Bitcoin is making its first significant transfer since breaking its all-time highs and reaching the $123,000 degree. After consolidating in a decent vary for practically two weeks, the worth is now pulling again towards $115,000—marking a 6% decline from latest highs. Whereas this retracement has stirred warning amongst short-term merchants, knowledge suggests there may be little trigger for concern at this stage.

Associated Studying

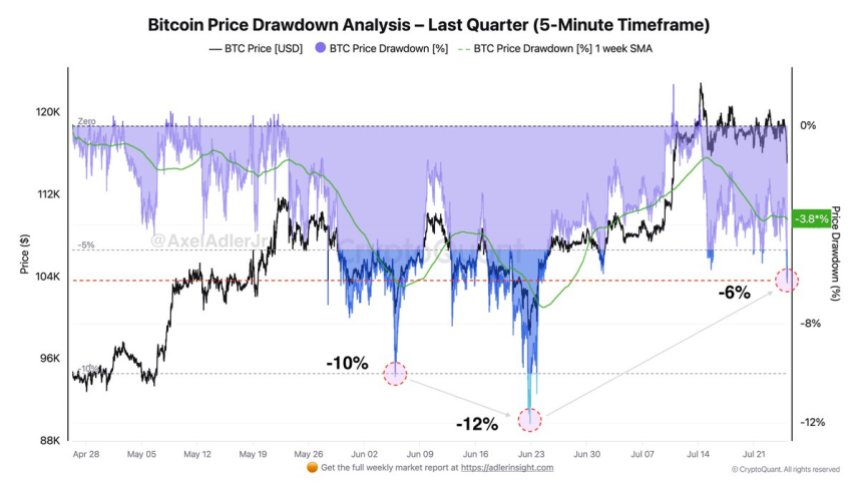

In accordance with CryptoQuant’s Bitcoin Value Drawdown Evaluation chart, the present 6% pullback stays effectively inside the regular volatility vary noticed throughout prior bull phases. This implies the transfer is extra doubtless a wholesome market reset than the start of a deeper correction.

As Bitcoin checks the decrease boundary of its former vary, buyers will intently look ahead to renewed energy or indicators of distribution. For now, fundamentals and long-term holder knowledge stay supportive, retaining bullish sentiment intact regardless of short-term volatility. The following few periods could decide whether or not BTC can bounce decisively or enter a broader consolidation part.

Bitcoin Volatility Stays Inside Norms As Market Enters Essential Part

In accordance with high analyst Axel Adler, Bitcoin’s latest worth motion could seem sharp at first look, however deeper evaluation exhibits that present volatility stays effectively inside regular historic ranges. Over the previous quarter, Bitcoin’s most notable intraday drops on the 5-minute timeframe reached -10% in early June and -12% in mid-June. In the meantime, the common weekly drawdown, represented by the inexperienced line on Adler’s chart, stays secure at 3.8%.

The present -6% pullback—following Bitcoin’s latest breakout to $123K and its retrace towards $115K—sits solely 2.2% deeper than this weekly common and remains to be removed from the panic-triggering extremes seen in earlier months. Regardless of the dramatic visible look, Adler emphasizes that the present correction aligns with a normal consolidation cycle usually seen throughout bull markets.

What makes this second particularly related is how different elements of the crypto market are behaving. Whereas altcoins retraced closely yesterday, immediately they’re holding above key assist ranges, signaling potential energy and a potential shift in market dynamics. This resilience throughout main altcoins might mark a rotation of capital inside the market, relatively than an exit.

Associated Studying

BTC Falls Under Key Assist as Quantity Spikes

Bitcoin has damaged beneath the tight consolidation vary it maintained for over two weeks, with worth dropping sharply to a neighborhood low of $115,009 earlier than barely recovering to $115,759. This marks a transparent technical breakdown of the horizontal channel between $115,724 and $122,077, as proven within the 4-hour chart. The breach beneath the decrease certain coincided with a spike in quantity, signaling decisive promoting strain from market contributors.

The drop pushed BTC beneath the 50-day (blue) and 100-day (inexperienced) easy transferring averages (SMAs), each of which beforehand acted as dynamic assist. The value is now hovering simply above the $115,724 horizontal assist zone, which is now being retested. A failure to carry this degree might open the door to deeper retracements towards the 200-day SMA close to $112,104, which might act as the following main assist degree.

Associated Studying

Technically, a bearish construction is creating within the brief time period, particularly after the breakdown from the triangle-like compression (marked in blue). Nonetheless, the elevated quantity accompanying the transfer may counsel capitulation from weak fingers, which might precede a reversal. Within the coming periods, Bitcoin’s potential to reclaim the $118K degree will decide whether or not bulls can regain management.

Featured picture from Dall-E, chart from TradingView