Bitcoin seems to be on the verge of a breakdown after rallying to $123,000 all-time highs earlier within the month. This reversal has taken the market unexpectedly, with the altcoin market, as soon as once more, bearing the brunt of the losses. Now, because the Bitcoin value reaches an vital stage, the questions of whether or not that is the beginning of a bear pattern or if there will probably be a bounce in value have change into extra pressing.

Bitcoin Tendencies Low After New Highs

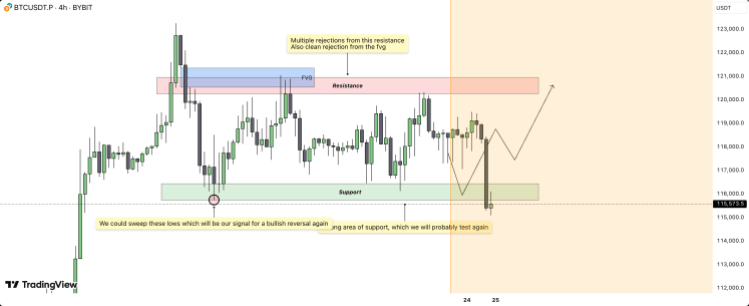

After the reversal again into the $117,000 ranges, crypto analyst TehThomas has revealed an evaluation outlining the present Bitcoin value pattern and the place it may very well be headed subsequent. To date, the analyst explains that Bitcoin remains to be buying and selling in a well-defined pattern after being rejected from the higher resistance zone at $120,000 a number of instances. Nevertheless, there’s nonetheless quite a lot of chew from its assist ranges under, which may very well be its saving grace.

Associated Studying

Because the analyst explains, the truth that the assist continues to carry reveals that there’s nonetheless quite a lot of shopping for happening for Bitcoin. This places the assist very tight round this space, but additionally makes it a harmful territory for the bulls. It’s potential that there’s a sweep again to those lows, and Thomas explains that such a transfer would engineer sell-side liquidity.

There may be additionally a Honest Worth Hole (FVG) on the $121,000 stage, which continues to be defended. That is the place a lot of the resistance has come from, pushing the worth again under $118,000 a number of instances already. Thus, this FVG is the following stage to reclaim within the marketing campaign for brand spanking new highs.

Bouncing Again From Lows

If the sweep again towards the lows is accomplished, it isn’t solely bearish for the Bitcoin value and will, in reality, be the transfer that helps to set off the following wave of uptrend. The analyst explains that consumers must step again in at this stage, with assist sitting firmly at $116,000. This accumulation throughout consolidation could be inherently bullish.

Associated Studying

Trying again on the FVG, the analyst explains that it might act as a magnet if the worth begins to rise once more. Nonetheless, all of this is dependent upon the Bitcoin value dipping again to assist after which bouncing off once more. The sweep of liquidity on the lows and the bounce would provide affirmation that the worth goes to maintain trending upward.

Nevertheless, there’s nonetheless the potential for a value breakdown from right here. Thomas factors to an invalidation of the bullish thesis if assist at $116,000 fails to carry and there’s no fast restoration. “Bitcoin stays locked in a transparent vary, and till the breakout occurs, the sides of that vary provide one of the best buying and selling alternatives,” the analyst defined.

Featured picture from Dall.E, chart from TradingView.com