The chief funding officer of the crypto asset administration agency Bitwise says that Ethereum ought to proceed rising within the coming months as demand for ETH will increase.

In a brand new thread on the social media platform X, Bitwise CIO Matt Hougan says that the second-largest digital asset by quantity will proceed rising as a consequence of overwhelming demand for it.

“ETH is on a tear. After buying and selling steadily downward for the primary 4 months of the 12 months, it has rebounded strongly. It’s up 50%+ previously month and greater than 150% since its lows in April. The explanation? Overwhelming demand from ETPs (exchange-traded merchandise) and company treasuries.”

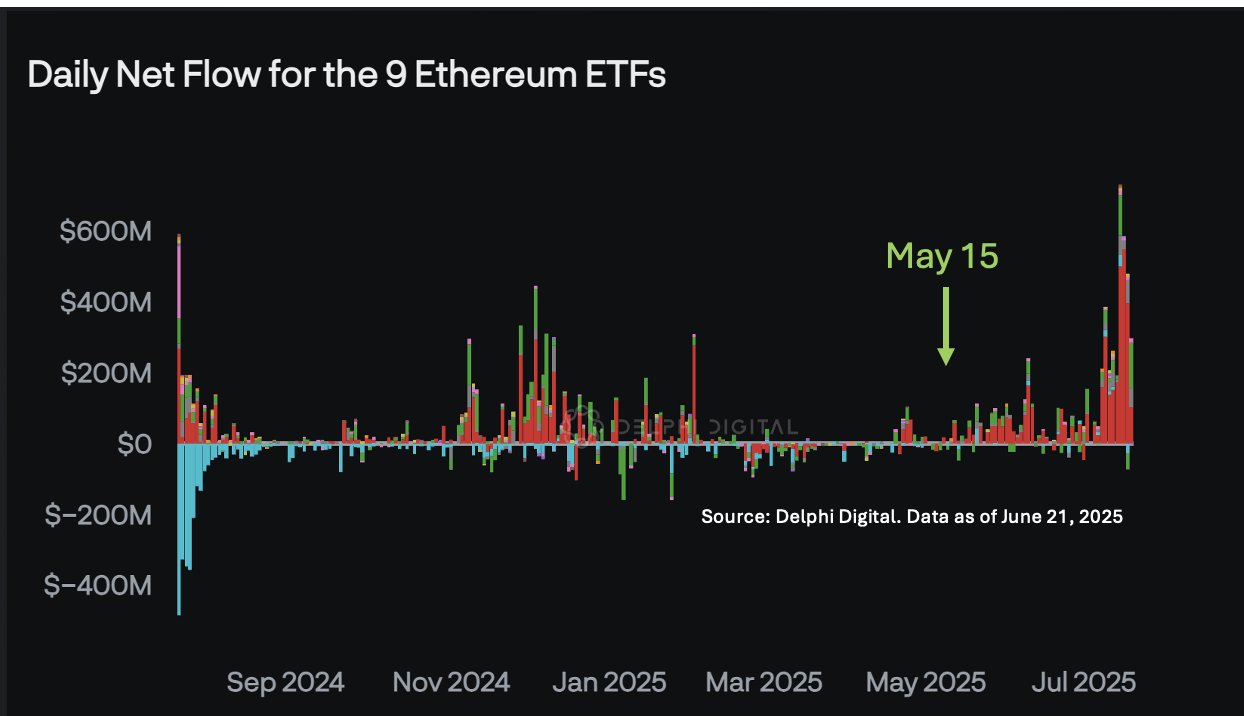

Based on Hougan, since Might, institutional demand for ETH has shot up, inflicting its value to skyrocket after its ETPs suffered a lackluster launch.

“ETH ETPs launched in July 2024, however the preliminary response was tepid… One thing modified in mid-Might. Since Might 15, spot Ethereum ETPs have been on a tear, pulling in additional than $5 billion. Firms have additionally gotten into the sport, with corporations like Bitmine and SharpLink saying Ethereum treasury methods.

By our estimates, ETPs and Company Treasuries have mixed to purchase 2.83 million ETH since Might 15 – greater than $10 billion at right now’s costs. That’s 32x internet new provide over the identical time interval. No marvel the value of ETH has soared!”

Based on Hougan, the blue-chip traders ought to proceed ramping up their investments into the highest altcoins, driving its value up for the approaching months.

“The fitting query to ask is: Will this persist? I believe the reply is ‘sure…’

With surging curiosity in stablecoins and tokenization, we count on sturdy ETH ETP inflows for a very long time to return. In the meantime, all indicators recommend the ‘ETH treasury firm’ development will speed up…

Looking, I can think about ETPs and Treasury Corporations shopping for $20 billion of ETH within the subsequent 12 months, or 5.33 million ETH at right now’s costs. In the meantime, the community is predicted to supply roughly 0.80 million ETH over the identical interval. That’s ~7x extra demand than provide.”

ETH is buying and selling for $3,635 at time of writing, a 3.2% lower on the day.

Observe us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Value Motion

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any losses you could incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in online marketing.

Featured Picture: Shutterstock/geogif