The brand new buying and selling week is off to a bullish begin, and a few altcoins are already standing out with spectacular momentum.

Whereas the broader market cooled off final week, a couple of property weathered the pullback and have continued to put up notable features. This has positioned them for potential continuation rallies within the days forward.

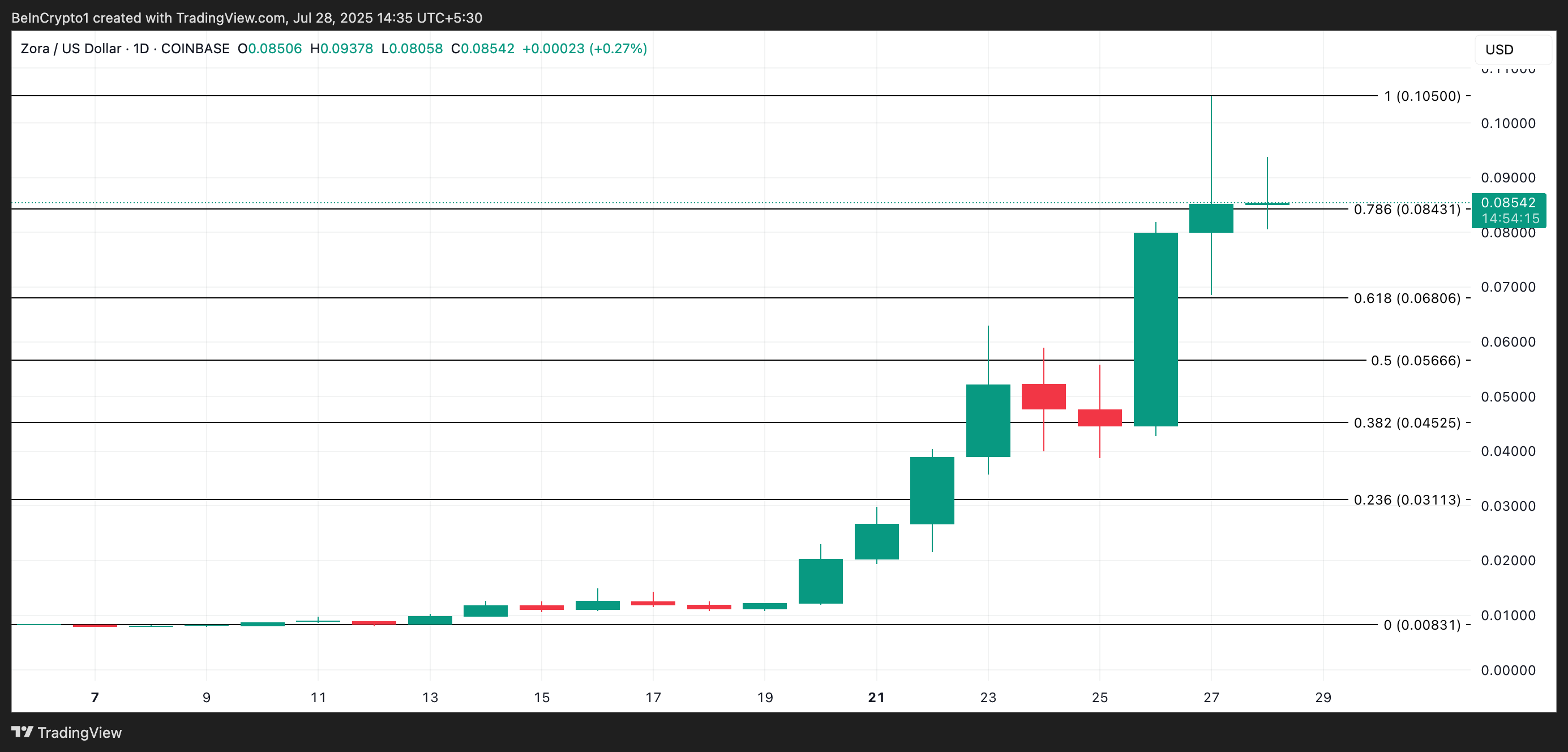

ZORA

ZORA, the native token of the Zora Protocol, is without doubt one of the altcoins to look at this week. Per Coingecko, its worth has rocketed by 325% to commerce at $0.085 at press time.

Moreso, the altcoin briefly traded at an all-time excessive of $0.105 throughout yesterday’s intraday buying and selling session. Whereas it has since witnessed a 20% correction from this worth excessive, ZORA continues to be up 8% over the previous day.

Throughout this era, its buying and selling quantity has surged to $500 million, marking a 12% improve. This uptick confirms that the rally is supported by rising investor demand and energetic participation out there.

When each worth and buying and selling quantity rise collectively, it’s seen as an indication of a wholesome, demand-driven rally. It means consumers are stepping in with conviction.

