Robinhood’s tokenized inventory choices in Europe have ignited debate over the legality of tokenizing fairness, particularly that of personal firms like OpenAI.

OpenAI stated Robinhood’s unapproved OpenAI tokens supply no fairness possession rights, inflicting regulators in Lithuania to open a proper inquiry. However that’s simply the beginning. With considerations over how totally different jurisdictions method tokenized shares, the boundary between innovation and illegality, and whether or not there are adequate authorized protections for inventory token holders.

To unpack the authorized complexities behind tokenized shares, Journal spoke with Yuriy Brisov of Digital & Analogue Companions, Joshua Chu of the Hong Kong Web3 Affiliation and Yulia Murat, head of regulatory affairs at International Ledger.

The dialog has been edited for readability and size.

Journal: What’s the authorized basis for tokenizing shares, and the way does it differ between private and non-private shares?

Brisov: Tokenization emerged as a technical answer — not a authorized one. It’s merely a digital format for this current brokerage construction. Normally, the voting rights are restricted, however the financial rights are transferred to shoppers. This mannequin is authorized within the US and Europe.

The priority arises with personal shares. If Robinhood solely provided tokenized variations of publicly traded shares, there wouldn’t be many authorized points as a result of the tokenized share continues to be the identical share, simply in a unique format. Within the US, an organization can nonetheless difficulty paper share certificates signed by two officers, or go digital and difficulty them by way of a brokerage. A tokenized share is basically a digital certificates.

Personal shares, nevertheless, include restrictions. You usually want firm or shareholder approval to resell. There are often preemptive rights that require you to supply the share again to the corporate or different shareholders earlier than promoting it to outsiders.

Chu: This obtained headlines as a result of OpenAI publicly condemned it. That’s as a result of these artificial wrappers are sometimes created with out understanding the rights hooked up to the unique shares. Does the vendor even have the precise to supply this? If not, patrons might find yourself holding one thing that’s both nugatory or comes with liabilities. If it breaches shareholder agreements, relying on the severity, it may have authorized penalties.

Robinhood knew the dangers. Once they launched the tokenized shares, they stated these are simply artificial representations. But when they’re profiting and utilizing others’ emblems, it opens the door to authorized points — not simply securities legislation, however trademark infringement and broader compliance violations.

Journal: When do tokenized shares cross the road into unregistered securities choices?

Brisov: Robinhood and others are actually saying they’re not reselling shares, however reasonably promoting pursuits in shares. That’s a slippery slope that brings us to the Howey Take a look at, which determines whether or not one thing is a safety. For those who make investments cash into a standard enterprise anticipating earnings solely from others’ efforts, then it’s a safety.

Most tokenized share choices would seemingly fall underneath this definition. In each US and European legislation, what issues is the financial actuality of the transaction, not what the paperwork say. If I’m shopping for a by-product of a inventory, anticipating revenue and doing nothing else, that’s clearly a safety.

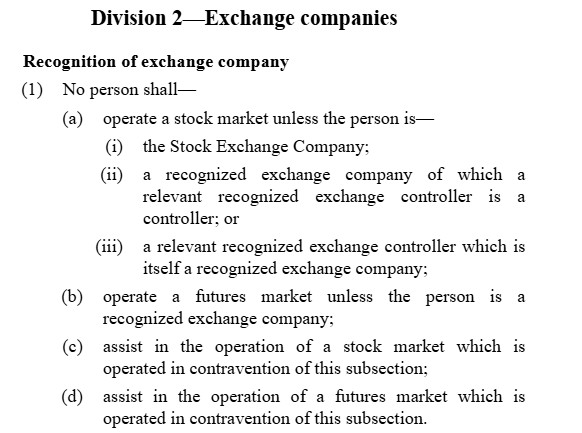

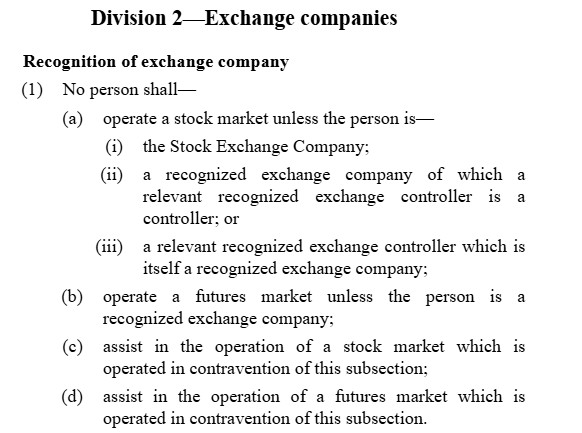

Chu: Below Part 19 of the Securities and Futures Ordinance (SFO) right here in Hong Kong, it’s really written into the legislation that the Inventory Change of Hong Kong (HKEX) — which is a restricted firm — is the one entity that may cope with Hong Kong company shares.

You’re in all probability accustomed to [American Depositary Receipts] — the mechanism permitting Individuals to purchase international firm shares with out instantly going into international jurisdictions. You haven’t seen Hong Kong doing that lots due to the monopoly provision underneath the SFO. For those who do it and also you’re profitable, you’re more likely to face litigation not simply from regulators, however from the inventory alternate itself. If HKEX needs to difficulty or record tokenized shares, they will. The legislation doesn’t prohibit utilizing know-how to report share possession otherwise.

