- Solana leads with ultra-low charges, blazing velocity, and $271M in Q2 income, far outperforming Cardano’s declining exercise and income.

- Cardano’s Hydra scaling continues to be underutilized, and its tiny $32M stablecoin market cap dampens institutional curiosity.

- Solana’s energetic DeFi, stablecoin development, and adoption throughout sectors make it the extra apparent funding proper now.

Solana (SOL) and Cardano (ADA) each declare to be quick, scalable powerhouses within the crypto world—however solely one among them is definitely shifting. The opposite? Nicely, it’s… kinda caught in second gear.

When you’re eyeing a crypto funding proper now, it actually comes all the way down to momentum, and, actually, Solana’s kinda leaving Cardano within the mud.

Solana’s Already Gunning It

Solana isn’t simply quick—it’s loopy quick. Transactions value lower than a penny (like, approach much less… we’re speaking fractions of a cent), and so they zip via in beneath a second. In the meantime, over on Cardano, you’re paying round $0.29 per transaction and ready 15 seconds—or longer—for finality. That may not sound like a giant deal, however in crypto? That lag’s sufficient to lose a commerce.

Due to that velocity and affordability, Solana’s attracting extra builders, customers, and dApps. It’s dominating. In Q2 alone, Solana pulled in $271 million in income—yeah, greater than another chain for 3 straight quarters. Oh, and in June? It matched each different L1 and L2 mixed when it comes to energetic wallets. Wild.

Its DeFi scene is stacked too, with over $9.3B in complete worth locked (TVL), trailing solely Ethereum. Plus, stablecoins on Solana grew 5.5% final month, hitting $10.4B. That’s the sort of capital stream that retains ecosystems thriving.

In the meantime… Cardano’s Struggling

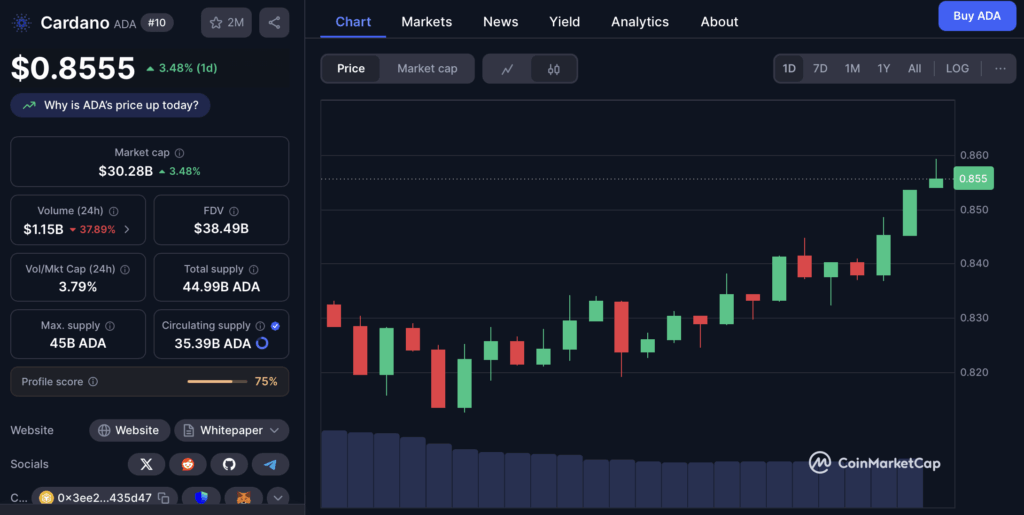

Cardano’s Q1 report reads extra like a warning signal. Day by day transactions dropped by practically 30%, DeFi TVL shrank 29% to $319M, and price income fell 32%. Ouch. That’s not only a blip—it’s a development.

What which means for buyers is easy: much less utilization = much less demand = meh value motion. With excessive charges and fewer customers, it’s no surprise the chain’s struggling to achieve traction.

Velocity vs. Concept: The Tradition Divide

Solana’s constructing in nearly each booming crypto phase—NFTs, AI networks, real-world asset tokenization, meme cash, you title it. The ecosystem strikes quick and iterates sooner. Initiatives launch confidently figuring out the chain’s going to evolve alongside them.

Cardano, although? It’s… cautious. Its Hydra scaling answer was first teased again in 2020 and solely just lately confirmed indicators of life. However even now, it’s largely theoretical. Positive, it examined effectively, however nobody’s actually utilizing it.

Even Cardano’s stablecoin footprint is minuscule—simply $32M. Evaluate that to Solana’s $10B and the distinction is sort of comical. With out that monetary infrastructure, massive gamers simply aren’t paying consideration.

Backside Line: Solana’s the One in Drive

Can Cardano catch up sometime? Possibly. However that’s a giant possibly, and it will take a severe reinvention to do it. Solana’s already racing forward, profitable over retail and institutional customers, rising income, and dominating the narrative.

So in the event you’re trying to again a series that’s already confirmed, liquid, and scaling up quick, Solana’s the straightforward choose. It’s not about potential anymore—it’s about execution. And Solana’s doing simply that.