Stellar’s native token XLM has trended steadily downward since reaching a neighborhood cycle peak of $0.52 on July 18.

Now buying and selling round $0.39, the altcoin has misplaced 14% of its worth in simply over two weeks, as bearish sentiment gathers tempo heading right into a traditionally troublesome month for the token.

XLM’s August Curse Returns With Promote Indicators Mounting

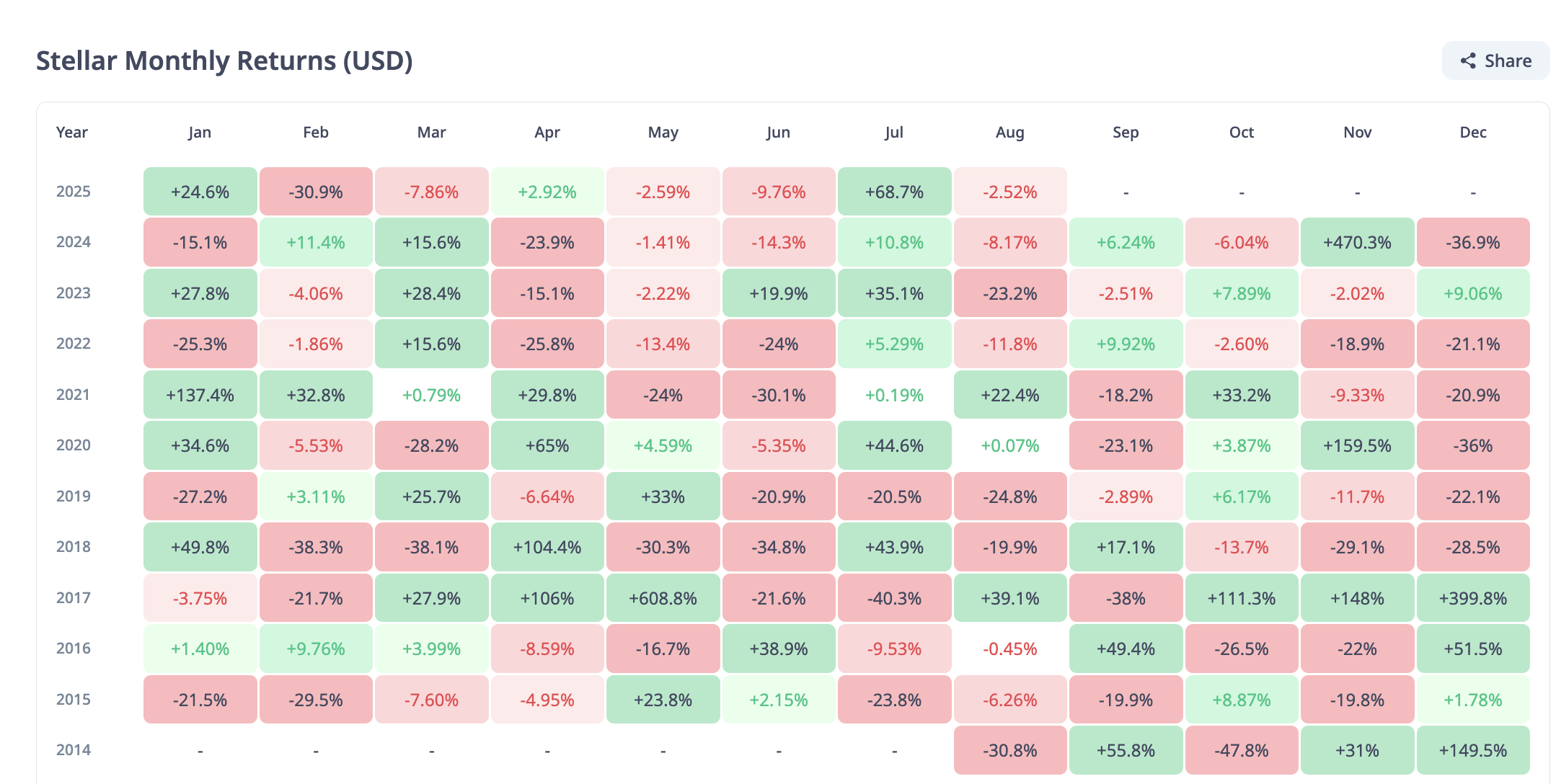

A evaluation of XLM’s month-to-month returns reveals a worrying sample. August has solely delivered a constructive month-to-month shut twice—in 2017 and 2021. Each different August has ended within the purple.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

This monitor file now intersects with weakening technical indicators, setting the stage for a possible downward pattern continuation as a brand new month commences.

Readings from the XLM/USD one-day chart present that the double-digit dip within the token’s worth has pushed its worth beneath its 20-day Exponential Transferring Common (EMA). This key shifting common varieties dynamic resistance above XLM at $0.40 at press time.

The 20-day EMA measures an asset’s common worth over the previous 20 buying and selling days, giving weight to latest costs. When the value trades above the EMA, it indicators short-term bullish momentum and suggests consumers are in management.

Converesly, when an asset’s worth breaks beneath its 20-day EMA, it represents a shift in short-term market sentiment from bullish to bearish. It displays growing sell-side, particularly when accompanied by different bearish indicators.

