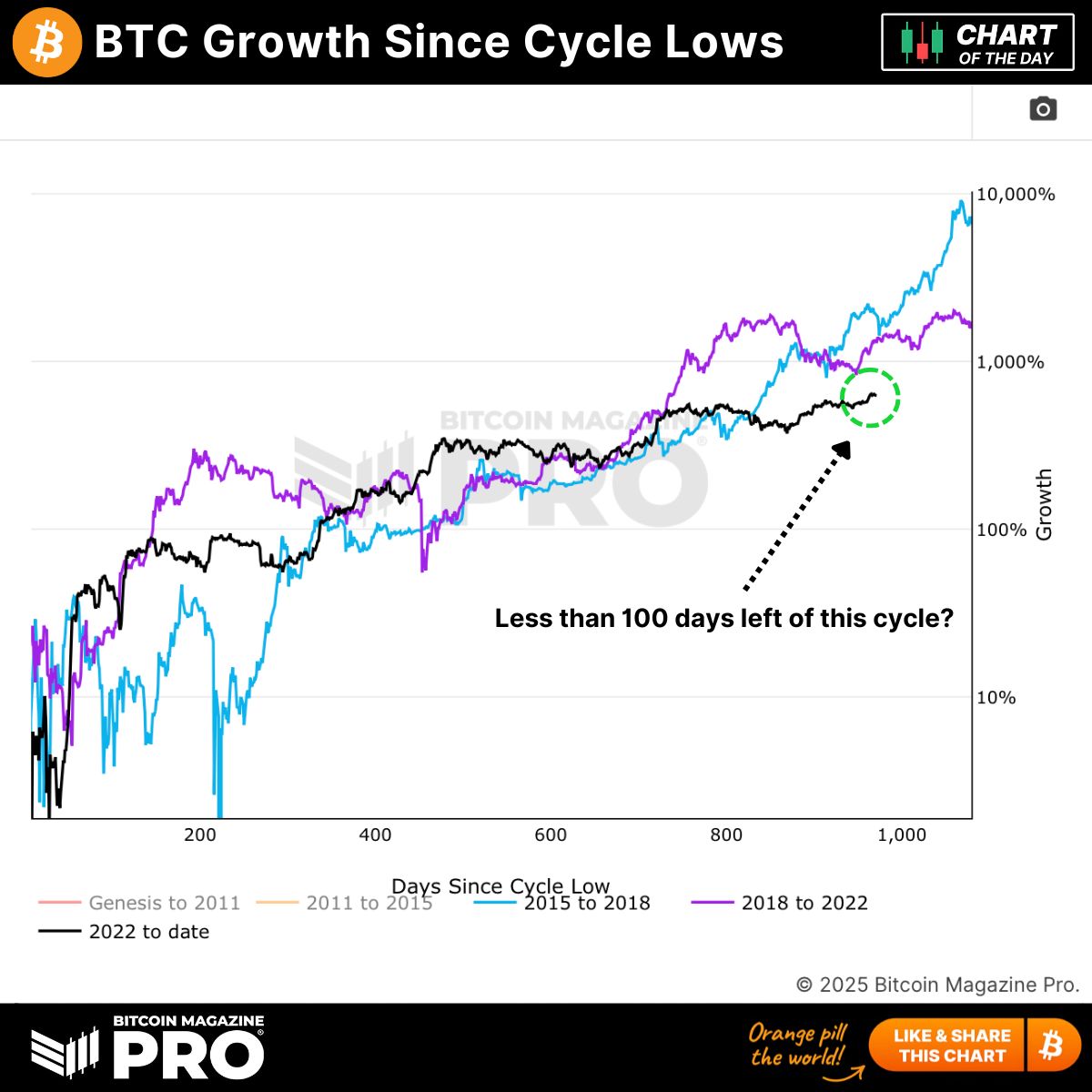

In response to a brand new chart shared by Bitcoin Journal Professional, the present Bitcoin market cycle could also be getting into its last stretch—with fewer than 100 days remaining earlier than a possible market high.

The evaluation compares the present cycle’s trajectory (2022 to 2025) to earlier bull markets, particularly the 2015–2018 and 2018–2022 cycles, suggesting a potential peak in October 2025.

The chart plots Bitcoin’s share development from every cycle low over time, and the similarities are hanging. In all three cycles, BTC skilled an early surge, a interval of mid-cycle consolidation, and a late-cycle acceleration in positive aspects. The black line representing the present cycle is carefully monitoring the patterns of 2017 and 2021, each of which topped roughly 1,000 days after the cycle low.

If the present pattern continues to reflect previous conduct, that may place the Bitcoin peak within the October 2025 window—fewer than 100 days from now. Whereas every cycle has its personal macro context, this sample means that historic rhythm nonetheless performs a strong position in shaping market expectations.

This projection coincides with different knowledge factors, together with the timing of Bitcoin’s halving cycles and the everyday post-halving surge seen in earlier years. Nevertheless, some analysts argue that this time may very well be completely different, citing new market forces akin to spot Bitcoin ETFs, stronger institutional adoption, and regulatory shifts underneath the Trump administration.

Nonetheless, the cyclical knowledge is difficult to disregard. If October does mark the highest, it could sign a last window for late-cycle positive aspects earlier than the market enters a brand new accumulation section. Whether or not or not historical past repeats precisely, merchants are watching carefully—as a result of timing the highest may very well be important.