Whereas the broader crypto market is in retreat, Ethena (ENA) is defying the development, rallying practically 20% prior to now 24 hours and catching the eye of merchants throughout the board.

However what actually stands out is the convergence of key indicators akin to rising whale exercise, regular alternate outflows, and a bullish chart setup. All indicators counsel that one thing larger could also be brewing. Might ENA be gearing up for a breakout rally?

Whales Are Gobbling Up Ethena

Crucial development proper now’s that whales are shopping for, and never promoting. In response to Nansen’s dashboard, ENA whale holdings have jumped 8.15% within the final seven days. On the present value, that stands near $1.87 million.

That’s a pointy enhance, and it’s taking place whereas a lot of the market is both flat or down. This sort of whale conduct often indicators confidence; huge gamers are positioning for a bigger transfer.

On the identical time, alternate balances are falling. Over the previous week, 1.07 billion ENA tokens have left exchanges.

Meaning Ethena (ENA) is transferring into personal wallets, not buying and selling platforms. When this occurs, it’s typically an indication that holders plan to sit down tight. Much less provide on exchanges means fewer probabilities of sudden promoting.

In brief, huge wallets are scooping up ENA, and the token is quietly disappearing from exchanges. That’s a robust bullish setup.

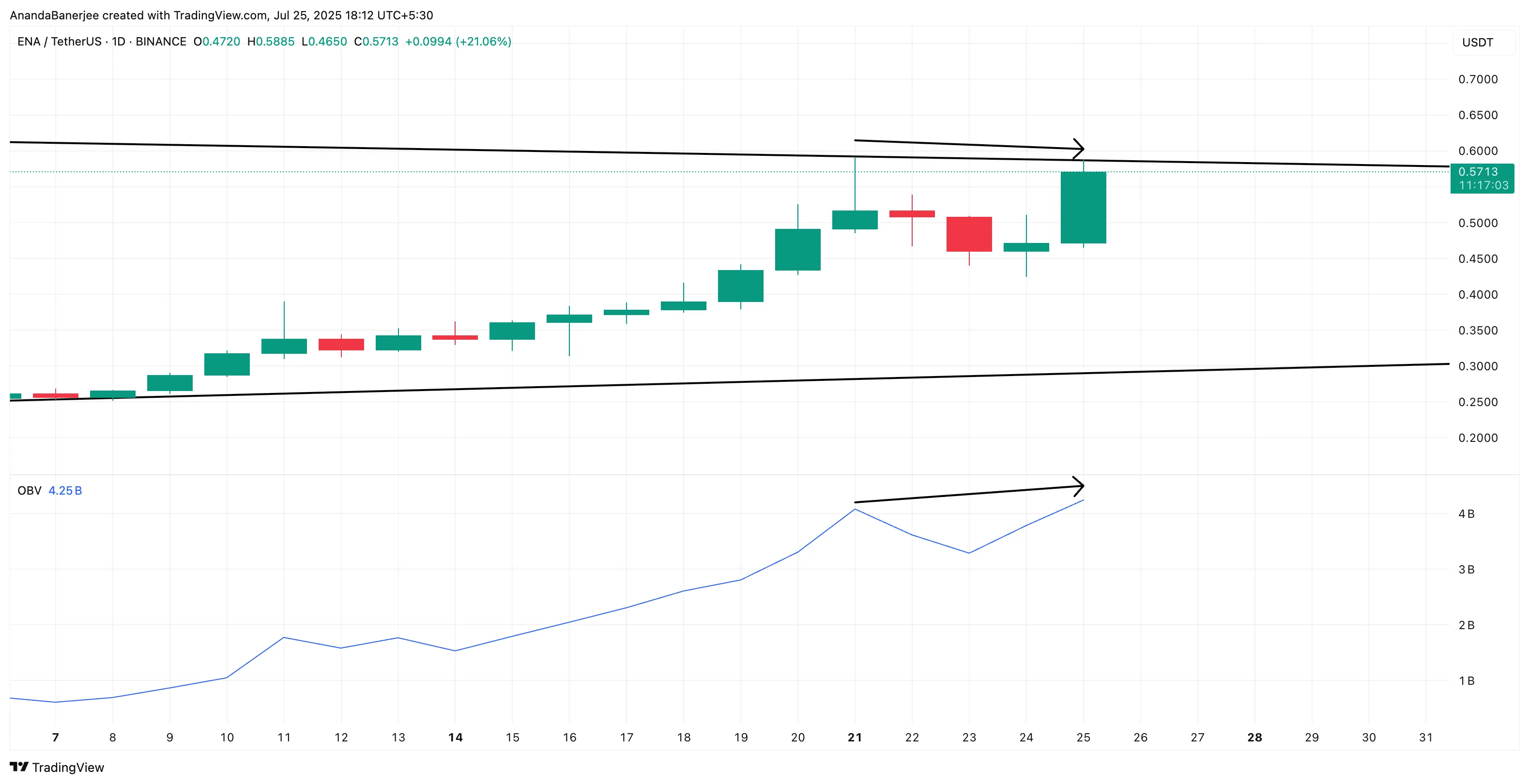

OBV Divergence Hints at Momentum Constructing Beneath

The chart reveals one thing much more fascinating. Whereas ENA’s value made a decrease excessive, the On-Stability Quantity (OBV) made the next excessive on the time of writing. That is known as a bullish divergence; it occurs when quantity flows counsel patrons are stronger than the worth motion reveals.

On the time of writing, ENA continues to be inside a converging wedge sample and buying and selling close to $0.57. The OBV development is breaking increased, which hints that purchasing strain is constructing underneath the floor. Patrons are quietly stepping in at the same time as the worth consolidates.

This sort of divergence typically seems earlier than a breakout. Mixed with the whale exercise, it reveals that accumulation could already be underway.

On-Stability Quantity (OBV) tracks whether or not quantity is flowing into or out of a token, serving to spot hidden traits.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

The Wedge Breakout Might Ignite the Subsequent Leg for ENA’s Value, However $0.60 Is Key

Technically, ENA has been buying and selling inside a wedge since late June. Nonetheless, simply so as to add one other layer of validation, the chart makes use of the trend-based Fibonacci extension device. This device or indicator is used to chart value targets throughout an uptrend.

The primary level of the Fibonacci extension plotting started close to $0.22 and extends to a current swing excessive round $0.59. Yesterday, ENA retraced to $0.42, however in the present day it’s bouncing again arduous and hovering just below the breakout zone.

The massive quantity to observe now’s $0.60. That’s the 0.5 Fibonacci extension stage from the current development. A clear breakout above the wedge at $0.58, adopted by the $0.60 mark, might unlock a rally towards $0.65, $0.71, and even past. Extra so with the present whale and quantity backing.

Nonetheless, right here’s the catch. If ENA fails to interrupt out and drops again beneath $0.51, the bullish case weakens. That will invalidate the wedge breakout thesis and will set off a pullback.

Disclaimer

According to the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.