FOMC conferences could set off market volatility, however in addition they mark key turning factors in broader macro cycles.

In keeping with a brand new chart shared by Swissblock, Bitcoin’s cleanest rallies have traditionally adopted the beginning of quantitative easing (QE)—and the subsequent comparable alternative could also be on the horizon.

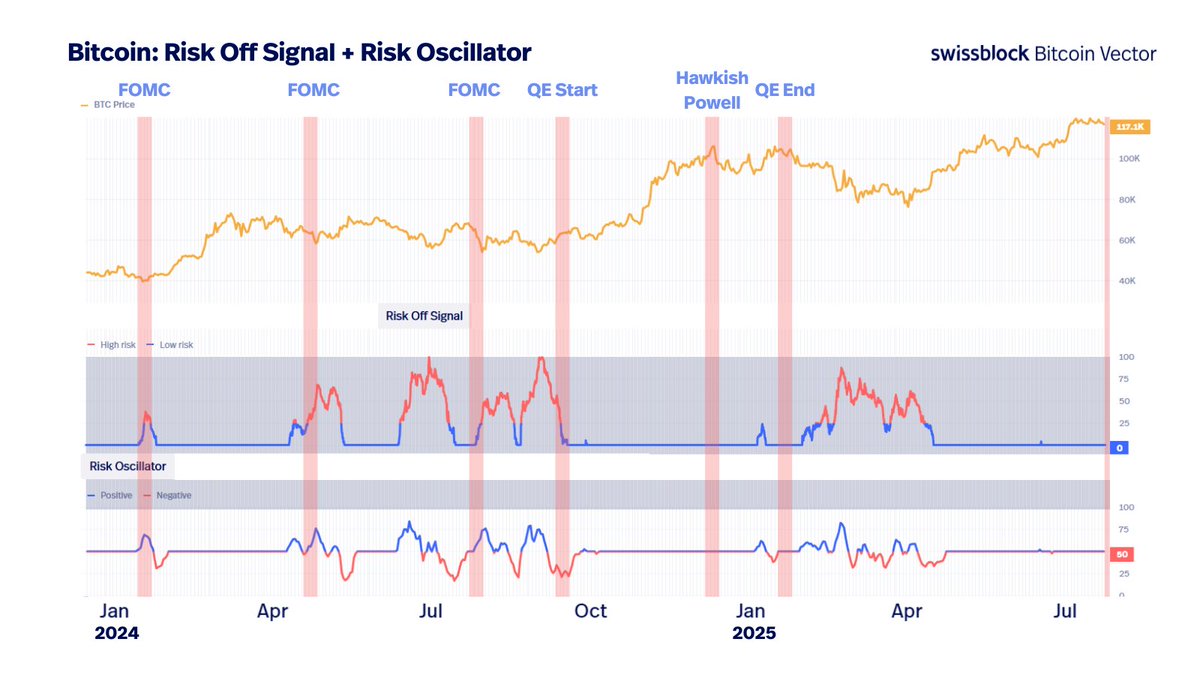

The chart combines Bitcoin’s worth with risk-off alerts and a threat oscillator, highlighting how low-risk zones usually precede breakouts, whereas high-risk intervals are inclined to coincide with consolidation or drawdowns.

Swissblock’s evaluation identifies a recurring sample: probably the most sustained Bitcoin upside emerged instantly after QE was launched. An identical breakout occurred after the March 2024 FOMC assembly when the chance oscillator flipped optimistic, aligning with a low-risk setting. Conversely, intervals flagged as high-risk—significantly throughout hawkish Fed commentary or QE withdrawal—coincided with Bitcoin corrections or sideways motion.

The message is obvious: macro liquidity leads crypto worth motion, and merchants ought to look ahead to alerts that QE may resume. “When QE restarts once more—anticipate the identical setup,” Swissblock famous, reinforcing the concept coverage shifts can rapidly change the market’s threat regime.

As Bitcoin hovers above $120K, traders are paying nearer consideration to the Federal Reserve’s subsequent transfer. If dovish coverage returns and liquidity expands, on-chain threat indicators could as soon as once more flip bullish—mirroring the macro-driven rallies of previous cycles.

Till then, monitoring macro flows and threat ranges could provide the very best information to timing entries in an more and more Fed-sensitive market.