Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A sudden surge of institutional and company curiosity in Ethereum (ETH) is setting the stage for what Bitwise Asset Administration’s chief funding officer Matt Hougan calls a “structural imbalance” between provide and demand—one that would propel costs nicely past the cryptocurrency’s already‑speedy ascent this yr.

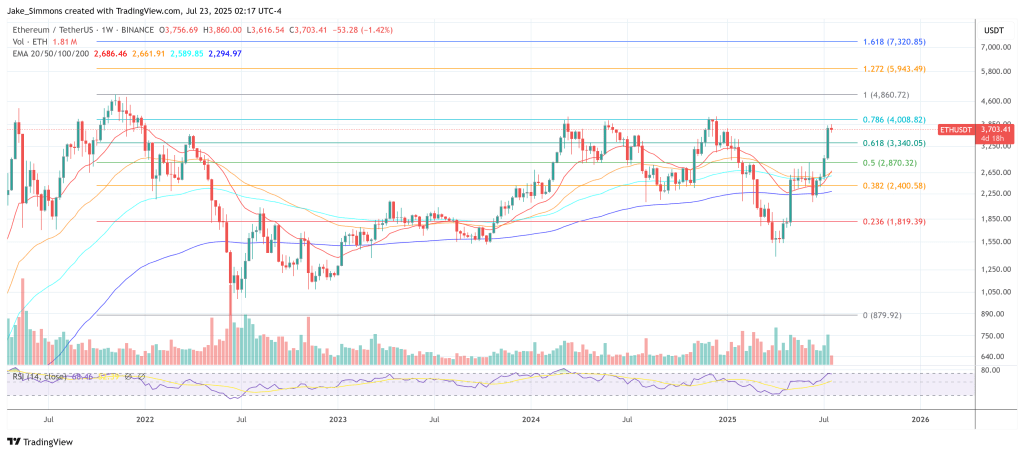

In a memo circulated to shoppers on 22 July 2025, Hougan famous that Ether has climbed greater than 65 % previously month and over 160 % since April. The rally, he argues, is being pushed not by sentiment alone however by a dramatic mismatch between the quantity of Ether produced by the community and the portions now being absorbed by trade‑traded merchandise (ETPs) and newly shaped “ETH treasury” companies.

Ethereum Demand Shock Is Inevitable

“Generally it truly is that easy,” Hougan wrote, echoing his lengthy‑standing thesis that, within the brief run, asset costs are dictated primarily by flows. He drew a direct parallel to bitcoin’s explosive efficiency following the launch of U.S. spot bitcoin ETPs in January 2024, when “ETPs, companies, and governments acquired greater than 1.5 million bitcoin, whereas the Bitcoin blockchain produced simply over 300,000.”

Associated Studying

The identical dynamic, he contends, has lastly taken maintain within the Ether market—solely extra forcefully. Between 15 Might and 20 July, spot Ether ETPs attracted greater than $5 billion in internet inflows, whereas a handful of publicly traded corporations started stockpiling the token as a main treasury asset. Among the many most aggressive patrons:

- Bitmine Immersion Applied sciences (BMNR) amassed 300,657 ETH—about $1.13 billion at present costs—and declared an ambition “of acquiring 5 % of all ETH provide.”

- SharpLink Gaming (SBET) bought 280,706 ETH ($1.06 billion) and disclosed plans to lift a further $6 billion for future acquisitions.

- Bit Digital (BTBT) liquidated its bitcoin reserves after elevating $170 million, redirecting the proceeds to greater than 100,000 ETH (roughly $375 million).

- The Ether Machine (DYNX) outlined an preliminary public providing constructed round a $1.6 billion Ether treasury.

In mixture, ETPs and public corporations purchased roughly 2.83 million Ether—valued at north of $10 billion—throughout the 9‑week stretch. Over the identical interval, the Ethereum community created solely about 88,000 ETH in new issuance, a ratio of demand to produce that Hougan calculates at 32 to 1. “No marvel the worth of ETH has soared,” he noticed.

Whether or not that strain continues is now the central query for traders. Hougan’s reply is an unequivocal sure. He factors out that, even after the current shopping for spree, Ether stays beneath‑owned relative to bitcoin within the ETP market: Ether funds management lower than 12 % of the belongings held by bitcoin ETPs, regardless of ETH’s market capitalisation standing at roughly one‑fifth of BTC’s. “With all the thrill surrounding stablecoins and tokenization—that are primarily constructed on Ethereum—we predict that may change,” he mentioned, predicting billions of {dollars} in further inflows “within the subsequent few months.”

Associated Studying

In the meantime, the economics of listed “crypto treasury” corporations look like self‑reinforcing. Shares of BMNR and SBET every commerce at almost twice the web worth of the Ether they maintain, a premium that incentivises administration groups to difficulty fairness, elevate capital, and buy nonetheless extra ETH. “So long as that is still true, you’ll be able to wager Wall Road corporations will funnel cash into extra ETH purchases,” Hougan wrote.

Bitwise initiatives that ETPs and treasury corporations may take up as a lot as $20 billion price of Ether—round 5.33 million cash at current costs—over the approaching yr. The protocol’s issuance schedule, in contrast, is anticipated so as to add solely about 800,000 ETH to circulation throughout the identical window, implying a 7‑to‑1 imbalance.

“That’s a good greater ratio than we’ve seen for Bitcoin because the spot ETPs launched,” Hougan mentioned.

Sceptics usually argue that Ether’s lengthy‑time period provide just isn’t capped in the best way bitcoin’s is, and that its valuation hinges on components past easy shortage, corresponding to community utilization and transaction charges. Hougan doesn’t dispute these factors however insists they’re secondary within the close to time period. “Within the brief time period, the worth of every little thing is ready by provide and demand, and proper now, there may be extra demand for ETH than provide,” he concluded.

At press time, ETH traded at $3,703.

Featured picture created with DALL.E, chart from TradingView.com