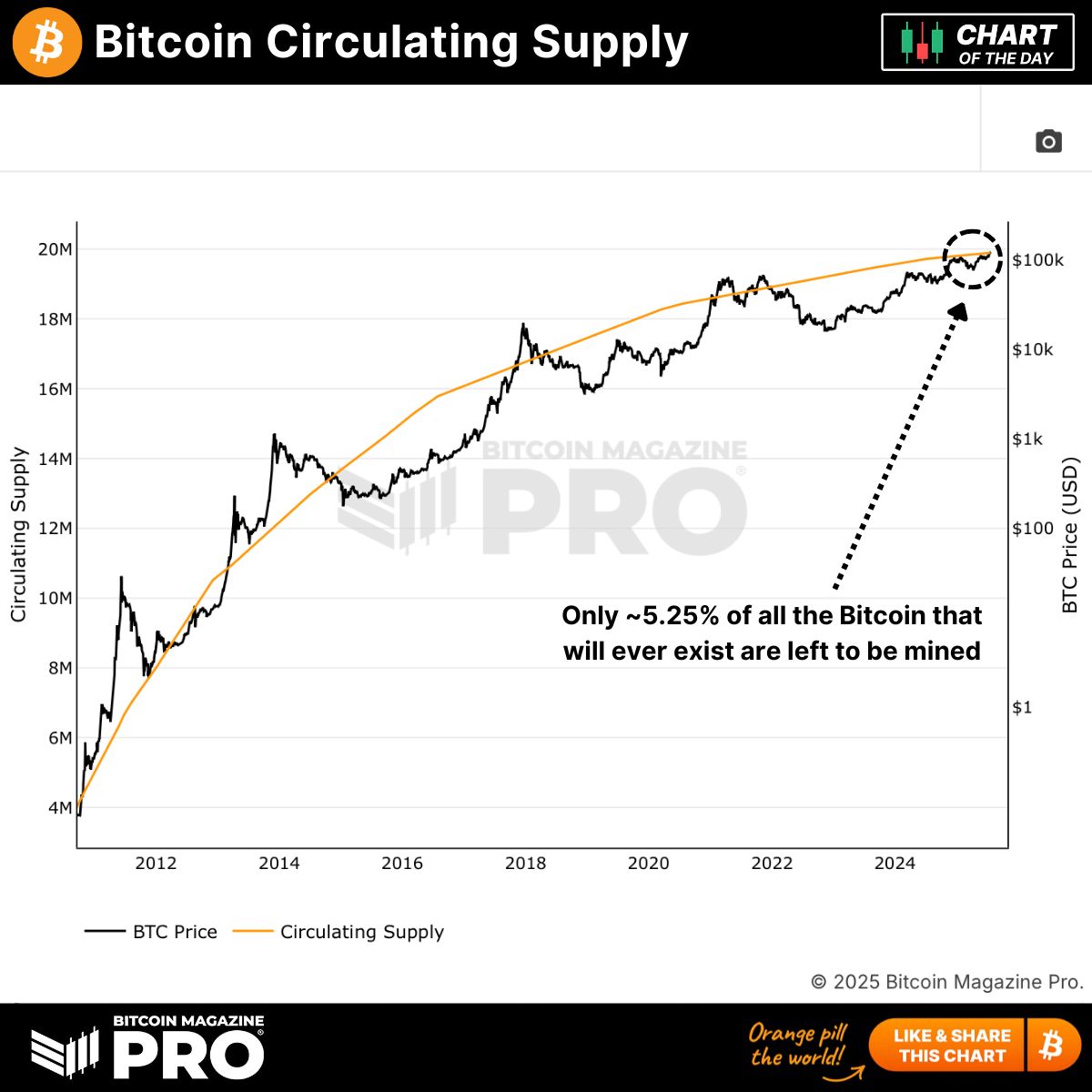

Bitcoin has reached a vital milestone in its programmed provide timeline—solely 5.25% of the whole BTC that may ever exist stays to be mined.

In line with knowledge shared by Bitcoin Journal Professional, over 94.75% of Bitcoin’s 21 million cap is already in circulation, marking a pivotal second for the asset’s long-term shortage narrative.

The chart illustrates how BTC’s provide issuance has steadily declined over time, following its predictable halving schedule. Every halving occasion—occurring roughly each 4 years—cuts the reward for mining new Bitcoin in half. As of now, Bitcoin’s provide curve is flattening, with simply over 1.1 million BTC nonetheless to be launched into circulation.

This vanishing provide comes at a time when demand is accelerating, fueled by institutional adoption, company accumulation, and retail inflows through spot ETFs. The current put up emphasizes: “Provide is vanishing… Tick tock.”

Bitcoin’s design limits its most provide to 21 million cash, a function embedded in its unique code by creator Satoshi Nakamoto. This difficult cap distinguishes BTC from fiat currencies and kinds the spine of its worth proposition as digital gold—an asset proof against inflationary financial coverage.

Traditionally, Bitcoin’s value has reacted to declining provide progress with long-term appreciation. The convergence of diminishing issuance and rising demand kinds what many buyers view as a bullish flywheel impact. The current chart from Bitcoin Journal Professional attracts a transparent connection between the flattening provide curve and value progress.