4 busted over fraud linked to $1.8 billion DGCX XinKangJia case

Hong Kong police have arrested 4 people in reference to an alleged cryptocurrency funding ring that defrauded victims of over 3 million Hong Kong {dollars}. The operation was linked to a bogus platform posing as affiliated with the Dubai Gold and Commodities Trade (DGCX). Nonetheless, the alleged ringleader escaped and publicly mocked victims for his or her supposed lack of intelligence in falling for the rip-off.

The arrests are a part of a wider fallout from the collapse of the so-called “DGCX XinKangJia” platform in mainland China. On June 25, the platform abruptly froze withdrawals for its 2 million customers. By the subsequent day, it had gone fully offline.

Marketed because the Chinese language department of the Dubai group, XinKangJia promised buyers 1% fastened each day returns on USDT-denominated investments in gold and oil. Earlier than shutting down, the platform allegedly transferred round 1.8 billion USDT (roughly 13 billion yuan) by way of Twister Money to offshore wallets, in line with blockchain safety agency SlowMist.

The scheme employed a paramilitary-style pyramid construction, dividing members into 9 ranks from “squad chief” to “commander.” Customers have been inspired to recruit new buyers to climb ranks and earn USDT bonuses.

On July 7, authorities in Taojiang County, Hunan Province, formally labeled the platform as a suspected case of fundraising fraud and unlawful network-based pyramid promoting. The actual Dubai Gold and Commodities Trade publicly disavowed any affiliation with the Chinese language platform on April 8, warning that any platforms, apps or promotional materials utilizing its identify have been unauthorized and certain fraudulent.

All XinKangJia’s deposits, returns and withdrawals have been carried out in USDT, putting the operation outdoors the scope of China’s conventional monetary oversight.

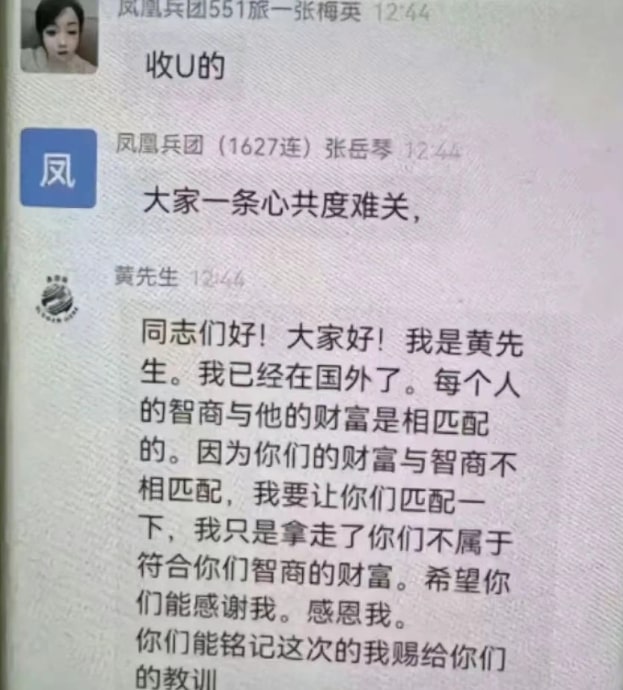

Public outrage intensified after XinKangJia’s founder reportedly fled overseas and mocked victims in group chats.

“Everybody’s wealth ought to match their intelligence. Since your wealth didn’t match your intelligence, I helped stability it out for you. I solely took what didn’t belong to your stage of intelligence. I hope you might be grateful,” reads a machine translation of a message from the founder, as proven in a screenshot shared by native media.

Anime followers should buy NFTs to grow to be Japan’s digital residents

As soon as identified primarily to knife collectors and manufacturing unit insiders, the quiet Japanese metropolis of Sanjo is now working a blockchain-powered experiment in civic identification.

On Tuesday, Sanjo launched the Digital Sanjo Citizen ID, an NFT that permits anybody on this planet to grow to be a digital resident of town. Holders acquire entry to a personal neighborhood and perks like sizzling spring stays, digital city corridor conferences and even voting rights in December’s digital mayoral election. They will additionally suggest initiatives for Sanjo’s digital future.

The NFTs, acknowledged by the native authorities, are designed by college students at a close-by anime faculty. Every token contains a “Guardian of the Artisans” that represents a real-world producer from the Tsubame-Sanjo industrial cluster, well-known for its knives, pliers and chrome steel instruments.

