Curiosity in XRP is cooling off, with key on-chain metrics signaling potential short-term weak point forward.

With waning bullish sentiment throughout the broader market, these components recommend a possible deeper value decline for XRP within the coming buying and selling periods.

XRP Merchants Are Tapping Out: $222 Million Exit Alerts Concern

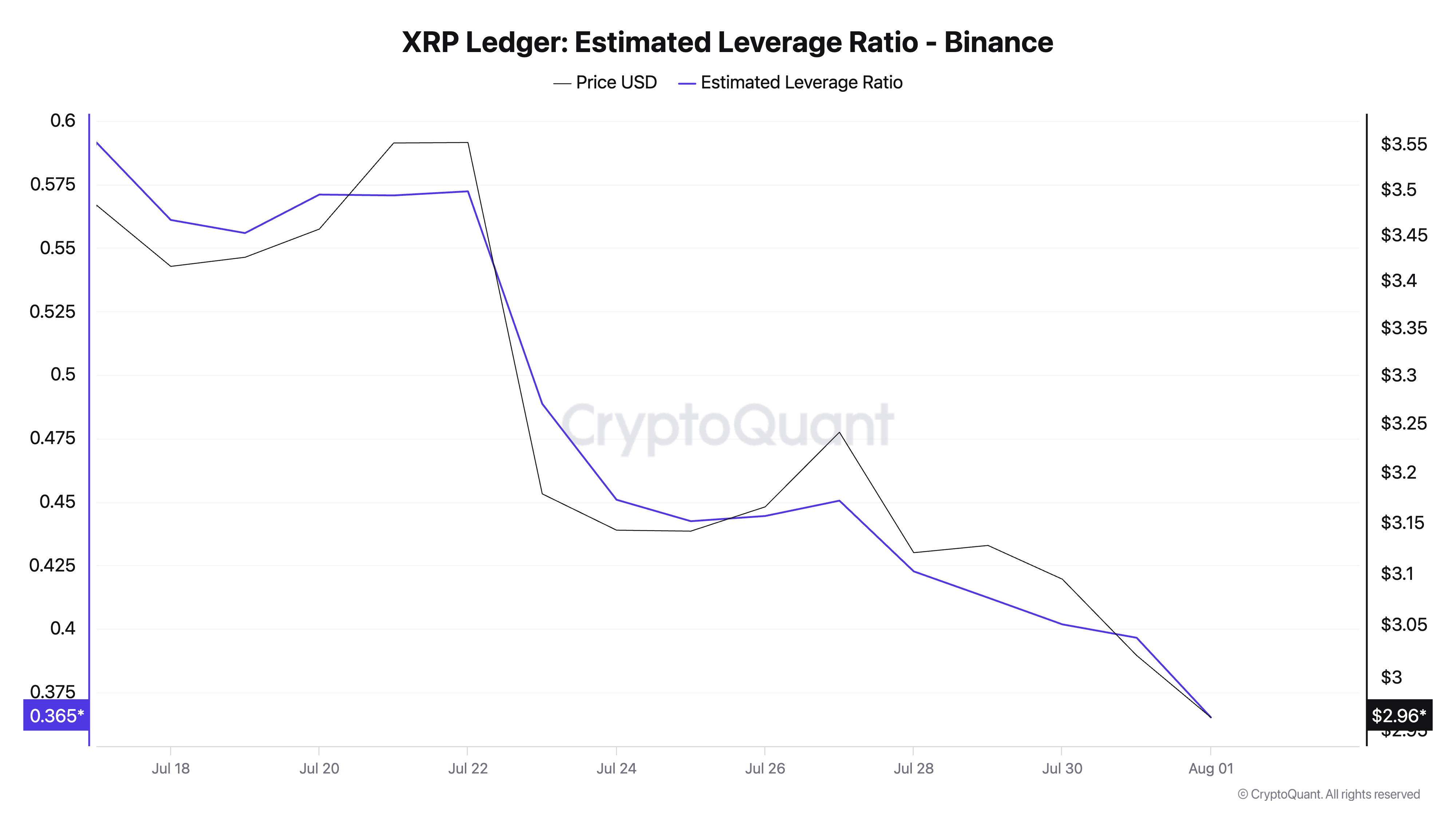

XRP’s falling Estimated Leverage Ratio (ELR) on main trade Binance confirms falling investor confidence and a declining urge for food for threat. In keeping with CryptoQuant, the ELR at the moment sits at 0.36 — its lowest weekly shut prior to now month.

An asset’s ELR measures the common quantity of leverage its merchants use to execute trades on a cryptocurrency trade. It’s calculated by dividing the asset’s open curiosity by the trade’s reserve for that foreign money.

