Disclaimer: The opinions expressed by our writers are their very own and don’t symbolize the views of U.At the moment. The monetary and market data offered on U.At the moment is meant for informational functions solely. U.At the moment will not be chargeable for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your individual analysis by contacting monetary specialists earlier than making any funding selections. We imagine that every one content material is correct as of the date of publication, however sure provides talked about might now not be out there.

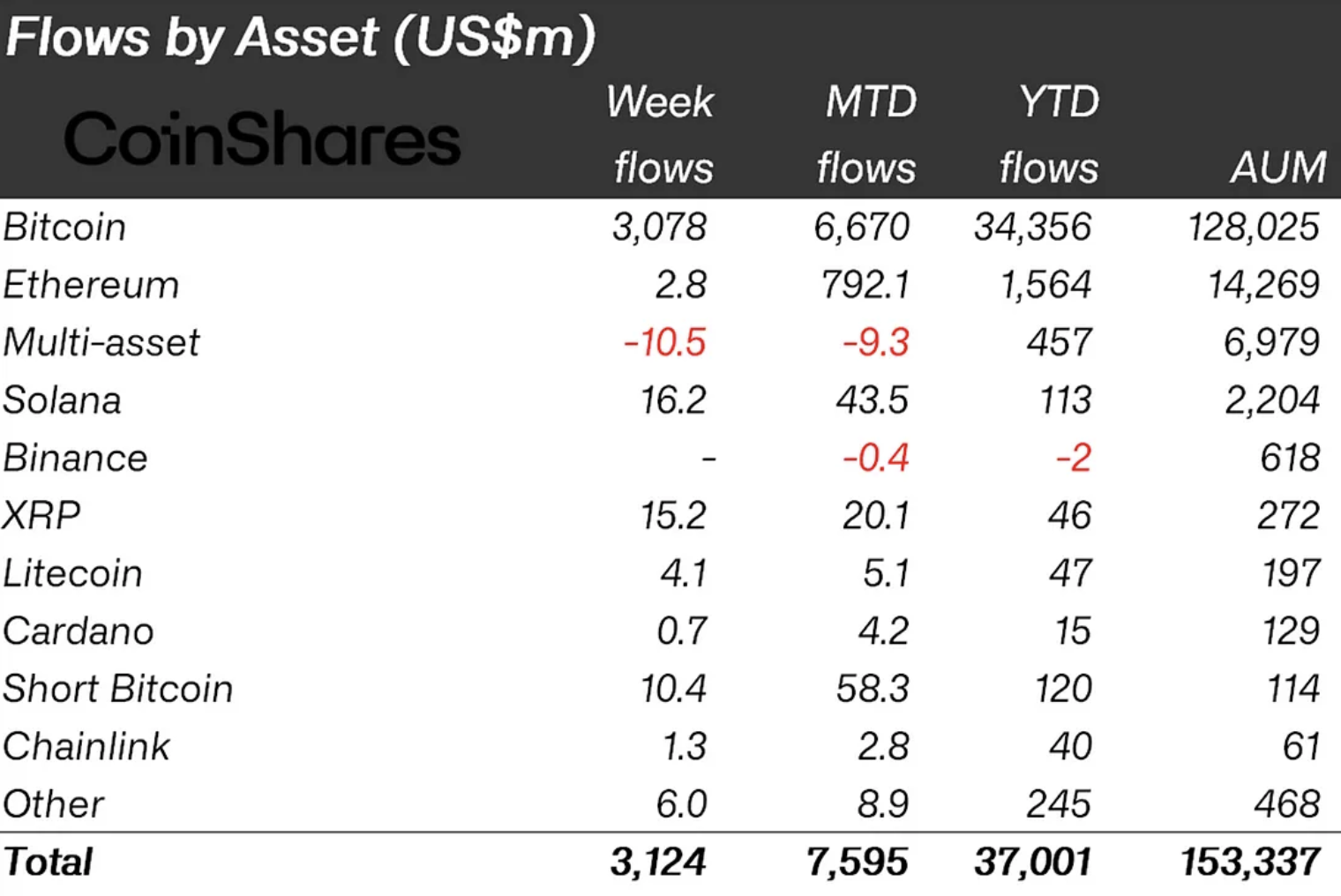

As grew to become recognized because of the newest weekly analysis by CoinShares, funding merchandise linked to the favored cryptocurrency noticed a staggering consequence with inflows of $15.2 million. In reality, that is 353% larger than the week earlier than and brings the year-to-date complete for XRP-focused ETFs to $46 million.

In different phrases, based mostly on basic math, final week noticed nearly half as a lot cash circulate into XRP ETPs, as within the earlier 11 months. The rationale for this avalanche of cash lies within the worth motion of the favored cryptocurrency. What drove crypto market individuals to push the worth of XRP up greater than 222% at its peak is what drove ETP merchants to purchase XRP investments final week.

Other than Gensler’s resignation from the SEC chairmanship, the potential causes behind the surge on each crypto and conventional markets could possibly be the long-awaited IPO of Ripple, the San Francisco-based firm that makes use of XRP in its enterprise blockchain providers and options.

Ripple IPO

Per week in the past, the CEO of SBI, a Japanese monetary conglomerate, stated that Ripple ought to put together for an IPO within the close to future attributable to upcoming adjustments within the U.S. authorities. Beforehand, the corporate was valued at about $30 billion, which is attention-grabbing since there may be about $55 billion price of XRP within the firm’s escrow accounts proper now. Sure, there may be an ongoing technique of emptying them, however the coffers nonetheless maintain a large quantity.

If Ripple does certainly go public, regardless of three years of powerful battles with the SEC over XRP’s standing, it will likely be an enormous profit to the cryptocurrency, its adoption and recognition. Not many digital belongings have comparable utility, adoption and regulatory standing upheld by U.S. courts.