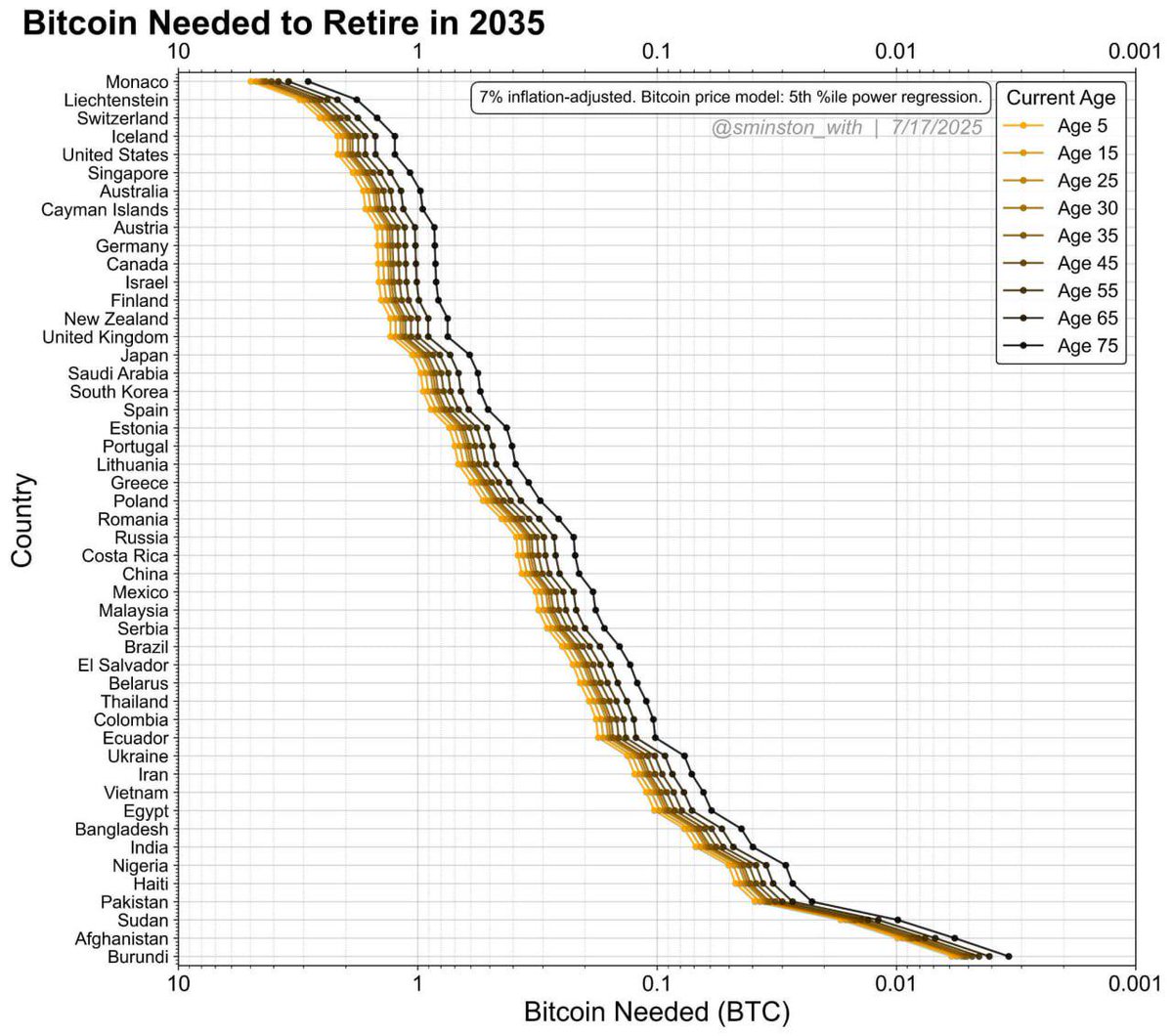

A brand new chart evaluation affords a hanging projection: how a lot Bitcoin one would want to retire comfortably by 2035 in several international locations—assuming continued BTC worth appreciation and seven% inflation adjustment.

The mannequin makes use of a fifth percentile energy regression for Bitcoin worth development and plots how a lot BTC residents of assorted international locations may must maintain retirement. The graph breaks down the information by age teams, starting from age 5 to age 75, revealing how retirement targets change based mostly on each geography and generational timing.

On the high of the record are ultra-wealthy nations like Monaco, Liechtenstein, Switzerland, and Iceland, the place people may have between 1 and 5 BTC—or extra—to retire in a decade. America additionally ranks among the many costliest retirement zones, carefully adopted by Singapore, Australia, and Germany. In these international locations, even somebody aged 25 in the present day would require not less than 1 BTC to safe a snug future.

Conversely, residents in creating nations like Afghanistan, Sudan, Haiti, and Burundi may solely want fractions of a Bitcoin—typically as little as 0.001 BTC—to retire, because of considerably decrease common residing prices. Nations like India, Nigeria, and Pakistan fall someplace within the center, the place between 0.01 and 0.1 BTC could suffice relying on present age.

The chart additionally highlights the dramatic shift in required Bitcoin as age will increase. Youthful people want significantly extra BTC, reflecting the longer horizon they need to fund. For instance, a 5-year-old in Monaco would want almost 10 BTC, whereas somebody already aged 75 may require solely a small fraction because of fewer remaining retirement years.

The evaluation paints Bitcoin not simply as a speculative asset, however as a possible long-term retirement hedge—significantly in high-income international locations the place fiat currencies could face erosion.

It additionally underscores the worldwide wealth hole, exhibiting how drastically retirement prices differ worldwide.

As Bitcoin adoption grows and institutional demand expands, projections like these might develop into important instruments for planning future monetary safety—particularly in an more and more digital economic system.