So, you died.

Persons are unhappy, your physique is handled, and the world retains spinning. However what occurs to your crypto?

Digital property turn out to be a part of your property — and the gears of the authorized system creak into movement to deal with this digital physique, now legally distinct from the one headed six ft underneath. The issue? Crypto inheritances are sometimes much less like accessing gold bullion in a secure, and extra like inheriting a buried treasure — it may be completely on the heir to really discover it!

This beginning information is for these planning their property, inheritors and executors — anybody who would possibly sooner or later be liable for determining what to do with digital wealth that doesn’t sit in a checking account.

Although authorized programs differ, crypto is often handled as property, not forex. As such, upon loss of life, it should be inventoried and valued in the identical means as valuable metals and distributed in keeping with the need — if one exists — and native inheritance legal guidelines. It will often be accomplished by an property administrator or executor, who might want to work out the property’s worth on the time of loss of life. Taxes may additionally be payable, relying on jurisdiction. As soon as settled, the property ceases to be.

Bitcoin inheritance: The Bitcoin Executor

A scenario like that is depicted in a forthcoming unbiased film, The Bitcoin Executor, that includes Graham Wardle from the Canadian TV drama Heartland. Within the movie, a skeptical economics professor turns into the executor of his Bitcoin-loving colleague’s property. The deceased left behind a number of {hardware} wallets, and because the professor makes an attempt to distribute the cash, he learns in regards to the know-how whereas confronting the philosophy behind it.

For these eager about passing on their crypto, producer Christopher Arcella has a easy piece of recommendation:

“Discover somebody you may belief, after which work out learn how to belief them if you find yourself gone”

Find and entry the deceased’s crypto property

Dropping a cherished one is traumatic, and units in movement a shocking quantity of logistics.

“After the preliminary shock, households begin considering what must be accomplished — they aren’t certain if they should contact the financial institution,” says Joonatan Lamsa, hedge fund relationship supervisor at Wealthrone. Lamsa has a decade of prior expertise in banking in Finland, the place he handled new estates on a month-to-month foundation. Step one, he would inform them, is to get a loss of life certificates, the availability of which ends up in freezing of the deceased’s accounts. “Crypto exchanges work the identical means,” he says.

The primary problem in a crypto inheritance scenario is usually merely determining whether or not any crypto exists, and if that’s the case, the way it was saved. If the deceased ever talked about crypto, there’s an opportunity they owned some — however not like conventional property, digital wealth might depart no clear paper path.

Until held in a monetary establishment by way of a crypto ETF like Goal (Canada) or ProShares (US), there’s no paper path. Exchanges don’t ship letters. Within the case of self-custody — whether or not on a cellphone, USB stick, or piece of paper — there is no such thing as a firm or establishment to contact. If nobody is aware of to look — and even what to search for — the property might stay undiscovered and completely inaccessible.

When you’ve discovered indicators of crypto, you’ll want to find out whether or not the property have been held on a centralized change (custodial) or in a private pockets (non-custodial). This distinction is essential, because it impacts not solely entry, but additionally the logistical and/or technical complexity of inheritance.

If saved on a centralized and controlled change like Coinbase, Binance or Crypto.com, the method is similar to accessing a checking account, as these firms maintain custody of the digital property on behalf of the consumer.

Lamsa emphasises that to ensure that property issues to proceed, paperwork have to be so as. “The loss of life certificates, proof that you’re concerned with the property, and legitimate ID,” he lists as the essential necessities. “The very best place to begin is customer support; they’re used to those requests.” As soon as the paperwork are confirmed, banks, brokerages, and exchanges will share details about property held.

If the deceased left behind login credentials, it could be technically attainable to log in and switch the funds — however that doesn’t imply you’re legally entitled to take action. In lots of jurisdictions, accessing another person’s account after loss of life — even with their password — will be thought of unauthorized use until you’re performing with correct authorized authority, similar to by a will or probate appointment. Some exchanges may additionally think about accessing a deceased particular person’s change account with out informing the platform as a Phrases of Service violation.

