Tether CEO Paolo Ardoino says the corporate might develop its USDT provide tenfold, probably surpassing $1 trillion.

His feedback comply with the passage of the GENIUS Act, a sweeping stablecoin invoice signed into regulation by President Donald Trump on July 18.

Tether Eyes $1.6 Trillion USDT Provide Following GENIUS Act Approval

The laws is the primary federal framework for stablecoin regulation within the US. It authorizes the Federal Reserve to license and supervise dollar-backed stablecoin issuers.

It additionally mandates full reserve backing, common audits, and anti-money laundering (AML) compliance for all entities providing these tokens within the US.

In an announcement, Ardoino stated the regulatory readability might unlock a brand new degree of adoption for USDT, the world’s largest stablecoin.

“Now that President Trump has led the US to embrace digital belongings, we imagine we will improve tenfold and cement the greenback’s international dominance,” he said.

Tether at the moment stories over $160 billion USDT in circulation throughout greater than 500 million customers globally. A tenfold improve would convey its provide to $1.6 trillion, a milestone that will additional entrench the token’s position in international crypto markets.

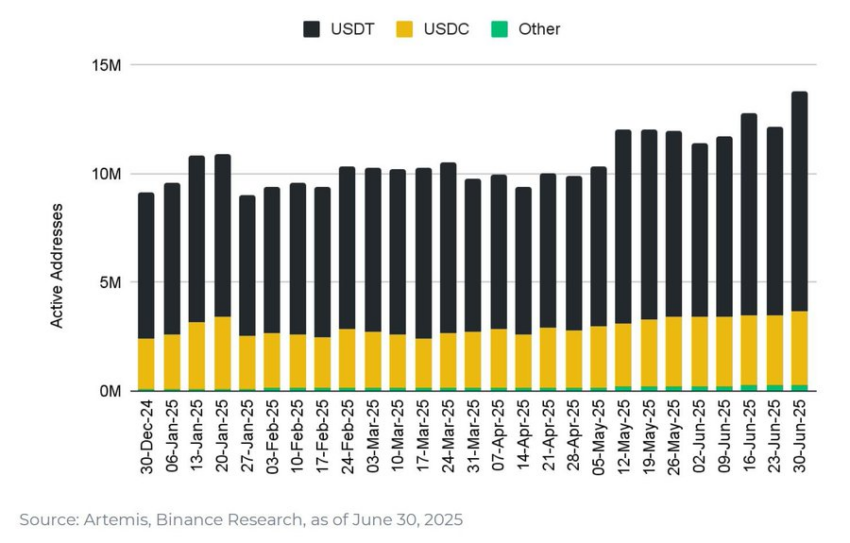

Ardoino’s objectives are unsurprising contemplating USDT is the dominant stablecoin available in the market. In keeping with obtainable market knowledge, the digital asset at the moment accounts for 73% of worldwide stablecoin transaction quantity.

In the meantime, regardless of the optimism, the GENIUS Act considerably raises the regulatory compliance bar for Tether.

Beneath the brand new regulation, Tether, which operates out of El Salvador, should meet US requirements on licensing, AML procedures, and reserve disclosures. These necessities are important for the corporate to keep up entry to the American market.

Thus far, Tether has solely been publishing quarterly attestations about its reserves. Nonetheless, it has not but delivered a complete, unbiased audit—an omission lengthy criticized by regulators and analysts.

Already, the corporate has pledged to adjust to the brand new guidelines and reiterated its dedication to endure a full audit of its reserves.

Nonetheless, the corporate’s capacity to ship on these guarantees—notably concerning reserve disclosures—will likely be essential.

It should possible decide whether or not Tether can preserve its management in an more and more regulated market that’s drawing curiosity from conventional monetary giants like MasterCard.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.