Friday’s jobs report has surprised even probably the most seasoned buyers and will have main ramifications for the worldwide monetary markets.

The Bureau of Labor Statistics launched Nonfarm Payroll information for July confirmed that the US economic system added solely 73k jobs final month, wanting the 110k forecast.

Nonetheless, it’s the sharp downward revisions to the earlier months’ NFP information which are making headlines.

Might payrolls had been revised down from 144,000 to 19,000, a drop of 125,000, whereas June payrolls had been revised down by 133,000 from 147,000 to 14,000.

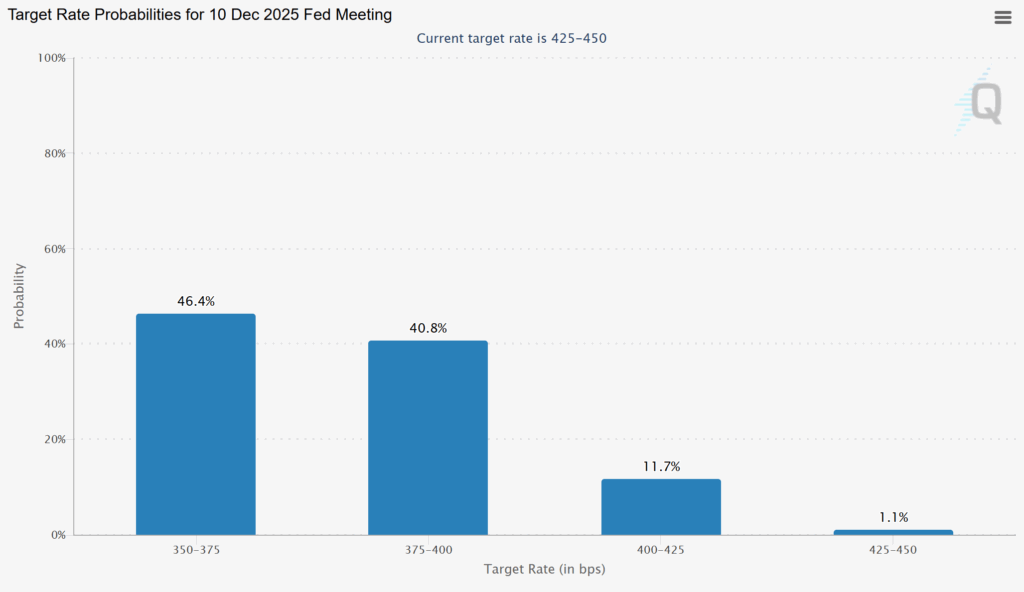

Following the large 258k downward revision, the percentages of a Fed fee reduce in September have surged to 81%. In actual fact, the CME FedWatch now exhibits three fee cuts because the odds-on situation, which is a decidedly bullish situation for the crypto market.

Nonetheless, crypto costs aren’t displaying any bullish energy. As an alternative, the Bitcoin value fell beneath $113,000 on Friday, whereas altcoins are faring a lot worse. Regardless of issues of a broader crypto crash, whales proceed to purchase the dip, anticipating explosive returns within the coming weeks.

Why The Jobs Information Downward Revision Is A Large Deal For Crypto?

Friday’s jobs information is prone to have appreciable ramifications for the crypto market.

A 258k downward revision over two months, in addition to a nasty miss within the July NFP information, isn’t one thing the market, or the Federal Reserve, might ignore.

Already, US President Donald Trump has fired the Biden-appointed Commissioner of the Bureau of Labor Statistics, Dr Erika McEntarfer, whom he accused of being a partisan and unreliable actor.

Nonetheless, the market isn’t shopping for that the roles information revision is pretend. Main US inventory indices fell by almost 2% on Friday, with the tech-heavy NASDAQ falling by 2.24%.

The underlying information is much more worrisome. For example, unemployment for brand spanking new labor market entrants noticed its highest month-to-month surge in July since 1967. Equally, excluding the healthcare and social help sector, the US economic system has truly misplaced 93,000 jobs over the previous 3 months.

Analysts are already throwing out phrases like recession and stagflation, the latter due to the recent PCE inflation information on Thursday. That is worrisome since crypto belongings are inclined to carry out the very best in a “goldilocks” economic system, marked by sturdy development and declining inflation.

Is It Time To Promote Crypto?

No, spot purchaser don’t must panic promote their crypto belongings.

There’s already a silver lining to Friday’s jobs information revision and the following crypto market crash. The percentages of a Fed fee reduce in September, which fell to 37% on Thursday, at the moment are at 80.3%.

In actual fact, the CME FedWatch is pricing in 3 fee cuts this yr, a decidedly bullish situation for threat belongings like crypto.

Distinguished analysts aren’t panicking both.

Legendary Wall Avenue investor and Fundstrat CEO Tom Lee has known as this week’s equities and crypto crash “a standard dip”. Contemplating he’s the Chairman of BitMine, the ETH treasury agency might be trying so as to add to its holdings.

Equally, well-liked influencer Earnings Sharks declare that the crypto market can have a pointy bounce again in September, which makes the continuing crash a wonderful buy-the-dip alternative.

Finest Cryptos To Purchase

Massive-cap crypto belongings proceed to be among the many greatest cryptos to purchase now, supplied sidelined buyers know when to purchase them.

For example, the Bitcoin value has two sturdy demand zones: $111,000 and $107,000, each providing wonderful shopping for alternatives.

Equally, analysts declare that $3500 for Ethereum and $2.50 for XRP are “presents”, contemplating their excessive upside potential.

Among the many low-caps, presale cryptos are in excessive demand, notably since they aren’t affected by short-term volatility.

For example, the brand new BTC Layer-2 token, Bitcoin Hyper (HYPER), surged as much as $6.4 million in its viral presale on Friday.

Bitcoin Hyper is establishing itself as the brand new distinguished undertaking within the Layer-2 sector, aiming to exponentially enhance BTC’s scalability and programmability.

Analysts imagine HYPER has excessive upside potential, with many viewing it as the subsequent 100x crypto.

In the meantime, low-cap memes are in excessive demand as effectively. For example, TOKEN6900, a more recent low-cap various of SPX6900, has raised over $1.5 million in its ICO.

Like Fartcoin, SPX and Pepe, it is usually an unapologetically utility-less meme coin, in contrast to most new tokens that unnecessarily and deceptively tie themselves to AI.

Very similar to HYPER, T6900 has impressed analysts with its excessive upside potential, with many eyeing as much as 100x returns from it.

This text has been supplied by one in all our business companions and doesn’t mirror Cryptonomist’s opinion. Please bear in mind our business companions might use affiliate packages to generate revenues by means of the hyperlinks on this text.