Like many rural areas in Japan, Sanjo is grappling with inhabitants decline and youth migration to larger cities. In response, officers are turning to the idea of kankeijinko — a “associated inhabitants” of outsiders who interact meaningfully with the neighborhood with out dwelling there.

Final 12 months, Cointelegraph reported that Yamakoshi, a village within the Niigata mountains, attracted 1,700 digital residents by way of an identical NFT initiative. Japan’s authorities has additionally been exploring metaverse purposes to deal with broader social points, together with “hikikomori,” or socially withdrawn people.

Learn additionally

Options

Blockchain Startups Assume Justice Can Be Decentralized, however the Jury Is Nonetheless Out

Options

When worlds collide: Becoming a member of Web3 and crypto from Web2

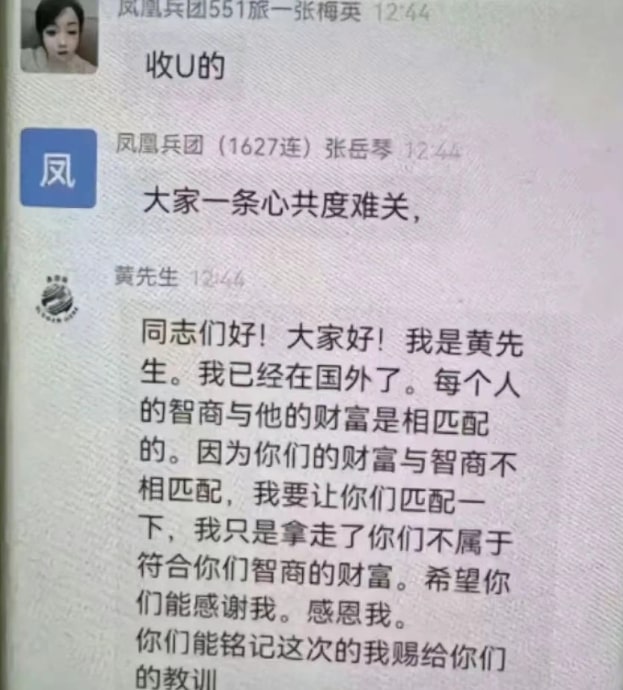

First main South Korean financial institution opens crypto web page

Shinhan Financial institution, considered one of South Korea’s largest industrial banks, has grow to be the primary mainstream monetary establishment within the nation to launch a devoted cryptocurrency part inside its cellular app.

The brand new function permits customers to trace real-time crypto costs, discover beginner-friendly academic content material and entry skilled analysis stories. It’s a part of Shinhan’s broader effort to make digital property extra approachable and clear for most of the people.

The app integrates with native alternate Korbit, enabling clients to hyperlink real-name verified accounts, view crypto holdings and request greater transaction limits.

Shinhan is considered one of 5 South Korean banks which have partnered with licensed exchanges, providing clients compliant pathways to commerce crypto by way of their financial institution accounts. The financial institution has lengthy positioned itself on the forefront of the nation’s digital asset adoption.

The launch comes as South Korea accelerates efforts to manage the crypto sector underneath President Lee Jae Myung’s administration. His marketing campaign included proposals for a won-pegged stablecoin. In late June, eight main banks — together with Shinhan — introduced a joint initiative to concern a fiat-backed digital foreign money.

Learn additionally

Options

Twister Money 2.0: The race to construct secure and authorized coin mixers

Options

‘Ethical accountability’: Can blockchain actually enhance belief in AI?

