With a soar in worth from 77,000 to 111,000 {dollars} per Bitcoin within the second quarter of 2024, Technique data a document revenue of 10 billion {dollars}, marking a historic second not just for the corporate, however for your entire cryptocurrency reserves sector.

Why is Technique’s revenue an unprecedented case?

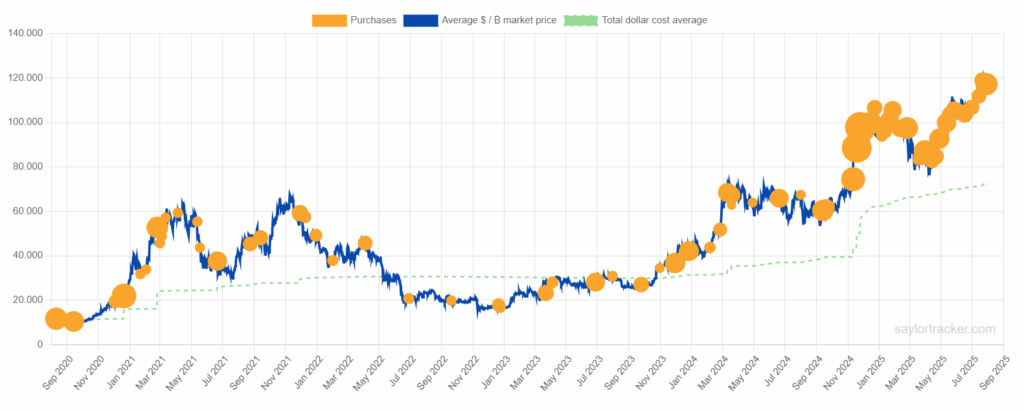

Technique, previously MicroStrategy, has constructed the most important Bitcoin holdings amongst all public firms, and the second quarter of 2024 marks a monumental turning level. After a lack of 5.9 billion {dollars} within the first quarter because of the value collapse, the sudden restoration of the asset allowed the corporate to document a revenue of 10 billion {dollars}. A outstanding restoration, supported by the expansion of Bitcoin’s value from 77,000 {dollars} to 111,000 {dollars}, in keeping with CoinGecko knowledge.

The income for the interval, amounting to 114.5 million {dollars}, represents a rise of 3% in comparison with the identical quarter of the earlier 12 months. Nonetheless, the important thing determine stays the big growth of crypto reserves, which at the moment are value 74 billion {dollars} in keeping with the most recent monetary assertion communicated to the SEC.

How does Technique’s monetary technique change?

Within the newest communication to the SEC, Technique broadcasts an progressive plan to increase 4.2 billion {dollars} by way of the issuance of recent perpetual most well-liked shares STRC, a transfer launched simply ten days earlier than the quarterly presentation. It’s the first time the corporate makes use of this instrument on such a big scale within the crypto sector.

On the similar time, Technique has simply invested 2.5 billion to extend its treasure: the reserves have skyrocketed from 499,000 to 597,000 BTC in simply three months, with a document enhance of 20% on a quarterly foundation.

What are the brand new developments within the inventory issuance coverage?

“`html

Along with the gathering by way of most well-liked shares, Technique introduces a brand new capital coverage: it should now not challenge frequent shares if the worth of those shares doesn’t exceed no less than 2.5 instances that of the reserves in Bitcoin, except the funds are supposed for the fee of curiosity or dividends associated to debt devices. This alternative goals to guard the worth of the frequent shares, limiting the dilution of present shareholders and strengthening transparency in the direction of the market.

“`

The affect on the markets: what does the title point out?

The market response is fast however cautious: in after-hours, the Technique inventory grows by 1.5%, reaching 408 {dollars} per share. Though it’s a reasonable progress in comparison with the growth in fundamentals, the sign for buyers and analysts is obvious: the corporate’s crypto technique is evaluated positively, strengthened by the soundness of the brand new governance on capital.

What penalties for the cryptocurrency reserves sector?

Technique confirms itself as an absolute pioneer in monetary innovation associated to Bitcoin, not solely accumulating extra belongings than anybody else but in addition experimenting with devices reminiscent of most well-liked shares and company debt to finance large-scale purchases. This “financialization” will increase the relevance of the crypto asset as a strategic company collateral, opening new avenues for threat administration and capital elevating for international large tech firms.

Consequently, the brink of 597,000 Bitcoin held, related to a valuation of 74 billion {dollars}, represents a possible benchmark for anybody trying to develop their stability sheet by leveraging cryptocurrencies.

What occurs now? Prospects and dangers

With Technique’s progressive method, questions for the long run multiply: the sustainability of the mannequin will depend on the efficiency of Bitcoin, the response of buyers to new fairness constructions, and the alternatives provided by additional bull within the asset’s value. Nonetheless, the danger associated to volatility additionally grows, which previously has already brought on bear in deep crimson.

The following quarter can be decisive: between the implementation of preferential actions and the evolution of the worth of crypto reserves, the way forward for Technique can be within the highlight of your entire international monetary sector.