This mix validates ZORA’s uptrend and hints at a probable revisit of the all-time excessive at $0.105.

Nevertheless, a push again from the bears may set off a break under $0.084 and a fall to $0.068.

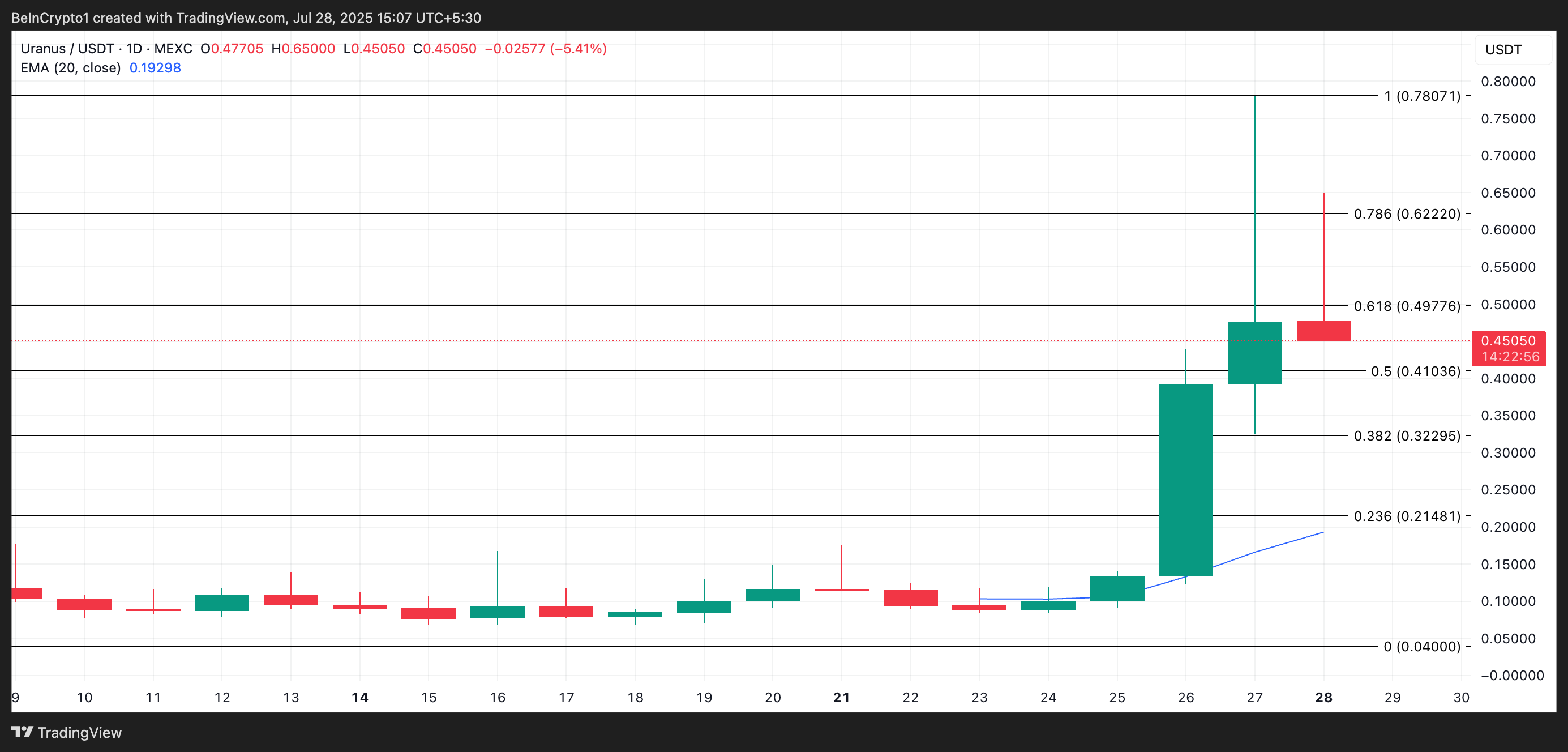

URANUS

Solana-based meme coin URANUS is one other high gainer on Coingecko to look at this week. Buying and selling at $0.47 at press time, the altcoin has seen its worth rise 235% prior to now seven days.

Readings from the URANUS/USD one-day chart present the token’s worth resting considerably above its 20-day exponential shifting common (EMA), reflecting the buy-side stress. As of this writing, URANUS’ 20-day EMA varieties dynamic assist under its worth at $0.192.

This key shifting common measures the asset’s common worth over the previous 20 buying and selling days, giving extra weight to current worth modifications.

When an asset’s worth trades above its 20-day EMA, it indicators short-term bullish momentum. This pattern suggests URANUS’ current worth motion is powerful and that its consumers are at the moment in management.

