Ki Younger Ju, CEO of CryptoQuant and a outstanding determine in crypto evaluation, has publicly declared that the standard Bitcoin cycle concept is not legitimate.

This daring assertion additionally serves as his admission that his earlier predictions are actually outdated. It displays a profound shift available in the market’s nature in comparison with the previous.

Why Has the Conventional Cycle Idea Collapsed?

Ki Younger Ju’s earlier Bitcoin cycle concept was constructed on two pillars: shopping for when whales accumulate and promoting when retail traders enter.

He used these two elements as the inspiration of his previous predictions — together with his earlier name in March that the bull cycle had ended.

Nonetheless, as market dynamics shifted, he acknowledged that this concept not matches. He even apologized, expressing concern that his prediction may need affected somebody’s funding selections.

The important thing distinction that led him to desert the idea lies in how whales behave. Previously, whales distributed Bitcoin to retail traders. However now, he realizes previous whales are promoting to newly rising long-term whales.

This shift has triggered the variety of holders to extend — surpassing the variety of merchants.

Bitcoin’s institutional adoption has surpassed not solely his expectations but in addition these of many analysts. This has resulted in a market atmosphere not like something seen in Bitcoin’s historical past, making comparisons difficult.

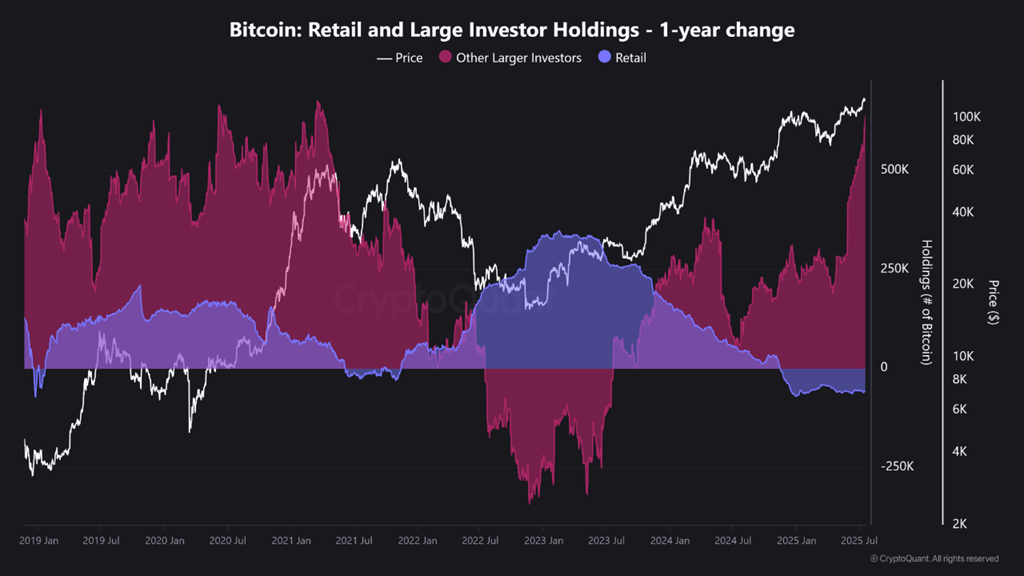

Latest evaluation on CryptoQuant backs up his argument. Analyst Burakkesmeci famous that on-chain information clearly exhibits this isn’t a traditional “retail investor frenzy,” not like earlier cycles.

Charts reveal that since early 2023, retail traders have been promoting BTC, and their holdings have steadily declined. In distinction, establishments, funds, and huge wallets — together with ETFs — have been actively accumulating Bitcoin.

“This cycle appears nothing just like the insanity of 2021. There is no such thing as a mass euphoria, neither is social media overflowing. Quiet and good cash is at present on stage — and most of the people are nonetheless watching from the sidelines,” Burakkesmeci mentioned.

Nonetheless, this new market atmosphere additionally makes forecasting a lot more durable.

In earlier cycles, traders acknowledged bear markets by the panic amongst retail holders. However now, a urgent query arises: What would a bear market appear like if institutional traders begin to panic as an alternative?

That could be the most important problem for threat managers in the present day.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.