Hedera (HBAR) is displaying no indicators of slowing down. The token is up over 92% month-on-month, signaling robust bullish momentum. However the story doesn’t finish there.

Whale wallets are piling in, funding charges are holding regular, and the worth construction exhibits room for a possible breakout continuation. With a number of legs of help behind this transfer, HBAR worth may very well be gearing up for extra.

Whale Pockets Surge Indicators Confidence

Whale wallets have continued their accumulation spree. Over the previous week, the variety of wallets holding 1 million HBAR or extra rose from 67.28% to 71.41%. Additionally, wallets with 10 million+ HBAR jumped from 86.29% to 91.62%. That’s a greater than 5% rise in a matter of days.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

Such a concentrated enhance in whale holdings usually displays rising confidence in near-term worth motion. It additionally means that bigger gamers are positioning themselves earlier than a possible continuation rally.

Whale pockets information tracks the proportion of provide held by massive wallets, serving to measure accumulation stress.

Funding Price Spikes Present Aggressive Longs

The open interest-weighted funding fee for HBAR reached 0.057% on July 18, its highest stage in months. As of July 21, it sits at a still-elevated 0.01%, suggesting that lengthy positions are sustaining their dominance.

This spike in funding charges mirrors HBAR’s current worth rally and implies that leverage is constructing in favor of bulls. Usually, a rising funding fee signifies aggressive lengthy positioning. It may possibly foreshadow continued upward momentum, particularly when backed by whale accumulation.

The great factor right here is that the Funding charges (regardless of being optimistic) aren’t overheated, suggesting that leveraged positions don’t dominate the derivatives market. This sample retains the danger of a protracted squeeze out for now.

An extended squeeze happens when over-leveraged lengthy positions are compelled to exit as costs dip, triggering a cascade of liquidations that accelerates the worth drop.

Funding charges replicate the price of holding leveraged lengthy vs. brief positions. A optimistic fee means longs are paying shorts, suggesting bullish sentiment.

HBAR Worth Motion Hints at a Breakout Zone

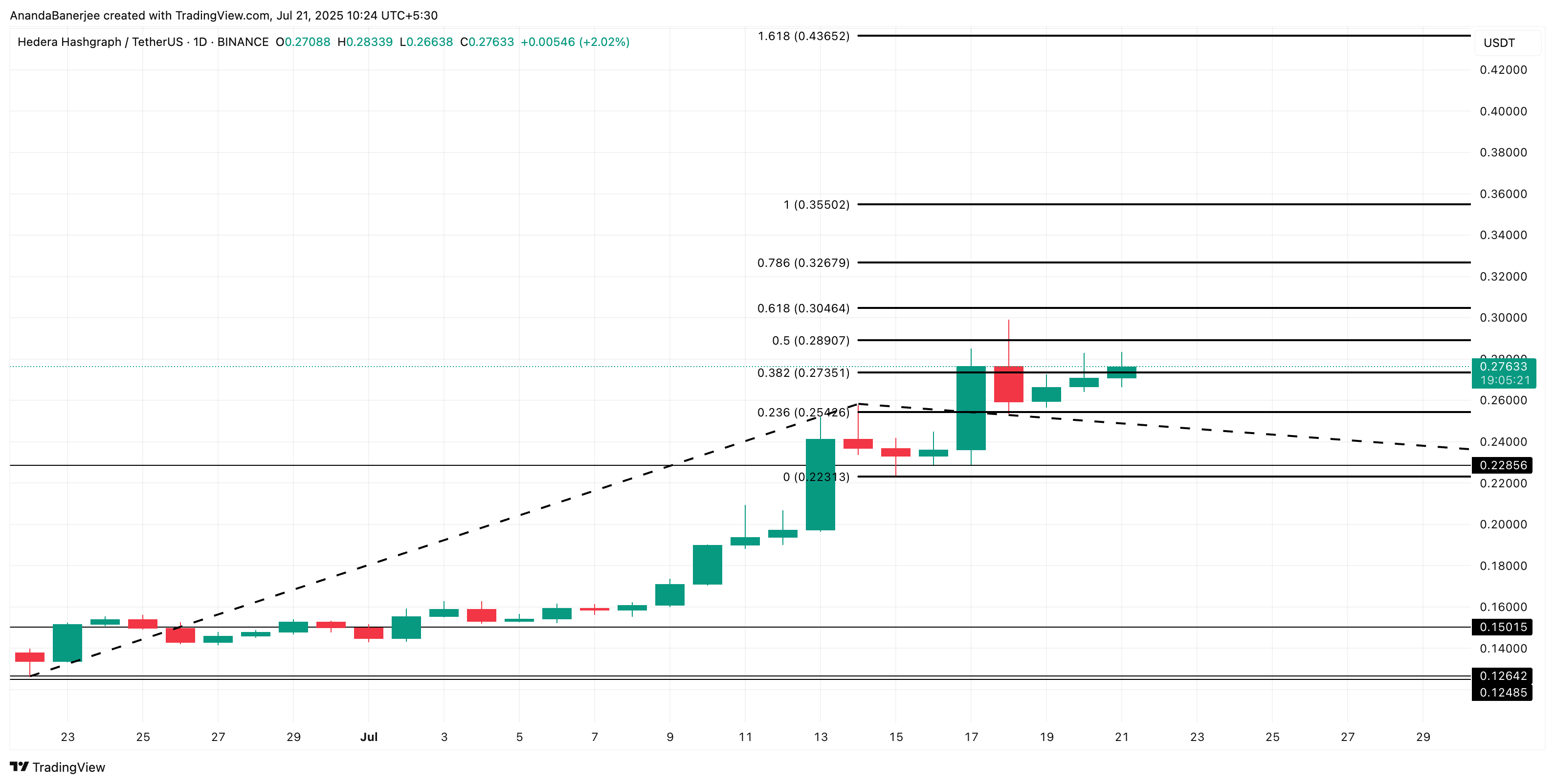

From a technical perspective, HBAR is at present hovering across the 0.382 Fibonacci extension stage at $0.27, after cleanly breaking above the 0.236 resistance or the $0.25 worth stage. This area has acted as a consolidation zone over the previous few periods, with worth discovering constant help.

If this stage holds, the following resistances lie at $0.28 (0.5 Fib) and $0.30 (0.618 Fib), adopted by the $0.32 (0.786 Fib) stage. A confirmed breakout from the 0.382 and 0.5 Fib ranges may open up the HBAR worth path towards $0.35+, which aligns with the 1.0 Fib extension and former swing highs.

Fibonacci extension ranges are used to determine potential targets or resistance zones by using the earlier impulse transfer and a subsequent worth retracement. On this worth chart, the $0.22 stage is used because the retracement zone, as the present swing continues to be beneath improvement.

As $0.25 serves as one of many strongest help ranges, a dip under it might probably invalidate the bullish development for now. Additionally, if the HBAR worth corrects under $0.22, the short-term development won’t stay bullish anymore.

Disclaimer

In keeping with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.