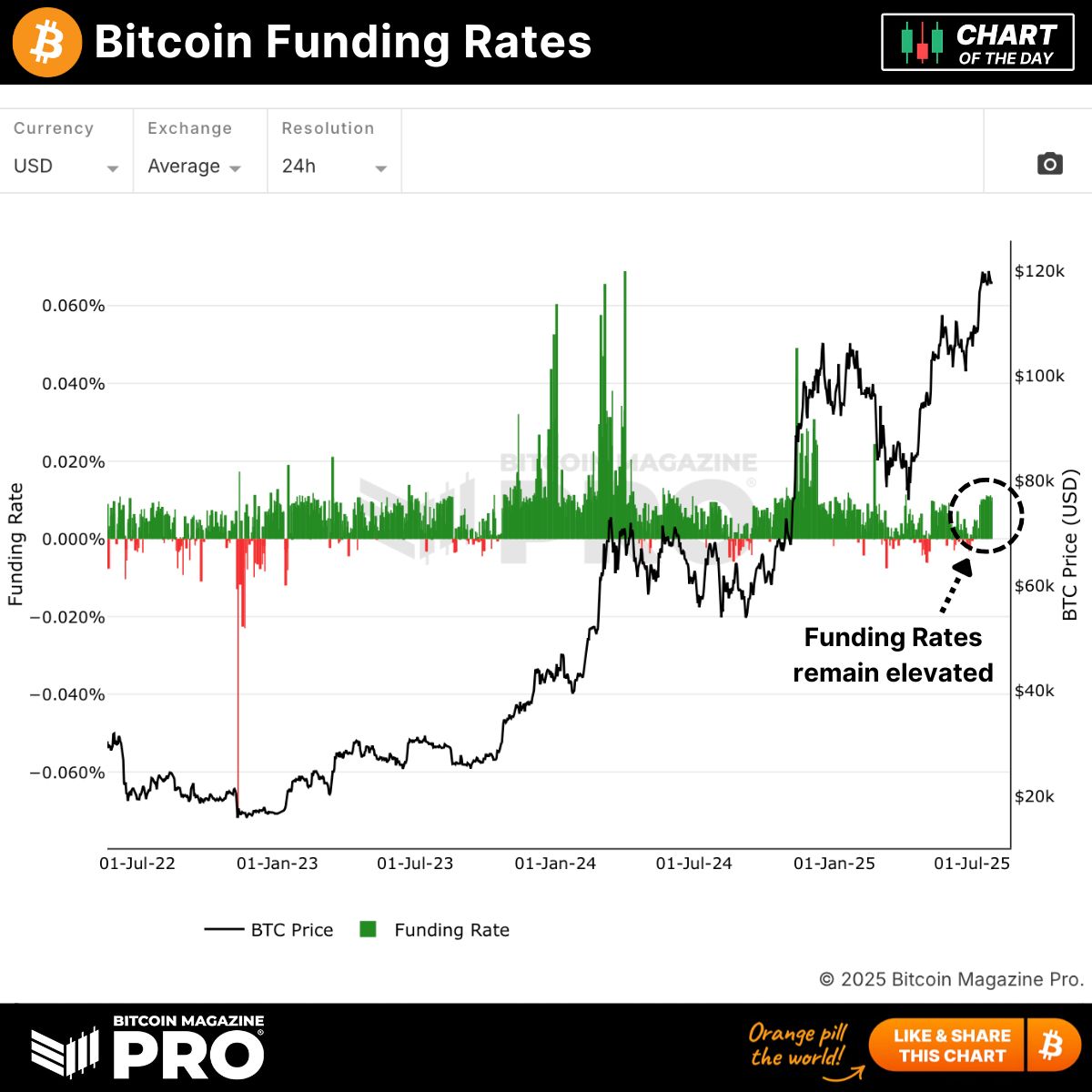

As Bitcoin continues to consolidate above $100K, a essential market sign is flashing: BTC funding charges stay elevated, at the same time as worth motion cools.

This sometimes displays leveraged merchants betting closely on upside—however such optimism is usually a double-edged sword.

The most recent information from Bitcoin Journal Professional exhibits that funding charges—charges paid by merchants holding lengthy positions in perpetual futures—have stayed nicely above impartial all through July. Traditionally, sustained excessive funding usually precedes sharp corrections, as over-leveraged lengthy positions turn out to be susceptible to liquidations if costs dip unexpectedly.

But on this case, the market has absorbed the leverage buildup with out main draw back. That has many questioning: are bulls really in management, or is the market organising for a punishing flush?

Since early 2024, Bitcoin’s worth has surged dramatically from underneath $40K to over $120K, pushed by ETF inflows, institutional shopping for, and macro tailwinds. However since topping out in Q2 2025, BTC has entered a consolidation section—buying and selling between $90K and $120K—with few clear breakout catalysts on the horizon.

Nonetheless, the elevated funding charges recommend speculative demand stays sturdy. Lengthy-biased merchants are clearly anticipating a renewed push towards new highs, betting that any short-term volatility shall be shallow. The query is whether or not the broader market agrees—or whether or not a wave of liquidations might be triggered if help ranges break.

This funding chart may sign rising divergence between retail optimism and institutional warning. Derivatives markets are inclined to warmth up throughout moments of complacency, and funding charge spikes usually precede giant directional strikes—both upward blowouts or downward squeezes.

Merchants now face a well-known fork within the highway: elevated funding charges can imply bullish momentum is brewing—or that leverage is outpacing actual demand. In previous cycles, each situations have performed out, typically in fast succession.

With Bitcoin nonetheless buying and selling close to all-time highs, the stakes are important. A profitable breakout might ship BTC into worth discovery above $130K, whereas a breakdown would possibly check the $80K–$90K zone. Both means, funding charges will probably stay a key indicator to observe within the days forward.