Welcome to the Asia Pacific Morning Transient—your important digest of in a single day crypto developments shaping regional markets and world sentiment.

Seize a inexperienced tea and watch this area. Bitcoin dominance briefly dipped beneath 60% amid altcoin momentum. Japan’s electoral shift has accelerated discussions on crypto tax reform, probably lowering the speed from 55% to twenty%. In the meantime, Jack Dorsey’s Block Inc. has joined the S&P 500, validating the viability of Bitcoin-integrated enterprise fashions.

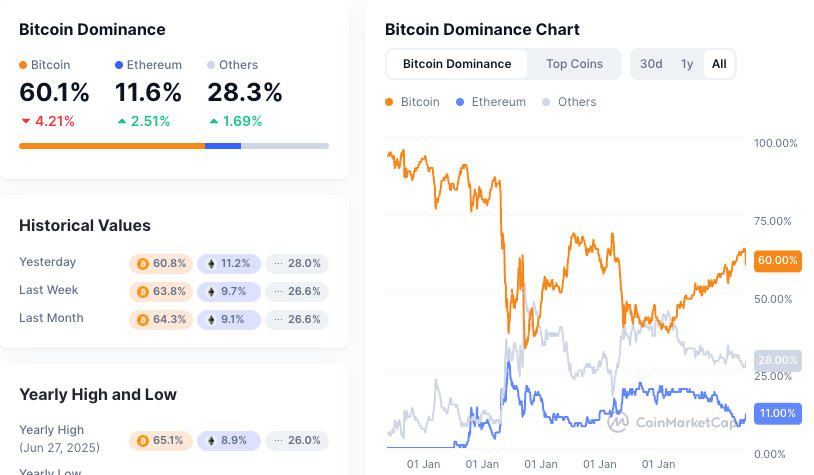

Bitcoin Dominance Dips Under 60% Threshold

Bitcoin dominance briefly fell beneath 60% this morning for the primary time since March. The metric, measuring Bitcoin’s share of whole cryptocurrency market capitalization, dropped to 59.8% early Monday.

This decline displays strengthening altcoin efficiency throughout main digital belongings. Ethereum gained 4% whereas XRP and Solana superior 2% and three% respectively. Bitcoin itself retreated 1% throughout the identical interval.

Market dynamics recommend portfolio rebalancing towards different cryptocurrencies is accelerating. Theme-based tokens skilled notable surges alongside broader altcoin momentum. The dominance ratio has since recovered to 60.1% as of 01:00 UTC.

Japan Election Triggers Crypto Tax Reform Momentum

Japan’s Liberal Democratic Occasion suffered its most important electoral defeat in a long time. The LDP misplaced its parliamentary majority in each homes for the primary time since 1955. Coalition accomplice Komeito fell at the least two seats wanting sustaining management in Sunday’s higher home election.

This historic shift creates unprecedented political instability amid rising dwelling prices and stagnant wages. Prime Minister Shigeru Ishiba faces inside requires resignation as populist opposition events achieve leverage. Markets anticipate volatility because the weakened authorities negotiates from a diminished place.

Digital Asset Coverage Transformation

The electoral consequence accelerates cryptocurrency taxation reform discussions considerably. Opposition events campaigned extensively on tax discount platforms, significantly concentrating on crypto belongings. Japan Blockchain Affiliation submitted proposals for separated taxation, changing the present 55% most charges with 20.315% unified levies.

Present heavy taxation hasn’t prevented Japan from rating fifth globally in cryptocurrency buying and selling quantity. Bitcoin-JPY pairs characterize the world’s third-largest market regardless of regulatory constraints. Company Bitcoin adoption accelerates domestically with MetaPlanet turning into the fifth-largest institutional holder globally.

Japan’s $20 trillion family financial savings pool represents huge untapped funding potential. Important tax reductions might unleash home demand, probably amplifying Bitcoin’s ongoing value momentum. Web3 advocate Takahiro Yasuno secured his first parliamentary seat, signaling technological coverage prioritization within the new political panorama.

Block Inc Achieves S&P 500 Milestone

Jack Dorsey‘s Block Inc will be a part of the S&P 500 index on Wednesday, marking institutional recognition of Bitcoin-centric enterprise fashions. The previous Sq. firm surged 10% in aftermarket buying and selling following the announcement. Block replaces Hess Company within the benchmark index.

This milestone follows Coinbase’s inclusion two months prior, establishing crypto-focused enterprises inside conventional fairness indices. Block operates a complete digital asset infrastructure, together with Bitkey self-custody wallets and Proto mining providers alongside cost platforms.

The corporate demonstrates strategic Bitcoin dedication by way of systematic treasury allocation. Block invests 10% of month-to-month Bitcoin income again into BTC, accumulating 8,584 cash price roughly $1 billion. Administration open-sourced their treasury blueprint, enabling company adoption and replication.

Block’s S&P inclusion validates institutional acceptance of Bitcoin-integrated enterprise fashions. The achievement represents broader market maturation as conventional indices accommodate blockchain-native corporations.

Shigeki Mori and Paul Kim contributed.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.