Altcoins are steadily gaining floor towards Bitcoin, with indicators pointing to the early levels of a broader market rotation.

Right this moment’s CMC Altcoin Season Index studying of 47/100—nonetheless technically impartial—marks a 147% soar over the previous month, reflecting rising investor urge for food past BTC.

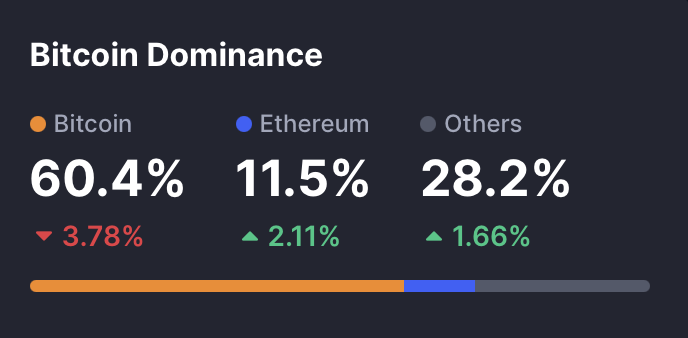

Bitcoin Dominance Retreats as Rotation Builds

Bitcoin dominance fell to 60.45%, down 0.6 factors prior to now 24 hours and three.4 factors since July 1. This regular decline aligns with a broader capital rotation development, the place buyers start to shift allocations towards altcoins. Although the Altcoin Season Index stays beneath the 75 threshold that may verify a full-blown altcoin season, the momentum is unmistakable.

Ethereum Ecosystem Sparks Institutional Curiosity

Main the cost is Ethereum and its surrounding ecosystem. ETH has surged 24.6% over the previous week, whereas Chainlink (LINK) gained 23.1%. Collectively, they pushed the Ethereum ecosystem’s market cap to $734 billion—up 3.25% in simply 24 hours. This rise coincides with bullish narratives round zkEVM upgrades and real-world asset (RWA) tokenization, which proceed to draw institutional capital.

Speculative Alts and Narratives Gas Good points

Speculative altcoins within the gaming and AI sectors are additionally catching wind. GameGPT posted a 43% weekly achieve, whereas Tezos spiked 81.7%—each pushed by renewed retail curiosity in high-risk narratives. Whereas volatility stays excessive on this sector, the upside reveals buyers are keen to maneuver past the conservative Bitcoin play.

Outlook

The information means that whereas Bitcoin stays dominant, altcoins—particularly these tied to Ethereum and rising tech themes—are gaining traction. If Bitcoin consolidates or pulls again additional, capital rotation into altcoins may speed up and push the Altcoin Season Index into full-season territory (>75). For now, Ethereum and Chainlink stay the clearest beneficiaries of this development.