If they maintain management, the token may prolong its features and climb above $0.497.

Conversely, if selloffs begin, the token may fall to $0.410.

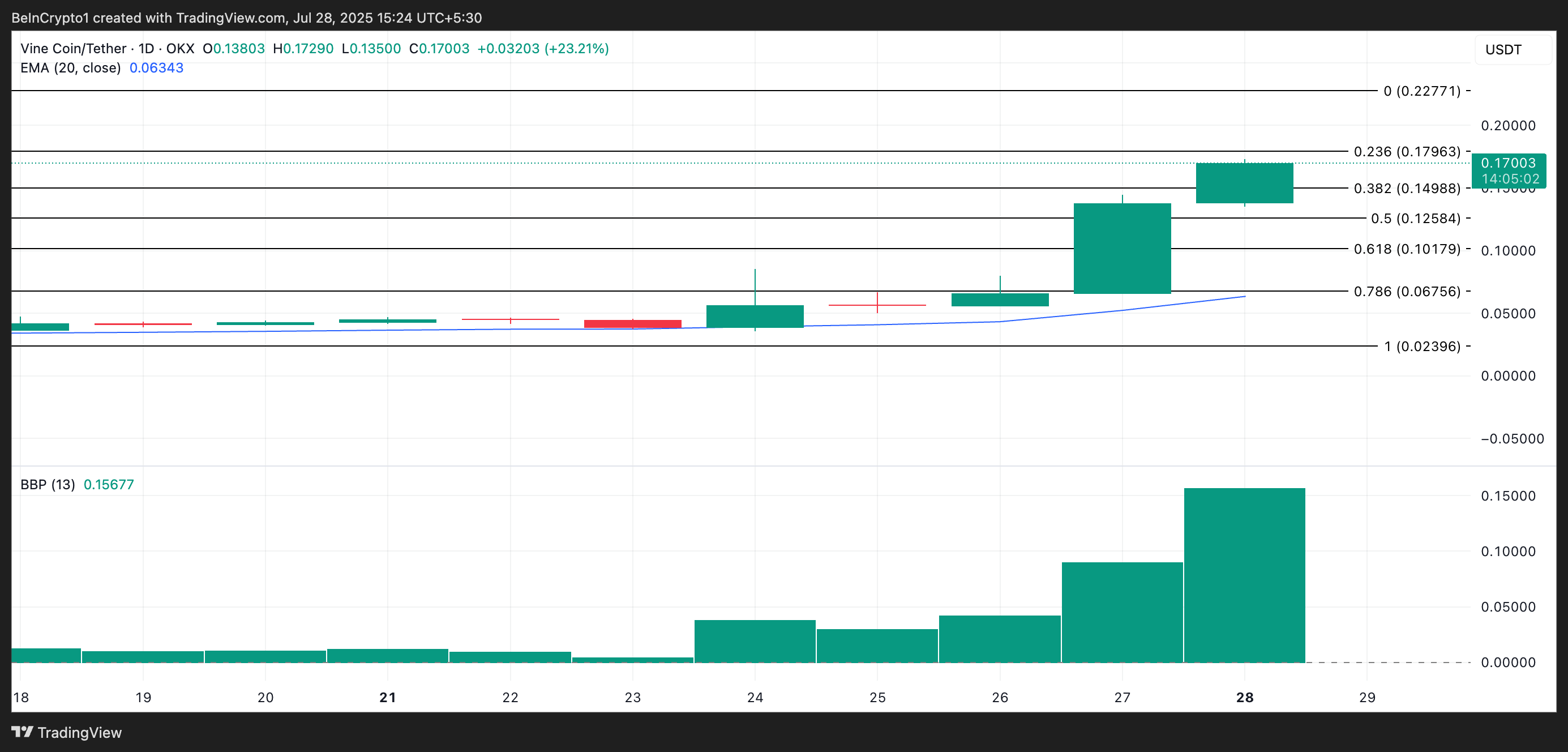

VINE

VINE, a meme coin impressed by the defunct Vine video app, is up 267% over the previous week, making it considered one of Coingecko’s high gainers to look at this week.

An evaluation of the token’s Elder-Ray Index highlights the climbing buy-side stress within the VINE spot markets. Over the previous 5 days, this momentum indicator—which measures shopping for and promoting pressures—has returned solely inexperienced histogram bars, whose sizes have grown with every buying and selling session.

This constant uptick in buy-side power means that bullish momentum round VINE is rising. The increasing inexperienced bars point out that consumers are steadily overpowering sellers, strengthening the current rally and hinting at continued upside if demand holds.

On this state of affairs, VINE may contact $0.179.

However, if the bears regain dominance, they might set off a worth dip to $0.149.

Disclaimer

In step with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.