Learn additionally

Options

Monetary nihilism in crypto is over — It’s time to dream huge once more

Options

How good folks spend money on dumb memecoins: 3-point plan for fulfillment

However we haven’t even touched on personal firms, which is what Robinhood’s case is about. On this specific case, you’re taking a look at an artificial relationship. You’re principally shopping for a useful curiosity, however not the precise underlying curiosity. Meaning you may’t sue if there’s an occasion the place authorized standing is required to go after an entity.

Journal: What are the dangers concerned in issuing tokenized shares by way of offshore entities?

Murat: When tokenized shares are issued by offshore entities and bought to people in jurisdictions just like the US, UK or EU, vital challenges come up from an Anti-Cash Laundering (AML) perspective. These challenges stem primarily from variations in regulatory requirements and difficulties in implementing compliance throughout borders.

One other core problem lies within the opaque possession buildings generally utilized in offshore tokenization schemes. Tokenized shares could also be issued by way of shell firms or special-purpose automobiles (SPVs) registered in secrecy jurisdictions, with no clear final useful proprietor (UBO) disclosed. This lack of transparency conflicts with the regulatory expectations within the US, UK and EU, the place UBO identification is a cornerstone of AML compliance.

When offshore platforms obscure both the id of the issuer or the investor, they frustrate AML enforcement and hinder regulators’ skill to detect and reply to suspicious exercise.

Journal: Are there any authorized and compliant paths to providing tokenized shares to the general public?

Brisov: If the corporate whose shares are being tokenized provides permission, there are two paths: both promote it privately to a restricted group of traders or go public.

Below US legislation, you can also make a secondary personal providing by way of an over-the-counter deal for those who’re a licensed broker-dealer. But it surely have to be restricted to accredited traders.

Learn additionally

Options

How Silk Street Made Your Mailman a Supplier

Options

Tokenomics not Ponzi-nomics: Influencing habits, earning profits

Alternatively, underneath Regulation S, you may supply shares solely to non-US traders. For instance, Robinhood may supply tokenized shares in locations just like the United Arab Emirates or Japan. It’s arduous to implement these geographic restrictions on a digital platform, but it surely’s potential. Binance and others have performed it.

Journal: Does tokenization or utilizing offshore jurisdictions exempt firms from disclosure necessities?

Chu: Completely not. Any firm that tries that may land in deep trouble. It’s not a loophole. Regulators worldwide comply with widespread ideas underneath worldwide our bodies.

The issue is that individuals suppose if it’s on a blockchain or offshore, it’s immune from securities legislation. It’s not. Tokenization doesn’t excuse you from disclosure or licensing necessities. Even for those who’re in a jurisdiction that hasn’t explicitly banned this, the second you contact retail or promote funding returns, you’re in securities territory.

Journal: What enforcement challenges come up when tokenized shares are issued by offshore entities?

Brisov: Regulators can and do implement securities legal guidelines throughout borders. Take the instance of TON. They raised almost $2 billion globally — solely $700 million got here from US traders. Nonetheless, the SEC froze belongings. US, U.Ok. and EU court docket orders carry huge weight internationally.

For those who’re providing tokenized shares from, say, the British Virgin Islands or Seychelles, you’re nonetheless underneath risk for those who goal world traders. Even for those who put a disclaimer saying you’re excluding the US, that solely works for those who actively prohibit entry. For those who merely say it however let anybody make investments, US legislation will nonetheless apply.

The SEC has a protracted attain. If US traders are concerned and even simply have potential publicity, the SEC claims jurisdiction.

Murat: Reporting obligations additionally fluctuate considerably. Even when offshore issuers are obliged to file Suspicious Exercise Stories (SARs) or Suspicious Transaction Stories (STRs), these studies are sometimes submitted to their native monetary intelligence items. This deprives US, UK and EU authorities of significant intelligence, until the transaction could be linked to a identified pockets or counterparty by way of superior blockchain tracing instruments. Nevertheless, even with such instruments, tracing illicit funds is commonly solely efficient when matched with off-chain id knowledge — knowledge that many offshore platforms both don’t gather or are unwilling to share.

Learn additionally

Options

Brokers of Affect: He Who Controls The Blockchain, Controls The Cryptoverse

Options

Crypto-Sec: $11M Bittensor phish, UwU Lend and Curve pretend information, $22M Lykke hack

Compounding these points is the usage of decentralized recordkeeping. Some tokenized fairness techniques function on decentralized networks, that means there isn’t any central entity with the ability to freeze suspicious funds or implement compliance actions. Whereas the blockchain itself could also be clear, if issuers or buying and selling platforms don’t preserve dependable KYC data off-chain, or don’t combine with blockchain analytics suppliers, the path of possession and accountability stays fragmented.

Regulatory authorities are starting to answer these points. Within the EU, the Switch of Funds Regulation (TFR) expands the Journey Rule to cowl crypto transactions, whereas UK and US authorities are rising strain on intermediaries — pockets suppliers, fee processors and platforms — to undertake risk-based compliance measures.

In the end, the usage of offshore platforms to difficulty tokenized shares with out adhering to high-standard AML controls presents a major risk to monetary integrity. Until these platforms undertake significant KYC, reporting and information-sharing practices, they are going to stay weak to abuse and more and more more likely to face enforcement motion or restrictions by main regulators.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist overlaying blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has lined Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.