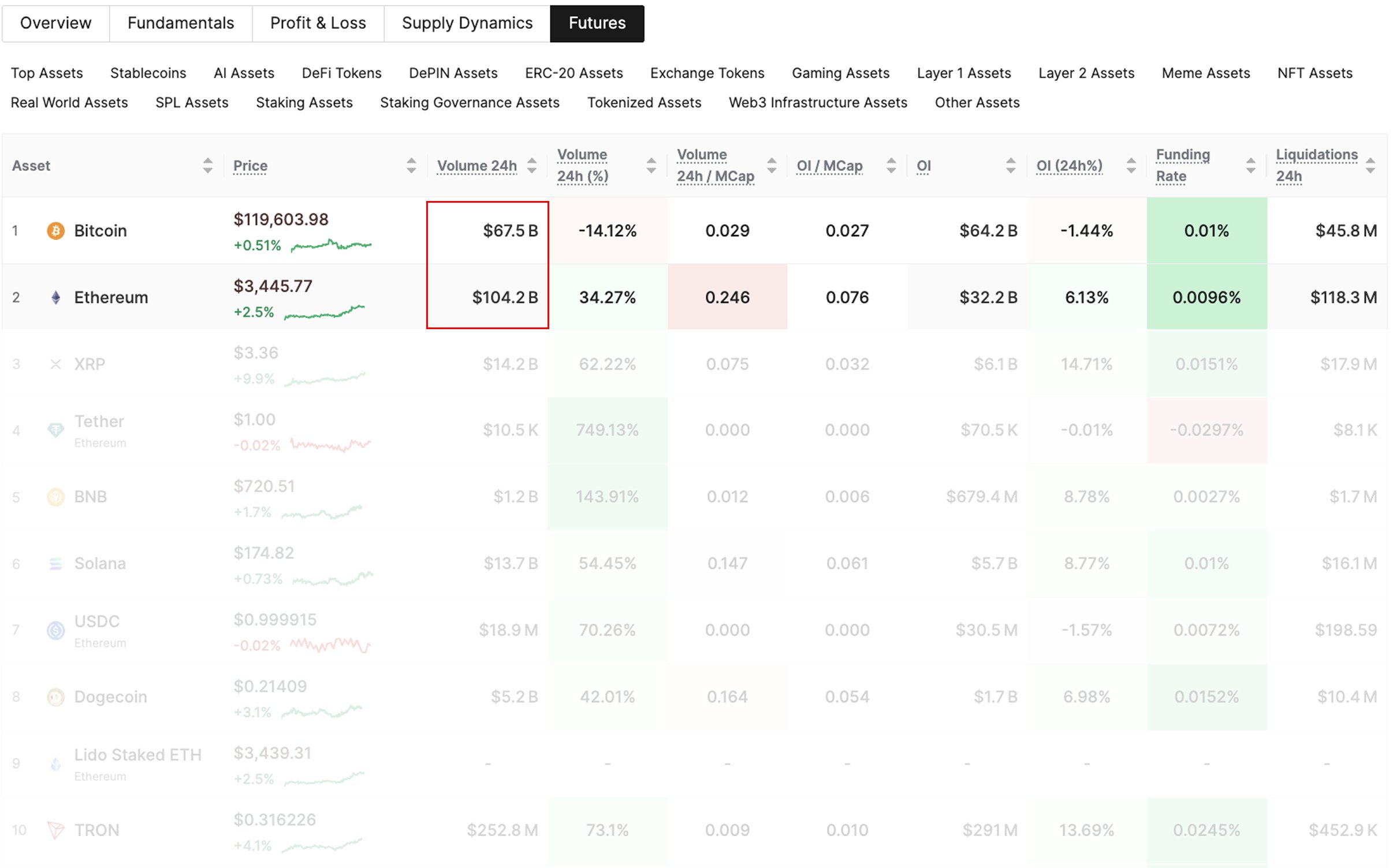

Under is a desk that exhibits how this metric in contrast between Bitcoin and Ethereum on the time of Glassnode’s publish.

Seems to be just like the ETH futures quantity far outweighs the BTC one | Supply: Glassnode on X

As is seen, Bitcoin registered a futures buying and selling quantity of $67.5 billion, notably decrease than the $104.2 billion determine witnessed by Ethereum. This isn’t one thing that ordinarily occurs, because the primary cryptocurrency normally observes extra speculative demand than ETH or the altcoins.

In the identical desk, information of some different futures-related indicators can be proven. The BTC Open Curiosity, a metric that retains observe of the whole quantity of futures positions presently open on all derivatives platforms, sat at $64.2 billion on the time of the publish.

The identical indicator for ETH was at $32.2 billion, indicating that the unique digital asset was nonetheless far forward by way of whole market positioning. That mentioned, the 24-hour change within the metric stood at a optimistic 6.1% for Ethereum, whereas Bitcoin noticed a drop of 1.4%

The contemporary demand for ETH has come as its worth has damaged away from the market, accompanied by a powerful wave of inflows into the spot exchange-traded funds (ETFs).

Apparently, whereas all this consideration got here towards the cryptocurrency, its common Funding Price nonetheless didn’t flip too optimistic. The Funding Price is an indicator that retains observe of the quantity of periodic charges that merchants on the futures market are exchanging between one another.

When this metric is inexperienced, it means the lengthy traders are paying a premium to the quick ones with the intention to maintain onto their positions. Such a development implies the presence of a bullish mentality among the many merchants.

From the desk, it’s obvious that the Funding Price stood at 0.0096% for Ethereum even after the spike in futures buying and selling quantity. This was lower than Bitcoin’s worth of 0.01%. Thus, whereas contemporary positioning is happening for ETH, it appears the traders are nonetheless not getting too optimistic.

“This setup leans bullish: robust speculative curiosity, rising OI, and no indicators of overheating but,” notes the analytics agency.

ETH Value

On the time of writing, Ethereum is buying and selling round $3,600, up virtually 21% within the final week.

The value of the coin has surged throughout the previous few days | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.