- BNB hit a brand new all-time excessive of $860, pushed by institutional adoption and treasury technique bulletins from U.S.-listed corporations.

- CEA Industries led the cost with a $500M BNB increase, backed by Binance co-founder CZ’s household workplace, whereas different corporations like LIMN, WINT, and Nano Labs dedicated a whole bunch of thousands and thousands to BNB.

- BNB’s function in company treasury diversification has fueled its outperformance, highlighting its rising standing as a retailer of worth.

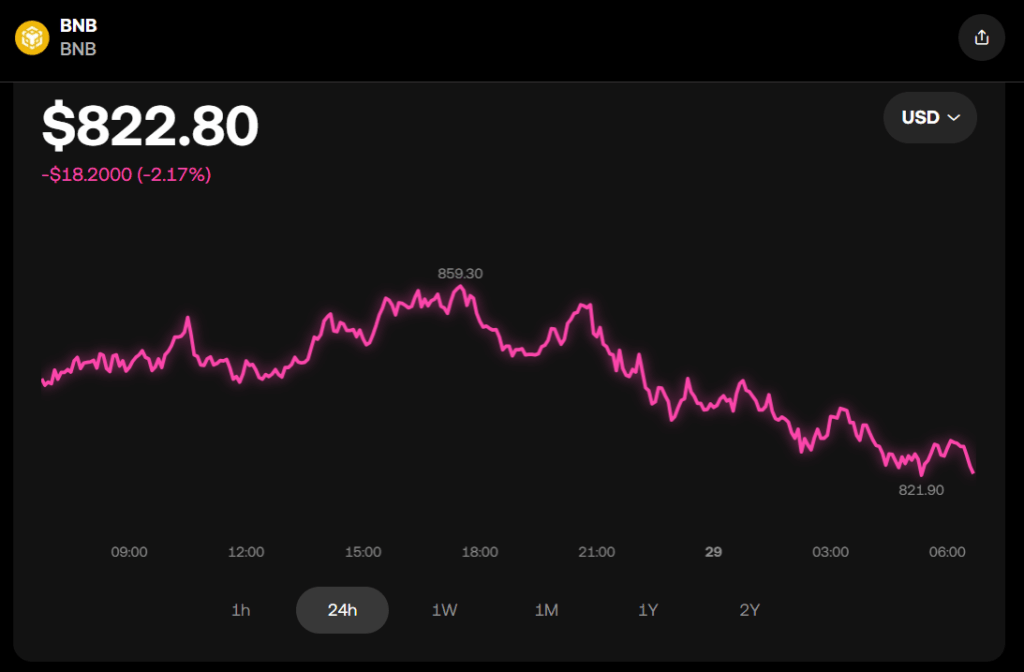

BNB, the native token of the BNB Chain, soared to a record-breaking excessive of $860 on Monday earlier than settling close to $840. It outperformed the broader crypto market, registering a 9% weekly achieve, making it the top-performing asset among the many high 10 cryptocurrencies (excluding stablecoins). The rally was fueled by a wave of U.S.-listed corporations adopting BNB as a part of their long-term crypto treasury methods.

Institutional Momentum Builds Behind BNB

The surge was catalyzed by a sequence of high-profile bulletins from publicly traded corporations. CEA Industries (VAPE) led the cost, revealing plans to boost $500 million for its BNB treasury, backed by Yzi Labs—Binance co-founder Changpeng Zhao’s household workplace. The announcement despatched VAPE’s inventory hovering over 700%, and the fundraising could broaden to $1.2 billion, solidifying its aim of changing into the biggest U.S.-listed BNB-holding firm.

Pharma and Tech Be part of the BNB Frenzy

The momentum didn’t cease there. Liminatus Pharma (LIMN) introduced the creation of a brand new subsidiary, “American BNB Technique,” with a mandate to take a position as much as $500 million in BNB. Equally, Windtree Therapeutics (WINT) dedicated as much as $700 million for BNB acquisitions final week. Tech agency Nano Labs additionally entered the scene, revealing a $100 million BNB buy over the weekend after beforehand disclosing crypto treasury intentions.

BNB’s Treasury Use Case Beneficial properties Critical Legitimacy

This rising institutional urge for food for BNB is reinforcing its standing not simply as a utility token for the Binance ecosystem, however as a authentic retailer of worth. The coordinated strikes from a number of U.S. corporations sign a brand new chapter for crypto treasury adoption, with BNB taking heart stage. These developments place further highlight on the BNB Chain and counsel that different large-cap tokens may even see related consideration as company treasury diversification methods evolve.