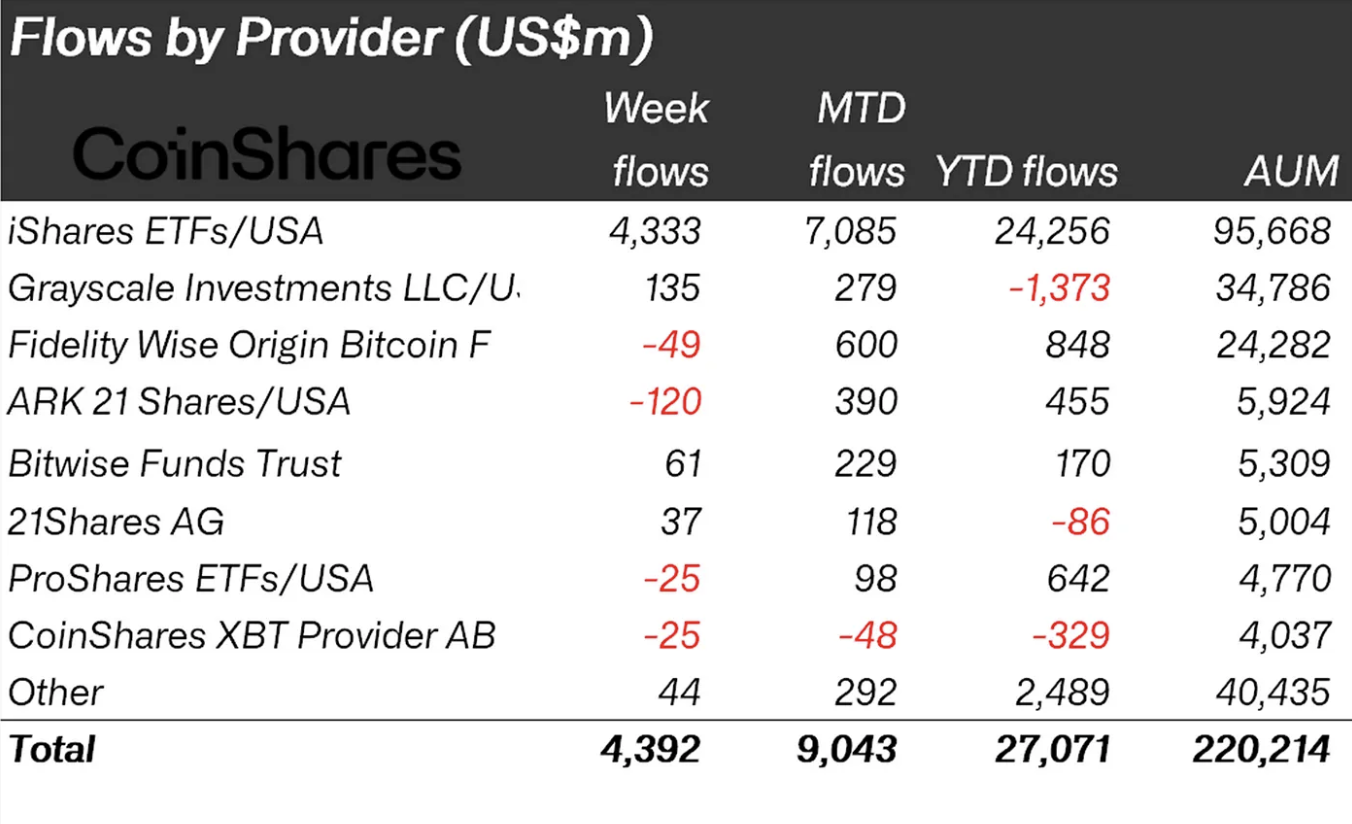

International crypto funding merchandise noticed a historic $4.39 billion in inflows final week, setting a brand new all-time weekly document and driving whole property below administration (AuM) to $220 billion.

Based on the newest report by Coinshares, this marks the 14th consecutive week of inflows, bringing 2025’s year-to-date whole to $27 billion. Trade-traded product (ETP) turnover additionally hit a document $39.2 billion, reflecting surging investor urge for food, particularly for Bitcoin and Ethereum.

Ethereum inflows smash earlier data

Ethereum led the market by a large margin, pulling in $2.12 billion in new capital—almost double its earlier weekly document of $1.2 billion. That determine additionally means Ethereum’s 2025 inflows have now reached $6.2 billion, surpassing the complete 2024 whole. Over the previous 13 weeks, these inflows signify 23% of Ethereum’s whole property below administration, signaling quickly rising institutional demand forward of its main tech upgrades.

