A crypto analyst identified for his charts says that altcoins are flashing a really bullish sign that’s been 5 years within the making.

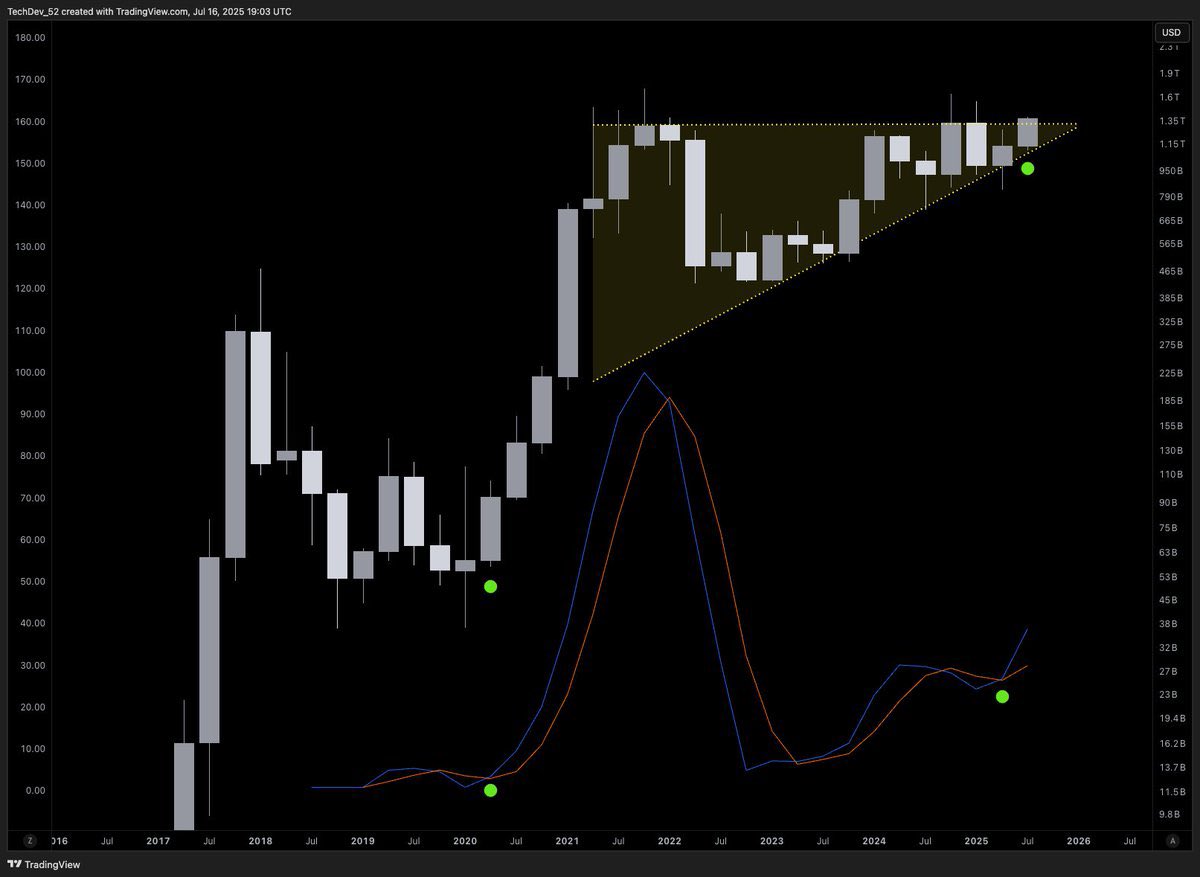

In a publish on the social media platform X, pseudonymous analyst TechDev shares along with his 535,000 followers a TOTAL3 chart, which measures the complete market cap of crypto property excluding Bitcoin (BTC), Ethereum (ETH) and stablecoins.

Utilizing three-month candles, TechDev’s evaluation means that TOTAL3 is presently breaking out of an enormous ascending triangle that began forming in late 2020.

“Macro altcoin growth has triggered.

Not seen since late 2020.

However this one comes after a 4-year coil…the longest in historical past.”