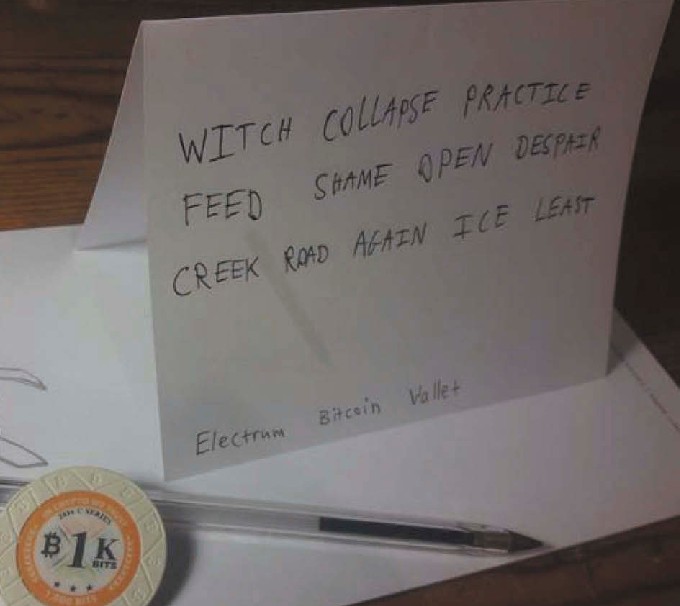

Pockets apps, browser extensions, and chilly storage gadgets fall underneath self-custody — there’s no firm to contact, solely PINs, passwords, personal keys, or seed phrases to entry the property.

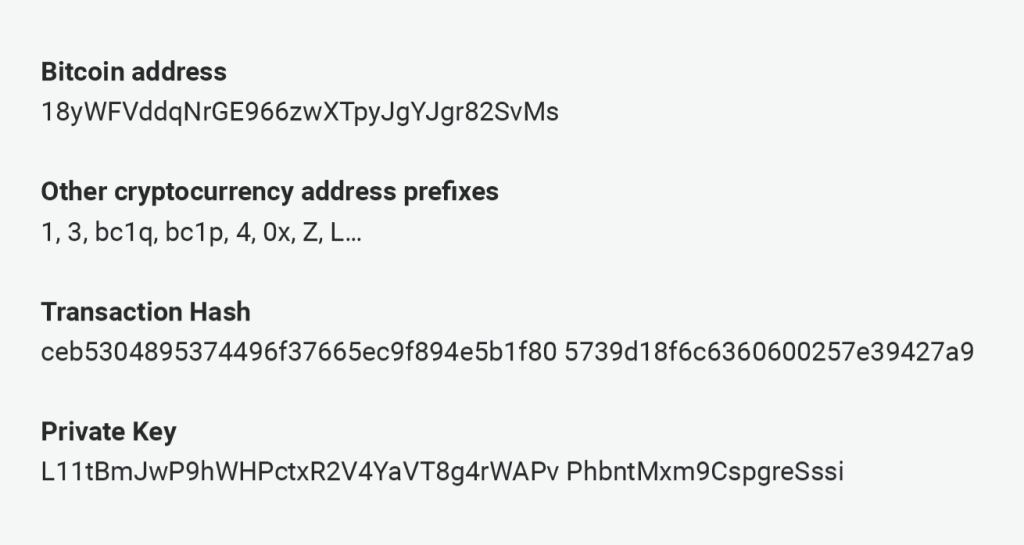

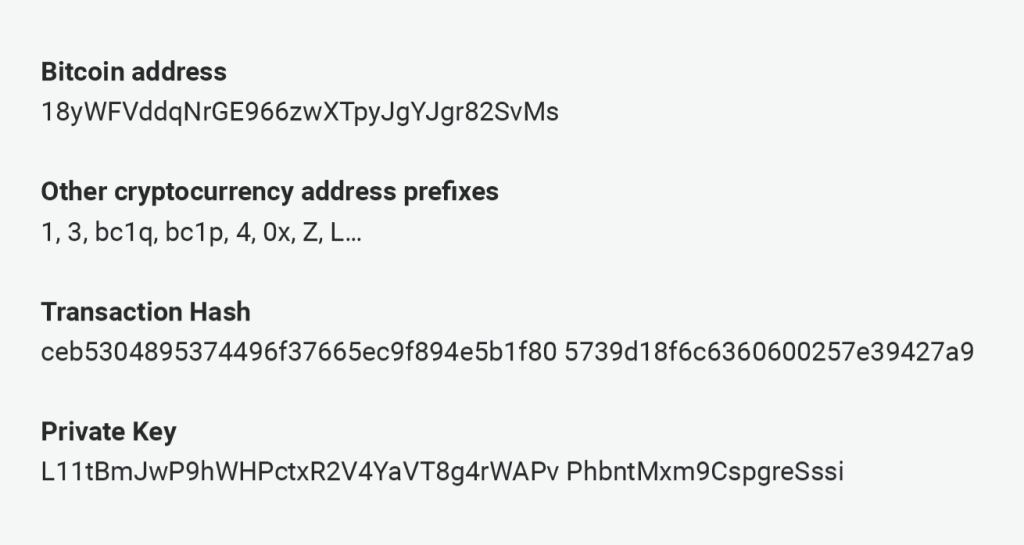

Even a single pockets handle will be revealing: blockchain explorers like Blockchain.data, Blockchair, or BTCscan allow you to test balances and hint exercise. You would possibly even spot deposits or withdrawals with a selected change. Equally, an change, even when empty, might have data regarding the place property have been despatched from it. Comply with the cash!

