Briefly

- Pump.enjoyable’s PUMP token has crashed greater than 60% since its launch, following a $600 million iCO.

- The meme coin launchpad’s co-founder has mentioned there is no airdrop coming any time quickly, which solely intensified the promote stress.

- What do the charts say? It isn’t wanting good.

The crypto market’s risk-on sentiment has completed little to save lots of Pump.enjoyable’s native token PUMP, which continues its downward spiral following Pump’s huge ICO simply two weeks in the past.

The crypto market is holding comparatively regular, with Bitcoin close to $117,000 and most cash nonetheless exhibiting bullish momentum. Pump’s token, although, not a lot. After debuting at a $4 billion absolutely diluted worth following the meme coin launchpad’s $600 million token sale, PUMP has now dropped by 63%. The token is at the moment buying and selling at $0.0024, effectively under its ICO worth, with a $879 million market cap and $2.4 billion FDV.

The disconnect between Pump.enjoyable’s success as a enterprise—deploying 12 million tokens and producing over $775 million in income—and its token’s disappointing efficiency has left buyers scratching their heads. And racing for the exits.

So what’s occurring?

Pump’s damaged guarantees

Throughout a July 24 livestream, Pump.enjoyable co-founder Alon Cohen confirmed that the extremely anticipated PUMP airdrop “wouldn’t occur within the speedy future,” triggering speedy promoting stress from upset buyers.

For context, Pump.enjoyable is a token launchpad on Solana that enables for anybody to create their very own meme coin in seconds and without charge. Previous to the launch of the PUMP token, which bought out in an ICO in 12 seconds, hypothesis was rampant amongst degens that Pump.enjoyable would airdrop some proportion of the token’s whole provide to customers of the platform. The corporate, in truth, confirmed that an airdrop was “coming quickly” when it introduced the sale of the token.

Now, Cohen has mentioned it’s seemingly not, and that’s acquired customers in a tiff. The obscure responses and lack of concrete timelines has remodeled a really hyped occasion from a really hyped platform into very panicked promoting.

Making issues worse, a latest $5.5 billion class-action lawsuit filed in New York alleges Pump.enjoyable operates an unlicensed on line casino scheme through meme coin buying and selling, with Solana Labs and the Solana Basis named as co-defendants.

The zero-vesting token mannequin, which initially attracted patrons with guarantees of speedy liquidity, has backfired spectacularly. Almost 60% of presale members have bought or transferred their tokens, in line with BitMEX, including to the relentless promote stress that has pushed PUMP 60% under its ICO worth.

Whereas Pump bleeds out, competitor LetsBonk has been quietly stealing market share, which can also be seemingly taking part in into this. Though Pump.enjoyable has progress numbers that rival the most important gamers in crypto, its income has slowed down significantly as LetsBonk captures an increasing number of of the meme coin buying and selling market.

On a facet notice, customers on Myriad, a prediction market developed by Decrypt‘s mother or father firm Dastan, had been as soon as not less than prepared to entertain the notion that Pump.enjoyable’s PUMP token would surpass the Bonk meme coin in market cap. Per week in the past, they gave PUMP an 18% likelihood. At the moment, these odds are down to simply 3.2%.

Regardless of Cohen mentioning that $20 million price of PUMP had been repurchased after launch, plus one other $550,000 in latest days, it’s seemingly completed little or no to stem the bleeding.

