Bitcoin is as soon as once more mirroring world liquidity traits—and that might have main implications within the days forward.

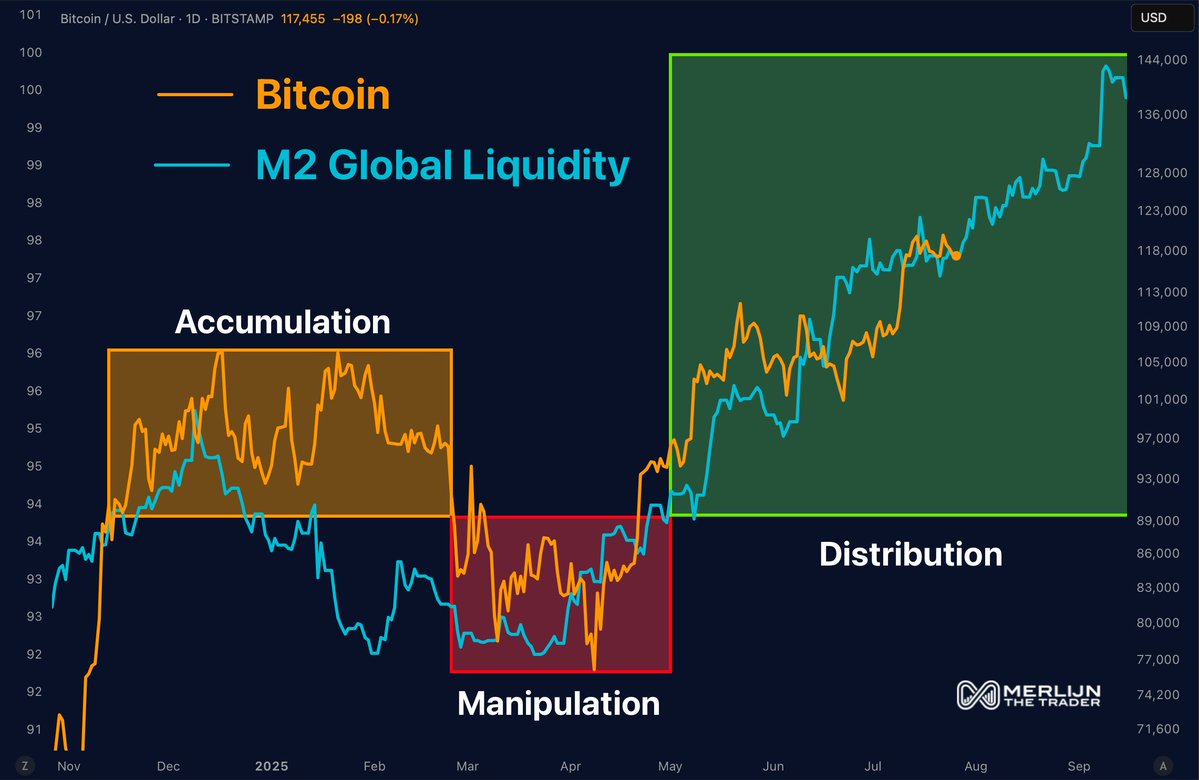

In line with Merlijn The Dealer, the current explosion in M2 world liquidity is being instantly mirrored in Bitcoin’s worth chart. His overlay evaluation exhibits that Bitcoin has adopted every part of the liquidity cycle—accumulation, manipulation, and now distribution—with near-perfect correlation.

The takeaway? “Ignore the noise. Comply with the liquidity,” Merlijn says, including that worth tends to obey wherever capital flows.

In his view, as M2 continues to surge, Bitcoin might quickly break by way of to new highs. The chart presently exhibits BTC monitoring world liquidity into a possible late-summer rally zone, already testing the $123,000 mark. Analysts are actually eyeing $135,000 and even $144,000 as near-term extension targets—assuming M2 doesn’t reverse.

In the meantime, Daan Crypto Trades provides one other layer to the technical image. His liquidation heatmap exhibits a really slender danger hall between $115,000 and $120,000. This tight band, formed by current sideways motion, signifies that if Bitcoin dips under ~$115K or breaks above ~$120K, a big batch of liquidations could possibly be triggered. That would create a sudden volatility spike—both upward or downward—relying on which path hits first.

The Binance liquidation knowledge reveals dense clusters of each lengthy and brief liquidations close to these ranges, suggesting that merchants are closely positioned on both aspect. If liquidity stress continues to rise, the $120K ceiling might give means rapidly, unleashing a spherical of liquidations that fuels a pointy breakout.

Briefly, world liquidity and leveraged positioning are converging to arrange Bitcoin’s subsequent main transfer. Whereas short-term consolidation might proceed, stress is clearly constructing. As Merlijn places it: “When liquidity floods in, Bitcoin doesn’t wait.”