Tips on how to seek for a crypto inheritance

Emails:

Search for welcome messages or safety alerts from exchanges like Coinbase, Binance, Kraken, Bitstamp, Crypto.com, Gemini or KuCoin. Attempt key phrases like welcome, account, login, safety, verification and gadget.

Units

Examine for cellular pockets apps like Belief Pockets, Exodus, Coinomi or Atomic; change apps; and browser extension Web3 wallets like MetaMask, Phantom, or Keplr, and test for phrases like pockets, crypto, blockchain, and Web3. Search for encrypted images or information which will comprise passphrases.

Password and 2-Issue Managers

Examine saved credentials and 2FA backup keys — these could also be saved in apps like Google Authenticator or Authy, or in password managers similar to Google Password Supervisor, 1Password, Bitwarden and LastPass.

Learn additionally

Options

Slumdog billionaire 2: ‘Prime 10… brings no satisfaction’ says Polygon’s Sandeep Nailwal

Options

Trump’s crypto ventures elevate battle of curiosity, insider buying and selling questions

Emails:

Search for welcome messages or safety alerts from exchanges like Coinbase, Binance, Kraken, Bitstamp, Crypto.com, Gemini or KuCoin. Attempt key phrases like welcome, account, login, safety, verification and gadget.

Units

Examine for cellular pockets apps like Belief Pockets, Exodus, Coinomi or Atomic; change apps; and browser extension Web3 wallets like MetaMask, Phantom or Keplr, and test for phrases like pockets, crypto, blockchain and Web3. Search for encrypted images or information which will comprise passphrases.

Financial institution vault

Some folks retailer their {hardware} pockets seed phrases in a secure deposit envelope or field, so test with the particular person’s financial institution.

Data

Look by digital data, .txt, .pdf, .json, or .key information labeled pockets, seed, phrase, personal, key, or backup could also be particularly necessary. When going by papers or information, be alert for seemingly random collections of 12–25 phrases which can be restoration phrases — these are sometimes handwritten in notebooks. Strings of letters or numbers will be keys, addresses, or transaction IDs, and these may also be saved within the type of QR codes, together with bodily Bitcoin. Banking data present withdrawals to or deposits from exchanges, and tax or accounting data might trace at crypto holdings. “Many individuals even have security deposit containers, and these are pure locations to retailer key backups,” Lamsa notes.

Mates and colleagues

They might have spoken about their holdings with others.

As soon as crypto is discovered and accessed, it needs to be transferred to a safe location — whether or not an change account or pockets managed by the property (or heir, within the case of inheritance distributions). It is very important perceive what’s being accomplished or rent reliable skilled assist, as errors are sometimes irreversible and might result in lack of all funds. Take a look at transactions — small transfers previous a bigger one — are advisable. Many noobs get scammed.

{Hardware} Wallets

These can seem like USB sticks, miniature calculators or displays, with frequent manufacturers being Ledger, Trezor and Coldcard. If discovered, they’re doubtless ineffective and not using a PIN code or restoration phrase, and should brick after too many unsuitable codes.

Crypto property planning to move on Bitcoin once you die

Write it down!

In Lamsa’s expertise, folks often kind out their affairs after they know they’re more likely to die inside a 12 months or two, however “typically an individual dies unexpectedly, with out preparations — in these instances it may take some effort to resolve issues.” An unknown account might finally be misplaced.

Wills, which will be easy and drafted with out a lot value, are a preferred means to make sure that property are distributed in keeping with needs. It’s, nevertheless, necessary to keep in mind that merely keen one’s crypto-assets to somebody isn’t sufficient — you must be sure that this particular person or somebody engaged on their behalf can reliably find and entry the property in query if you find yourself completely unavailable to reply their questions on it. There aren’t any help tickets within the grave. In case your family members don’t know the place to click on, the cash are gone.

