South Korea is taking a significant step towards stablecoin oversight and digital forex growth. Based on a July 29 report from Yonhap Information, the Financial institution of Korea has introduced the set up of a brand new digital asset division inside its Monetary Settlement Bureau. The newly shaped division will monitor the broader crypto market and lead inside discussions particularly targeted on the event and regulation of Korean won-based stablecoins.

As a part of a broader organizational shift, the central financial institution will rename its Digital Foreign money Analysis Lab to the Digital Foreign money Lab beginning July 31. This alteration is meant to mirror a transition from pure analysis towards extra business-oriented growth. Moreover, Staff 1 and Staff 2 of the previous Digital Foreign money Know-how Division can be restructured into two new models: the Digital Foreign money Know-how Staff and the Digital Foreign money Infrastructure Staff. These groups will concentrate on privacy-preserving applied sciences, deposit-token platforms, and testing environments for stablecoin usability.

This reorganization indicators South Korea’s rising dedication to main in digital forex innovation. As stablecoins and central financial institution digital currencies (CBDCs) acquire world momentum, the Financial institution of Korea seems to be aligning its inside infrastructure for a extra hands-on, policy-driven position in the way forward for cash.

Financial institution of Korea Alerts Stronger Dedication to Stablecoin Improvement Regardless of Check Delays

A Financial institution of Korea official lately clarified the aim behind renaming its Digital Foreign money Analysis Lab to the Digital Foreign money Lab, stating, “We needed to make it clear that this isn’t a division that solely does analysis, as there is no such thing as a different division that makes use of the phrase ‘analysis’ in its title aside from the Financial Analysis Institute.” The change underscores the central financial institution’s intention to align the unit with broader operational and policy-driven obligations. Nevertheless, the official additionally famous, “There won’t be a lot change within the unique work.”

The Digital Foreign money Lab, which developed from the Analysis Division earlier this 12 months, stays on the forefront of South Korea’s central financial institution digital forex (CBDC) initiatives. One among its key initiatives is “Venture Han River,” a long-term initiative designed to check the real-world usability of a digital received. The primary part of testing concluded efficiently on the finish of final month, however the second part has been placed on maintain. The delay stems from issues raised by collaborating banks over the dearth of a long-term roadmap and the monetary burden of continued participation.

Regardless of the short-term suspension, Financial institution of Korea Governor Lee Chang-yong emphasised throughout a press convention on July 10 that Venture Han River goals to “safely introduce a won-denominated stablecoin.” He added, “Whether or not it’s a received stablecoin or a deposit token, digital forex is required sooner or later.”

This reinforces a key development in world finance: the accelerating adoption of stablecoins past the US. South Korea’s evolving framework highlights the growing significance of nationwide stablecoin initiatives, significantly as international locations search to modernize cost methods and keep sovereignty over digital monetary infrastructure.

USDT and USDC Dominance Holds Close to 6%

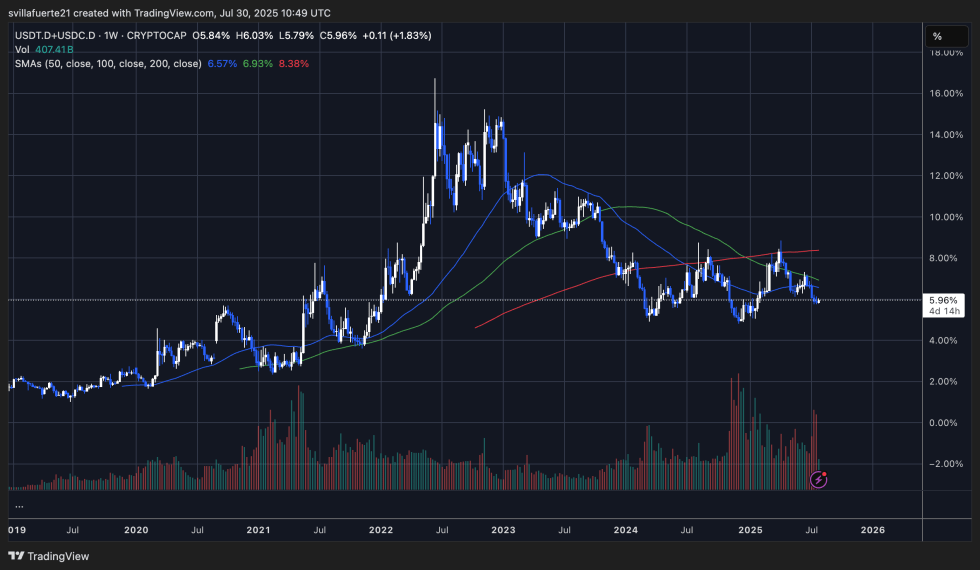

The mixed dominance of USDT and USDC at present sits at 5.96%, based on the weekly chart, reflecting a comparatively impartial stance in stablecoin capital positioning. After peaking above 18% in early 2022—throughout a interval of heavy risk-off sentiment—the metric has been on a gradual decline, indicating a shift of capital out of stablecoins and again into threat property.

The chart exhibits that USDT+USDC dominance has persistently struggled to carry above the 50-week (6.57%), 100-week (6.93%), and 200-week (8.38%) shifting averages. Latest value motion confirms resistance close to these ranges, with dominance now testing its mid-cycle help across the 6% threshold.

This downtrend usually suggests rising threat urge for food, as capital rotates out of stablecoins and into unstable property like BTC, ETH, and altcoins. Nevertheless, the truth that dominance has not damaged under 5% displays a cautious market that also maintains a powerful base of sidelined capital.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.