Ripple (XRP) value has surged 182.80% within the final 30 days and 30.26% previously week. Whereas its EMA traces stay bullish, with short-term traces above long-term ones, indicators like RSI and CMF counsel the uptrend might be shedding steam.

A weakening momentum may lead XRP to check assist at $1.05, with the chance of falling beneath $1 if promoting strain grows. Nonetheless, if consumers regain management, XRP might goal resistance at $1.63 and probably attain $1.7, its highest value since 2018.

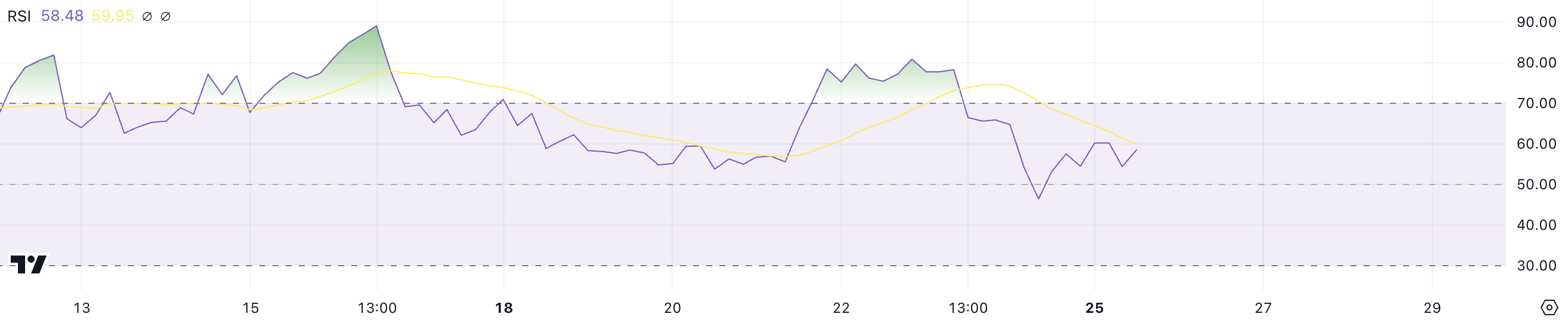

XRP RSI Is In A Impartial Zone

Ripple RSI is at present at 58, a decline from over 70 just some days in the past. The RSI, or Relative Energy Index, measures the momentum of value actions on a scale from 0 to 100, with values above 70 indicating overbought circumstances and potential for a pullback, whereas values beneath 30 counsel oversold circumstances and doable value restoration.

The drop from 70 to 58 displays cooling bullish momentum, signaling that the latest rally could also be slowing down with out but coming into bearish territory.

An RSI at 58 suggests XRP stays in a wholesome vary, leaning towards bullish sentiment however with decreased shopping for strain in comparison with earlier ranges. Following a 30.26% value surge within the final seven days, the RSI decline signifies a interval of consolidation could also be forward.

If RSI continues to fall, it might trace at elevated promoting strain, probably resulting in a value correction. Nonetheless, if the RSI stabilizes or rises, XRP value might regain momentum and try additional upside.

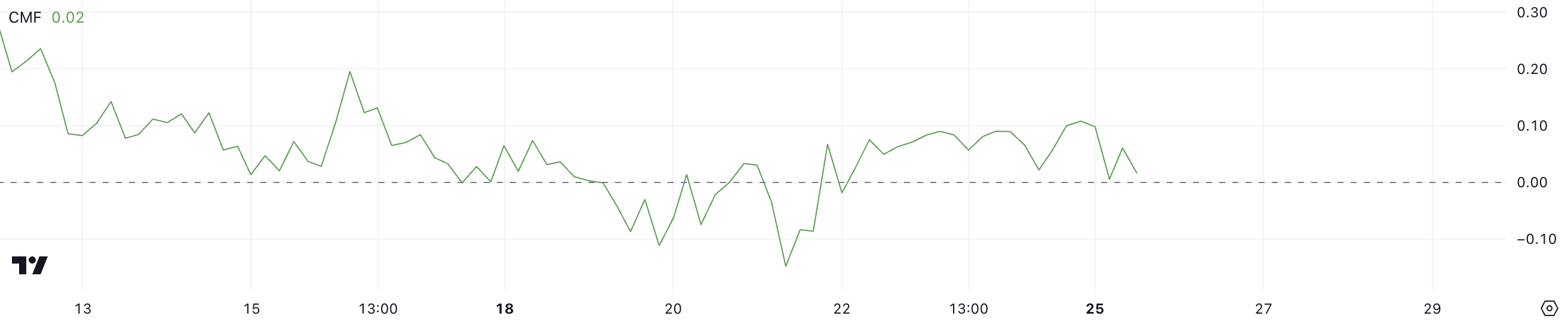

Ripple CMF Is Closely Declining

XRP’s CMF is at present at 0.02, a decline from 0.11 simply two days in the past, indicating a big discount in shopping for strain. The CMF, or Chaikin Cash Movement, measures the movement of capital into or out of an asset over a interval, with values above 0 indicating internet inflows (shopping for strain) and values beneath 0 reflecting internet outflows (promoting strain).

Since November 22, Ripple CMF has remained constructive, signaling that consumers have persistently maintained dominance regardless of the latest decline.

With a CMF at 0.02, Ripple nonetheless displays a slight internet influx of capital, suggesting the bullish sentiment has not totally light however is weakening. If CMF turns destructive, it might point out a shift to internet outflows, probably signaling elevated promoting strain and a doable value correction.

For now, the constructive CMF helps a cautiously optimistic outlook, however additional declines might sign the start of a bearish pattern for XRP value momentum.

Ripple Value Prediction: Is $1.7 On The Horizon?

XRP’s EMA traces keep a bullish setup, with short-term traces positioned above long-term ones, indicating that the general pattern stays upward. Nonetheless, different indicators just like the CMF and RSI counsel that the uptrend could also be shedding momentum.

If the bullish pattern weakens additional and a downtrend emerges, XRP value might take a look at key assist round $1.05, with the potential to fall beneath $1 if promoting strain intensifies.

However, if the uptrend regains power, XRP value might break by way of its resistance at $1.63 and intention for $1.7, which might mark its highest value since 2018.

Disclaimer

Consistent with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.