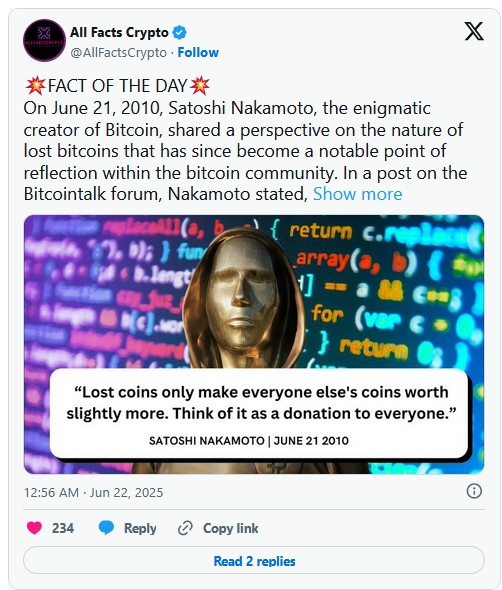

Unclaimed cash would possibly find yourself as deserted property, maybe finally handed over to the federal government by a course of known as escheatment, or just stored indefinitely by exchanges the place legal guidelines permit. Misplaced cash, as Satoshi put it, are “a donation to everybody.”

“Even within the worst case, your family members ought to be capable to entry your laptop, information and electronic mail,” says Lamsa. He recommends protecting backup keys, directions and printed paperwork in a fireproof secure — and making certain cellphone passcodes are recoverable.

“For issues like overseas financial institution accounts, personal inventory holdings, or restricted partnerships in funding funds, bodily paperwork with account numbers is perhaps the one means inheritors know the place to go knocking.”

Varied crypto inheritance companies supply to assist on this entrance. One in all these, DGLegacy, invitations purchasers to provide them a listing of crypto property in addition to appoint beneficiaries or trustees, notifying them if the “heartbeat protocol” detects indicators that the consumer is now not current — by monitoring social media and sending check-up emails and calls. Self-custody supplier Casa presents an inheritance service that features {hardware} gadgets and restoration instruments.

{Hardware} suppliers like SafeKey, makers of a USB gadget for safe logins, have additionally entered the market — each buyer will finally die, in spite of everything (until Bryan Johnson proves we are able to dwell perpetually, that’s). They’ve partnered with InheritIt to create Secret Shares Distribution Protocol “in order that a number of beneficiaries can safely keep shared possession of your crypto inheritance.”

Learn additionally

Options

Bitcoin vs stablecoins showdown looms as GENIUS Act nears

Options

Saving the planet may very well be blockchain’s killer app

How wealthy Crypto OG passes on crypto after loss of life by way of trusts

For these with important crypto holdings, trusts supply a approach to move wealth throughout generations — whereas protecting some management over the way it’s used.

“We’re targeted on property planning for crypto OGs,” says Jeffery Broer of Satoru Belief, a Hong Kong-based agency. “Meaning individuals who gained their wealth within the final 15 years of crypto.” He notes that trusts date again to the Crusades, when knights entrusted their land to somebody in case they didn’t return from warfare.

A belief permits an individual — the settlor — to position property underneath the care of a trustee, who manages them underneath authorized directions for the advantage of particular folks or causes. Not like wills, which frequently undergo probate and will be contested, trusts supply privateness and continuity — but additionally include higher complexity and price.

Crypto holders could also be cautious of giving up custody, however Broer suggests a compromise: “You don’t must entrust 100%. Even 50% is sufficient — the purpose is it’s professionally managed if one thing occurs.”

Trusts can maintain crypto by way of authorized entities, with the trustee dealing with KYC, tax reporting and onboarding. Setup prices usually begin round $20,000, making them higher suited to estates price $1M or extra.

“Do I belief my 18-year-old to handle seven figures of Bitcoin?” Broer asks. “Or an expert to behave of their finest curiosity till they’re prepared?”

Not each OG makes use of a belief. “If one thing occurs to me, I’ve attorneys who’ll know what to do and the place to get keys,” stated one nameless early holder — however I’ve put sufficient actual property in every of my youngsters’ names that even when that someway turns into an issue, the crypto gained’t matter.”

Some haven’t any plan — and their cash might meet the identical destiny as Gerald Cotten’s. MicroStrategy’s billionaire CEO, Michael Saylor, plans to go away his hundreds of cash to the void like Satoshi, as soon as stating, “I’m a single man, I’ve no kids — after I’m gone, I’m gone.”

Plan or no plan, Arcella, producer of The Bitcoin Executor, believes easy training goes a great distance. He encourages would-be inheritors to replicate on why they’re receiving crypto as a substitute of fiat.

“It’s in all probability taken the particular person a whole lot of work to get to the stage of passing it on — most would need their family members to no less than perceive why they did that.”

Subscribe

Probably the most participating reads in blockchain. Delivered as soon as a

week.

Elias Ahonen

Elias Ahonen is a Finnish-Canadian creator based mostly in Dubai, who purchased his first Bitcoin in 2013 and has since labored around the globe working a small blockchain consultancy. His guide Blockland tells the story of the trade. He holds an grasp’s diploma in worldwide and comparative regulation and wrote his thesis on NFT and metaverse regulation.