Infini Hacker Strikes ETH amid worth surge

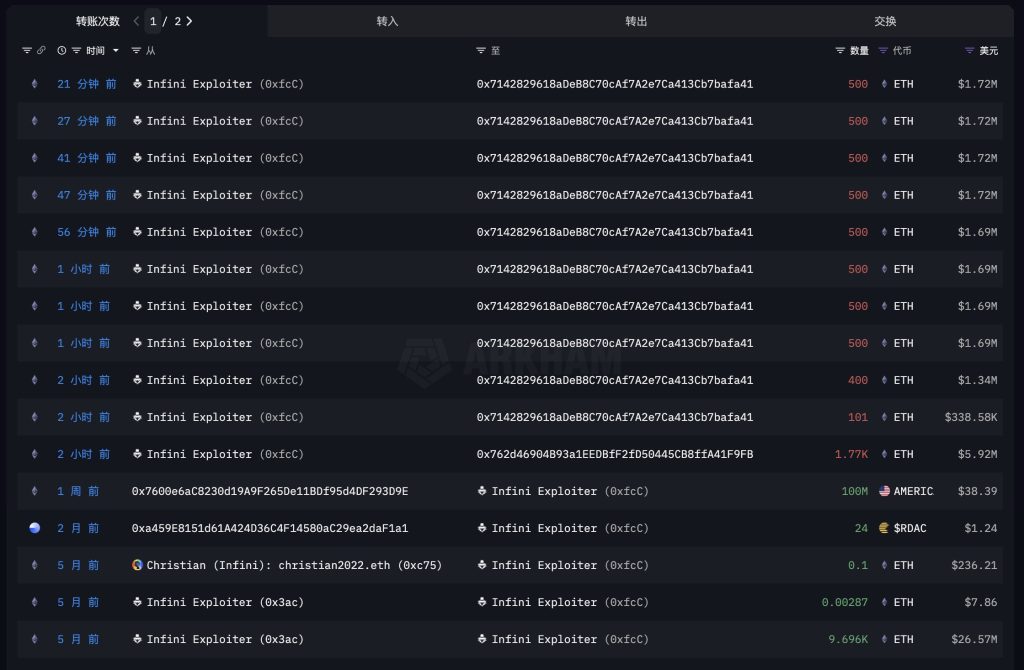

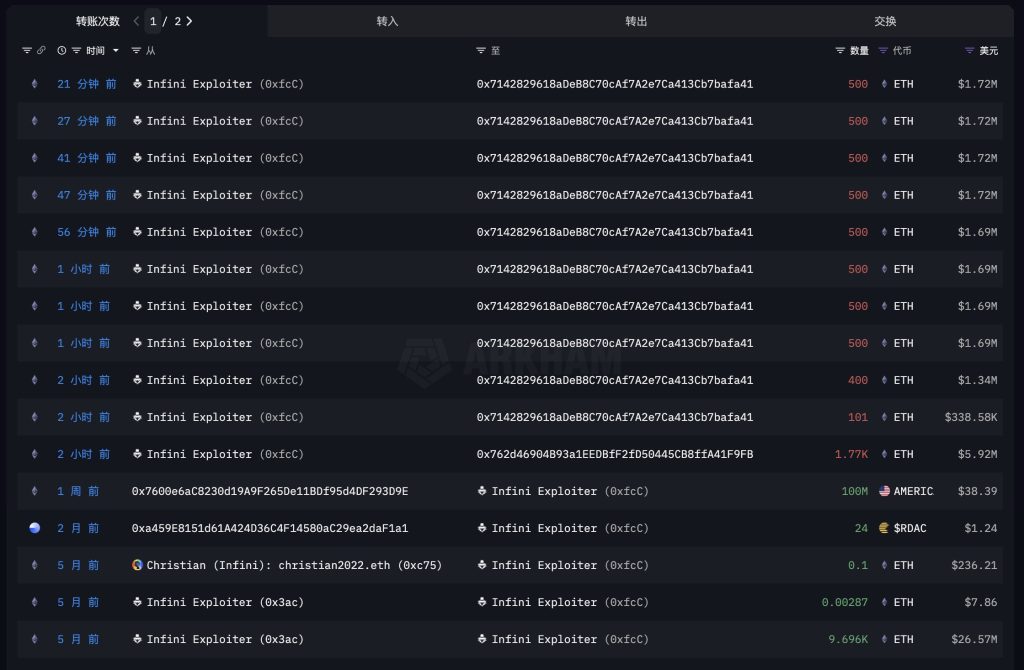

The attacker behind the $50 million exploit of crypto card firm Infini has begun laundering stolen funds, capitalizing on Ethereum’s current worth rally to safe multimillion-dollar positive factors.

On Feb. 24, the attacker drained $50 million in USDC from Infini’s vaults and rapidly transformed the funds into 17,696 ETH. With Ethereum now buying and selling above $3,400, the stash has grown to roughly $61 million — an $11 million unrealized revenue.

Onchain information analyzed by blockchain sleuth EmberCN reveals the hacker has began to dump a portion of the holdings. To this point, 1,770 ETH has been swapped for $5.88 million in DAI, and 5,001 ETH has been funneled into Twister Money, a privateness software often used to obscure fund actions.

Infini had beforehand provided a bounty for the return of the funds and initiated authorized proceedings. In June, the corporate introduced it will shut down its stablecoin card enterprise.

The attacker nonetheless controls round 10,925 ETH of their pockets.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist protecting blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has coated Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.