Bitcoin adopted with $2.2 billion in inflows, down from $2.7 billion the prior week. Nonetheless, Bitcoin ETPs made up 55% of all BTC spot trade quantity, underscoring their dominance in present buying and selling exercise.

U.S. drives quantity, altcoins achieve momentum

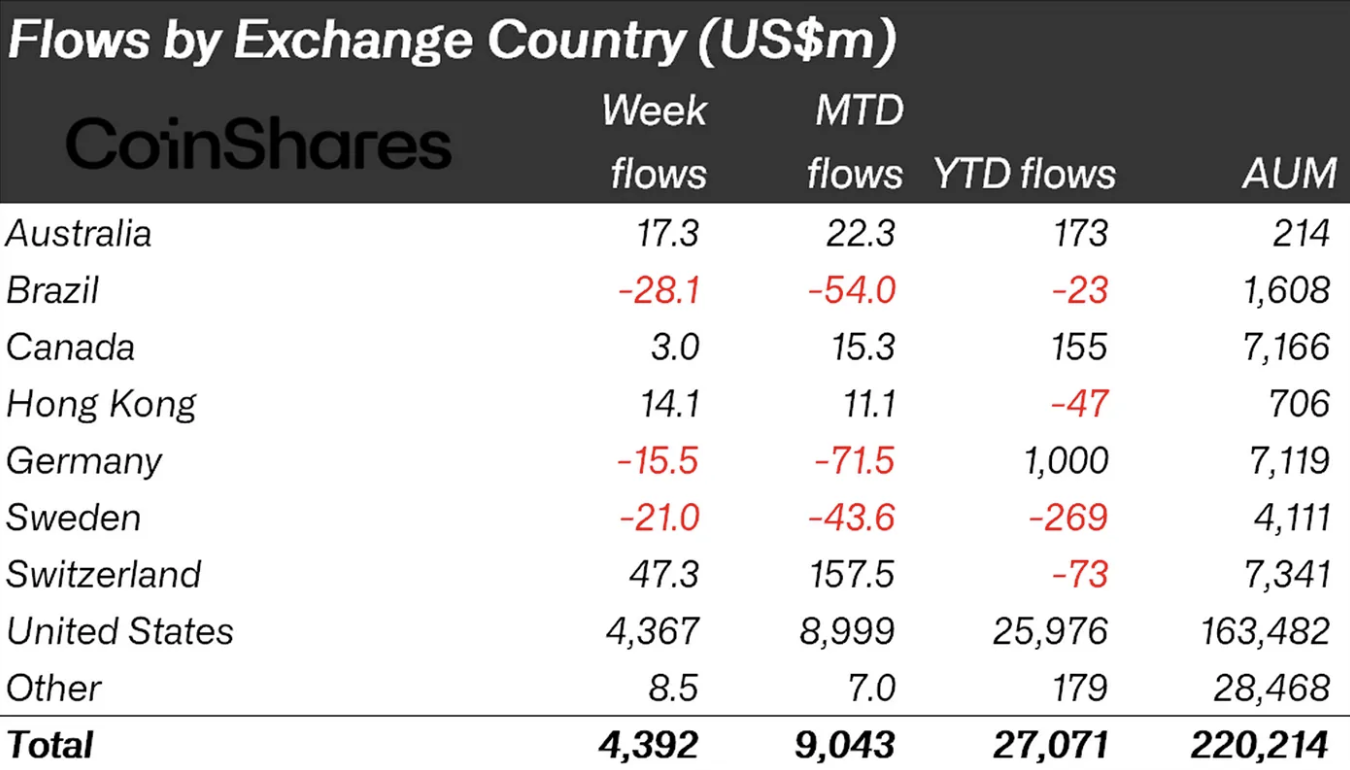

America accounted for the lion’s share of final week’s exercise, recording $4.36 billion in inflows. Switzerland, Hong Kong, and Australia additionally noticed modest positive aspects, with inflows of $47.3 million, $14.1 million, and $17.3 million respectively. Brazil and Germany, in contrast, posted outflows of $28.1 million and $15.5 million.

Past Bitcoin and Ethereum, a number of altcoins additionally recorded robust curiosity. Solana introduced in $39 million, XRP adopted with $36 million, and Sui attracted $9.3 million. This continued altcoin influx pattern suggests buyers are diversifying past simply the highest two property as optimism builds throughout the broader digital asset market.