As Bitcoin (BTC) continues to hover within the excessive $110,000 vary, on-chain knowledge suggests {that a} short-term worth pullback could also be imminent. That stated, the broader market construction stays firmly bullish.

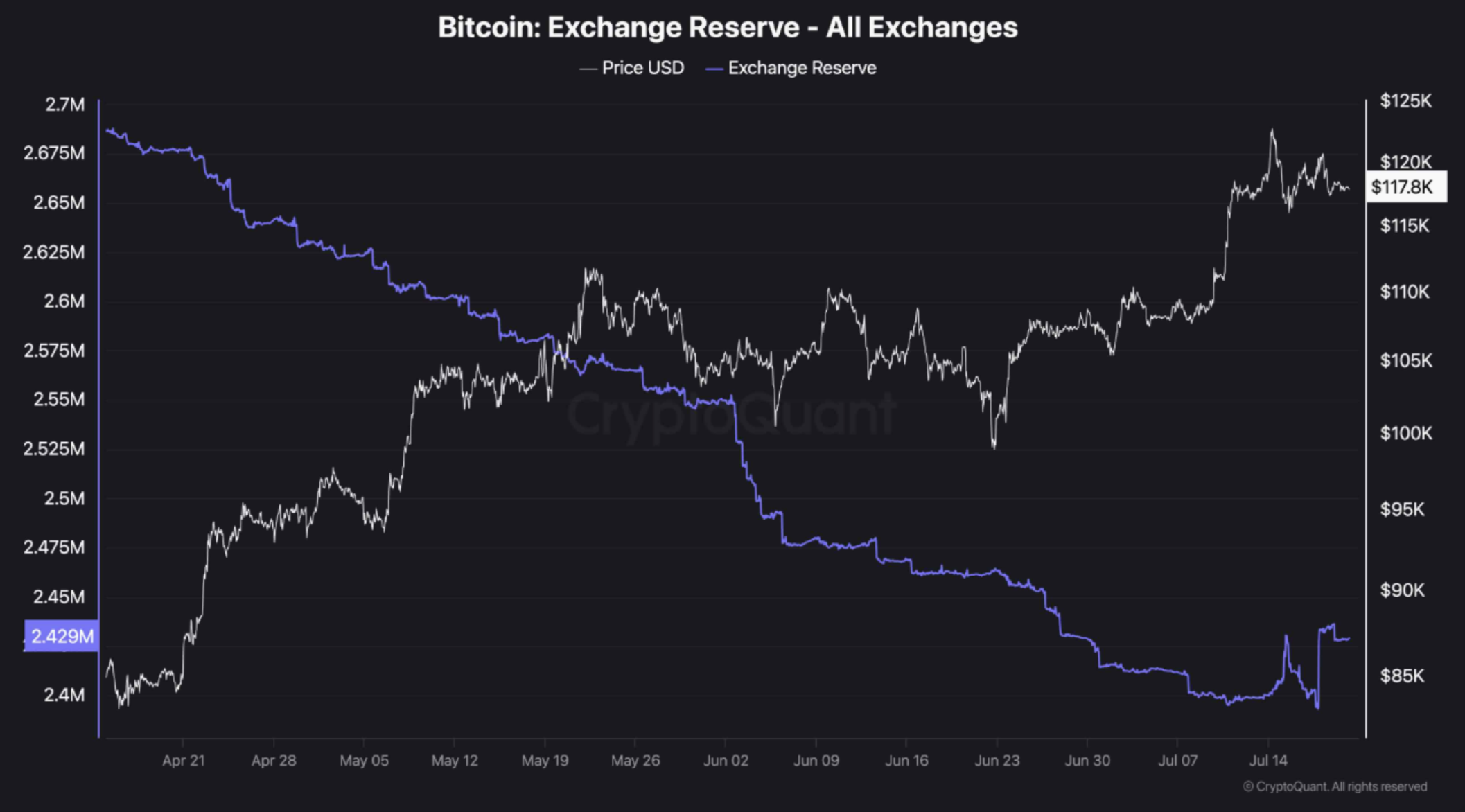

Bitcoin Trade Reserves Hit Close to-Month Excessive

In accordance with a latest CryptoQuant Quicktake put up by contributor ShayanMarkets, BTC reserves on centralized exchanges have risen to their highest stage since June 25. This surge in exchange-held Bitcoin might sign rising profit-taking exercise amongst buyers.

Associated Studying

An increase in BTC inflows to exchanges usually precedes distribution phases, as extra cash turn into accessible for potential sale. This shift is usually interpreted as a weakening in buy-side stress, which may result in a short-term worth decline. ShayanMarkets commented:

Traditionally, rising trade reserves are related to native market tops, as extra BTC turns into accessible for potential sale. Nonetheless, this metric alone shouldn’t be seen as a definitive set off for speedy worth drops. Broader market liquidity, sentiment, and demand dynamics stay key.

The analyst emphasised that whereas larger reserves might counsel short-term promoting stress, they don’t essentially point out a reversal in pattern. Any correction ought to be evaluated in context, until accompanied by a big change in macroeconomic or technical indicators.

In a separate CryptoQuant put up, analyst Darkfost identified a pointy uptick in Bitcoin whale exercise. Notably, the final two Bitcoin native tops occurred when month-to-month common inflows from whales exceeded $75 billion.

Between July 14 and July 18, common month-to-month inflows from whale wallets surged from $28 billion to $45 billion – a $17 billion soar. This sample means that some whales could also be taking income following Bitcoin’s latest all-time excessive of $123,218 on Binance.

What Does On-Chain Knowledge Recommend?

On-chain knowledge additionally reveals that long-term holders are distributing their BTC, whereas short-term holders are more and more accumulating. This type of rotation is usually related to late-stage rally conduct and potential exhaustion.

Associated Studying

Nonetheless, the short-term holder Market Worth to Realized Worth (MVRV) ratio at the moment sits at 1.15, effectively under the standard profit-taking threshold of 1.35. This suggests that there should still be room for additional worth appreciation earlier than a broader selloff begins.

Nonetheless, not all indicators are reassuring. The Bitcoin NVT Golden Cross – a metric that compares community worth to transaction quantity – is trending larger, which can level to rising market froth.

Likewise, trade knowledge from Binance signifies that BTC might be dealing with a near-term pullback. At press time, Bitcoin trades at $118,052, down 0.4% over the previous 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com