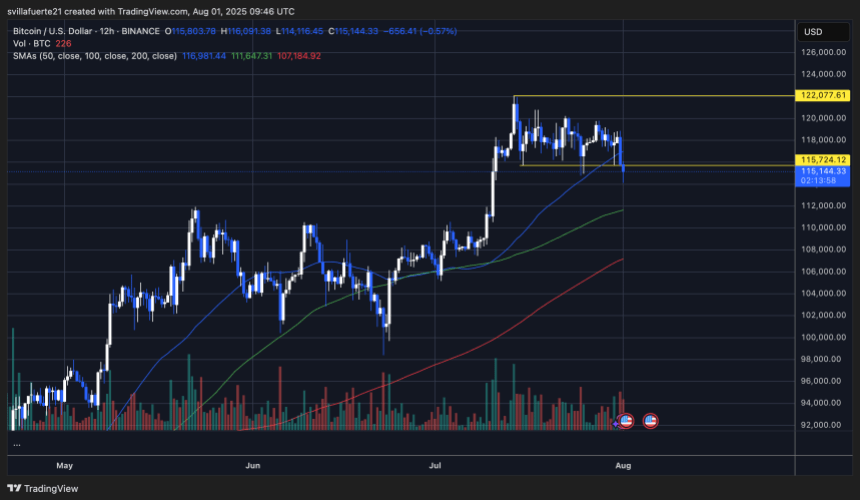

Bitcoin has damaged down from the two-week consolidation vary that held the market between $115,724 and $122,077, reaching a brand new native low close to $114,000. The drop confirms a shift in short-term momentum, placing bulls on the defensive. The $117,000 degree—beforehand a key assist zone—now serves because the speedy resistance that should be reclaimed to sign a potential reversal.

Associated Studying

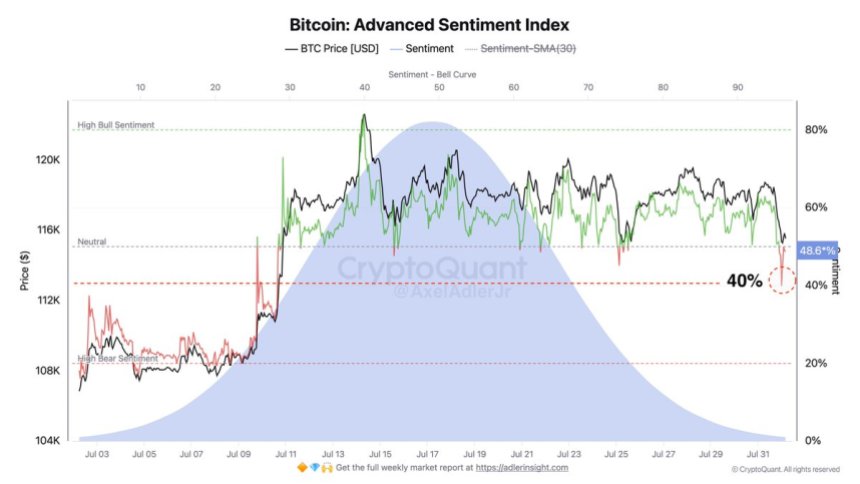

The breakdown comes at a essential time, as sentiment throughout the market begins to shift. In accordance with recent knowledge from CryptoQuant, futures sentiment turned bearish at the moment, falling sharply earlier than bouncing again barely to 48%. Whereas nonetheless near impartial, any studying beneath 50% indicators bearish dominance in positioning. This provides stress to an already fragile technical construction and suggests merchants are bracing for extra draw back.

Except bulls can get well $117K shortly and shut with energy, Bitcoin dangers getting into a deeper correction section. With long-term assist ranges nonetheless intact, the broader bull development stays in place—however this breakdown marks the primary important lack of momentum in weeks. The approaching periods might be essential in figuring out whether or not that is only a shakeout or the beginning of a bigger development reversal.

Bitcoin Superior Sentiment Index Alerts Rising Bearish Strain

Prime analyst Axel Adler has shared new insights into the Bitcoin Superior Sentiment Index, a key metric used to gauge futures market positioning and broader investor temper. In accordance with Adler, the index lately dropped to 40%—a pointy decline that mirrored rising threat aversion and bearish positioning. Though the metric has since rebounded to 48%, it stays beneath the essential 50% threshold, which separates bullish from bearish territory.

This rebound indicators a short lived pause in adverse sentiment, however the broader development reveals a shift from bullish warning to bearish worry. Adler notes that so long as the index stays beneath 50%, the market lacks the boldness wanted to maintain upward momentum. Merchants are rising more and more defensive, decreasing lengthy publicity and bracing for additional draw back.

If momentum continues to deteriorate, BTC might take a look at the $112,000 degree—the earlier all-time excessive set in Might. This zone might act as psychological and technical assist, however failure to carry it might set off a deeper correction.

With the Superior Sentiment Index caught in bearish territory and worth motion weakening, the market seems to be getting into a riskier section. Whereas this doesn’t but sign a full development reversal, it does replicate rising uncertainty. Till sentiment and worth reclaim greater floor, warning is warranted. The subsequent transfer will possible rely upon whether or not bulls can defend $112K—or if bears achieve full management of the development.

Associated Studying

BTC Loses Key Help After Breakdown

Bitcoin has formally damaged down from its two-week consolidation vary, shedding the essential $115,724 assist degree highlighted within the chart. The value reached a brand new native low at $114,116 earlier than recovering barely to the $115,100 zone, the place it’s at the moment looking for footing. This marks a big shift in momentum, as bulls didn’t defend the decrease boundary of the vary, which held agency all through July.

The 12-hour chart reveals rising quantity accompanying this breakdown, including weight to the bearish transfer. BTC now trades beneath the 50-day SMA ($116,981), confirming weak spot in short-term construction. The subsequent main assist sits round $112,000—the prior all-time excessive set in Might—which might act as a psychological and technical ground.

Associated Studying

The 100-day and 200-day SMAs stay nicely beneath present worth motion, suggesting that the macro development remains to be intact. Nevertheless, speedy momentum has clearly shifted, and bulls should reclaim the $117,000 space shortly to invalidate this breakdown.

Featured picture from Dall-E, chart from TradingView