The analyst believes that the altcoin market is buying and selling in step with what’s referred to as a Livermore Accumulation Cylinder, a sample recognized by dealer Jesse Livermore, a pioneer of day buying and selling outstanding within the early 1900s.

Livermore Cylinders usually see worth commerce inside an ascending megaphone sample, making more and more larger highs and better lows earlier than a ultimate parabolic run nicely exterior the higher resistance line of the vary.

Says TechDev,

“It’s not sophisticated.

All the alt market is in a Livermore cylinder.”

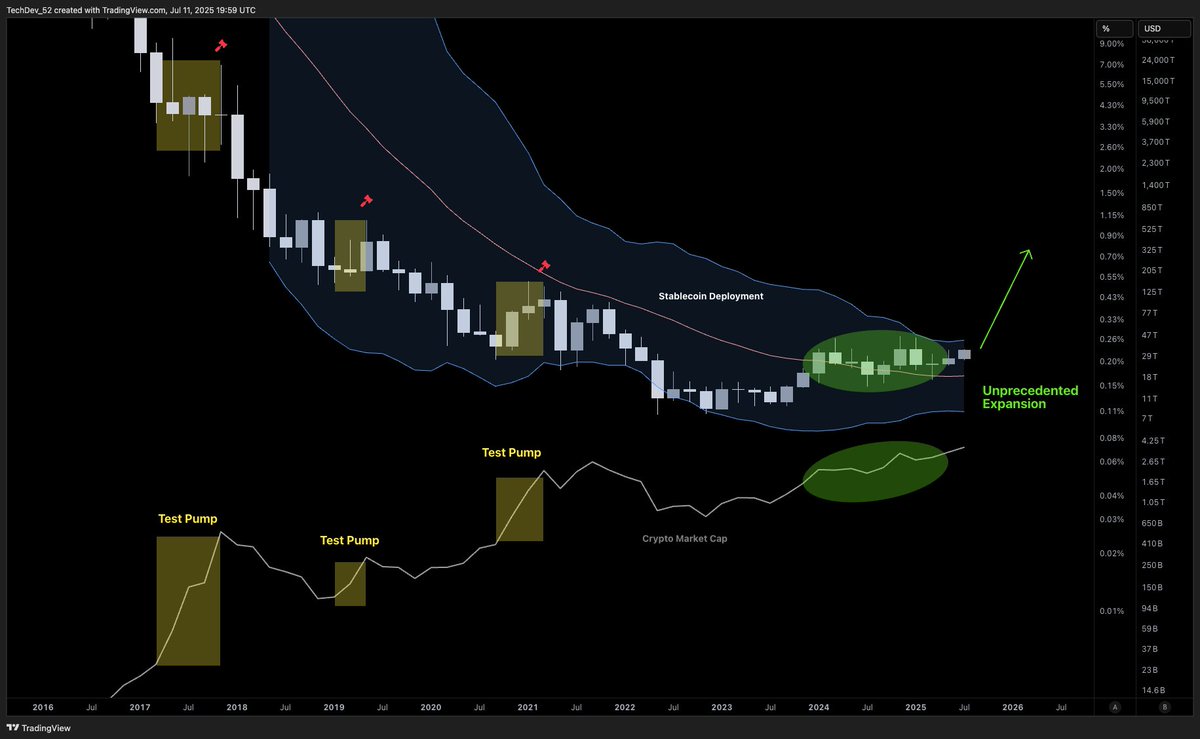

TechDev can also be keeping track of stablecoins. He shares a chart exhibiting the inverse of stablecoin dominance, or as he describes it, “stablecoin deployment.”

The analyst notes that as stablecoins get deployed, it boosts digital asset costs, however that stablecoin deployment has by no means actually entered an uptrend, solely non permanent consolidations.

“Most nonetheless don’t get it.

That is stablecoin deployment. When it rises, crypto rises.

However the strikes related to prior bull runs have solely been countertrend strikes.

This would be the very first breakout.

It has no precedent.

All prior runs have objectively been take a look at pumps.”

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Worth Motion

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses chances are you’ll incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/GrandeDuc/Fotomay