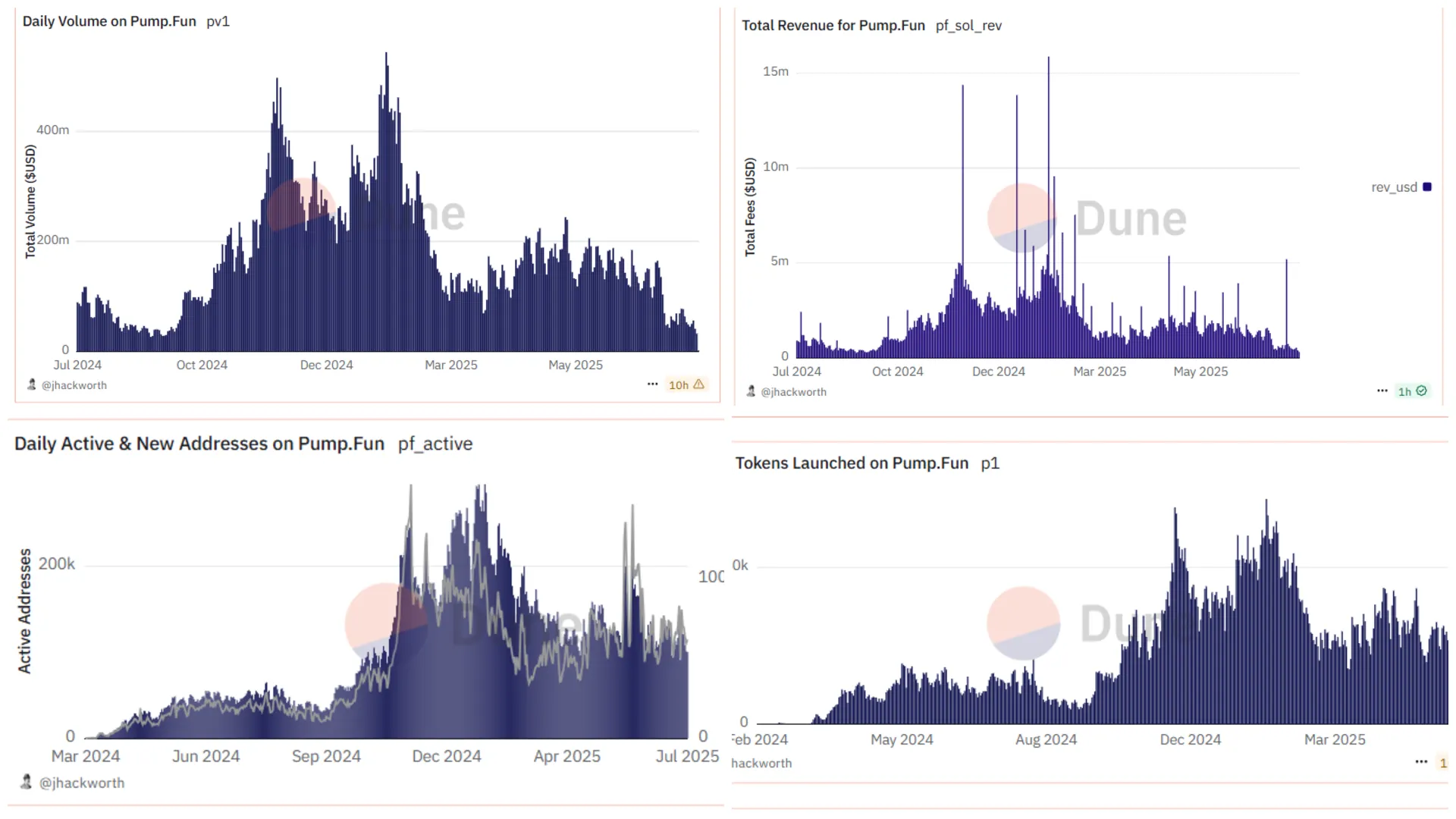

The launchpad’s declining exercise and practically all of its fundamentals counsel its glory days could also be behind it. Each day energetic customers are down 70% from the height, income numbers have fallen all year long, and the variety of tokens launched has additionally declined in 2025.

So what concerning the charts?

PUMP worth evaluation: Not a bull in sight

Simply to catch you up as soon as once more: The PUMP token is at the moment buying and selling at $0.0024. Down 2.50% in a single hour, down 15.28% within the final 24 hours, down 41.88% within the final week, and down 63% since July 16—sooner or later after its ICO.

It’s the worst performing token within the prime 100 cash. And that’s been the case for a couple of days now.

In equity, the token is much too younger to do correct technical evaluation on every day candlesticks. However the 4-hour chart paints a grim image for PUMP holders, with each technical indicator screaming “promote.”

The Relative Power Index, or RSI, sits deep in oversold territory at 28 factors. Sometimes something under 30 signifies excessive promoting stress. Whereas oversold circumstances usually precede bounces, the shortage of any bullish divergence suggests sellers stay firmly in management.

Merchants usually search for RSI to climb again above 30 as an early signal of stabilization, however PUMP exhibits no such indicators.

The Common Directional Index, or ADX, measures development power no matter course, with readings above 25 confirming a powerful development and above 40 indicating a particularly highly effective transfer. At 41, PUMP’s ADX confirms this is not only a correction after the ICO’s pump however a full-blown downtrend with important momentum. When ADX is this elevated throughout a worth decline, it usually means the promoting stress has extra room to develop earlier than exhaustion.

With PUMP being such a younger token, conventional 50-day and 200-day worth averages aren’t accessible. Nonetheless, the shorter-term averages that exist all slope downward, with every successive common under the earlier one—a textbook bearish alignment. So, for merchants, it actually doesn’t take a lot to conclude that, proper now, any short-term common will register decrease costs than an extended development, since costs have solely gone down with no bullish correction.

This configuration acts as dynamic resistance on any bounce makes an attempt, making sustained rallies practically unattainable.

The Squeeze Momentum Indicator is at the moment “off” on the 4-hour timeframe, indicating that volatility has already been launched—in all probability put up ICO. This implies the explosive transfer down has performed out within the close to time period, however with none bullish momentum constructing, it’s straightforward for merchants to interpret this to imply sideways-to-down motion is the probably situation.

The one glimmer of hope comes for day merchants utilizing the 1-hour chart, which can also be extraordinarily bearish however exhibits a zone of bullish impulse not less than within the speedy time period. Not sufficient to cancel multi-day losses, however in all probability good for a couple of trades with very small home windows. We’re speaking hours if not minutes.

The descending channel sample seen on the chart supplies clear boundaries for the present downtrend. PUMP would wish to interrupt above $0.0027 (the higher channel line) to even trace at a development reversal. Till then, the trail of least resistance stays decisively decrease. Sorry, PUMP believers, however we don’t make the foundations.

Key Ranges:

- Instant assist: $0.00239 (psychological degree and stop-loss zone)

- Robust assist: $0.00200 (spherical quantity that would appeal to discount hunters)

- Instant resistance: $0.0028 (pivot level and liquidity zone)

- Robust resistance: $0.00340 (higher boundary and breakout degree)

Disclaimer

The views and opinions expressed by the creator are for informational functions solely and don’t represent monetary, funding, or different recommendation.

Each day Debrief Publication

Begin each day with the highest information tales proper now, plus unique options, a podcast, movies and extra.