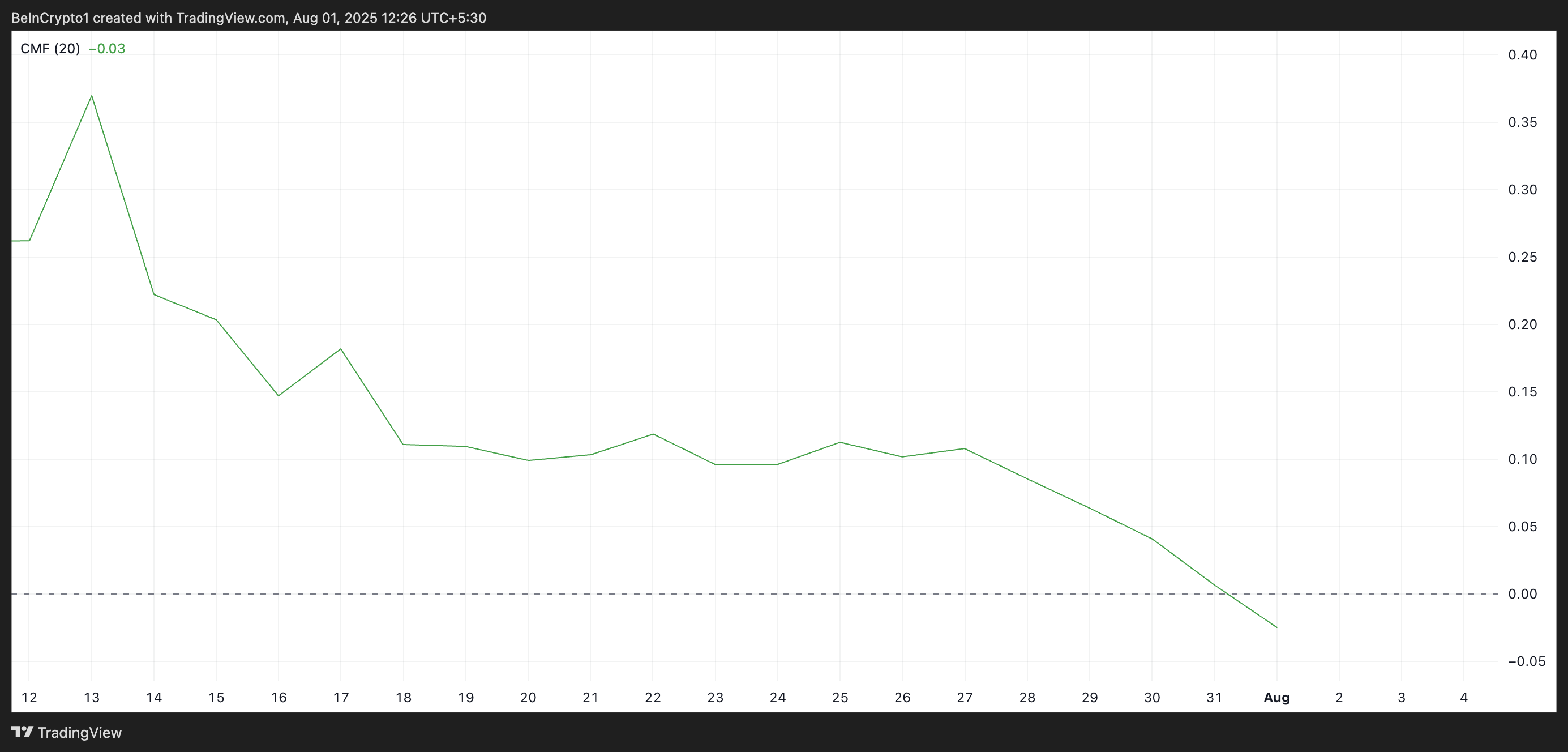

Including to this bearish outlook, XLM’s Chaikin Cash Move (CMF) has slipped beneath the zero line—one other purple flag that hints at a sustained decline this August. The CMF studying sits at -0.03 at press time, indicating a internet capital outflow from XLM’s spot markets.

The CMF indicator measures how cash flows into and out of an asset’s market. When its worth is constructive, consumers dominate the market, and capital flows into the asset.

Conversely, a unfavorable CMF displays distribution—that means that promoting stress is stronger and cash is leaving the asset. This pattern means that XLM’s ongoing worth decline will not be merely the results of short-term volatility however is backed by actual market weak point.

Will It Break Right down to $0.32 or Bounce Above $0.41?

XLM at the moment trades at $0.39 at press time. The weakening demand for the altcoin and its traditionally poor August efficiency recommend it could enter a broader short-term downtrend for an additional 12 months. With each worth momentum and capital stream indicators flashing purple, sentiment is tilting firmly in favor of the bears.

If capital inflows proceed to weaken, XLM’s worth may fall to $0.36. If this stage fails to carry, the downtrend could deepen to as little as $0.32.

Nonetheless, a reversal continues to be attainable if purchaser demand begins to get better. A sustained uptick in accumulation may push XLM again above its 20-day EMA. If this breakout holds, the token could reclaim $0.41, opening the door to a short-term bullish reversal.

The put up One other Crimson August for XLM? Information Indicators a Repeat of Its Historic Sample appeared first on BeInCrypto.