XRP’s declining ELR signifies a diminished threat urge for food amongst merchants. It means that buyers are rising cautious in regards to the token’s short-term prospects and are avoiding high-leverage positions that might amplify potential losses.

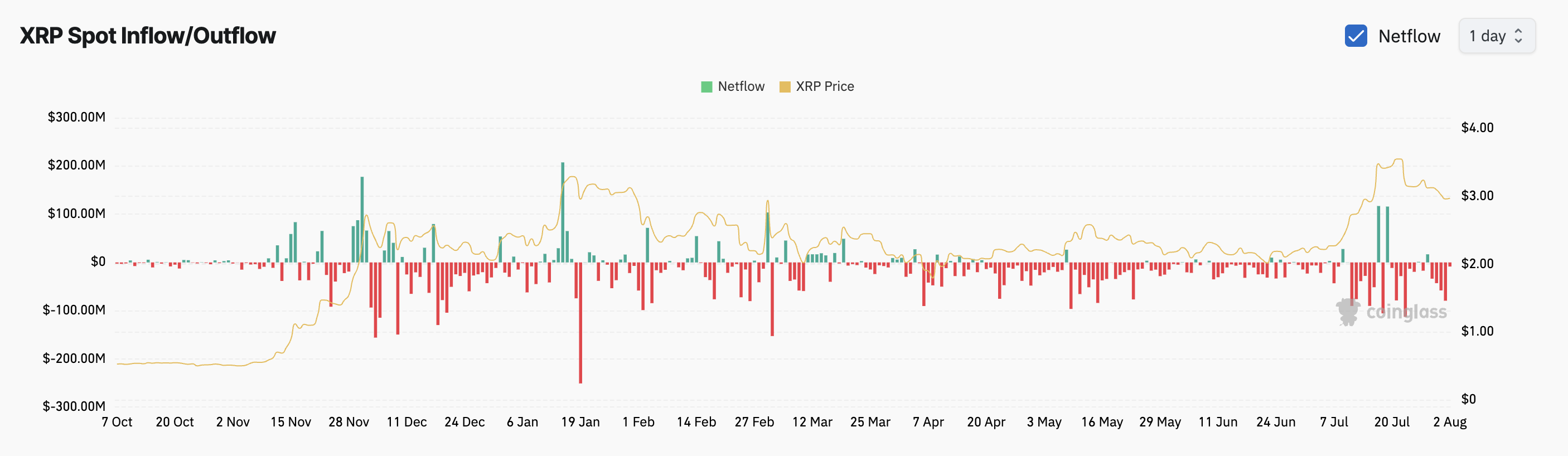

The pattern is not any totally different amongst spot market contributors. In keeping with Coinglass knowledge, XRP has recorded damaging netflows exceeding $222 million since July 29, signaling persistent sell-side dominance and weak buy-side stress.

When an asset data damaging spot netflows, merchants are promoting their holdings and taking income, whereas fewer patrons are stepping in to exchange them.

This pattern may worsen XRP’s present downtrend, because the demand for the asset decreases whereas its provide builds up.

XRP Bears Shut In on $2.71—However a $3.39 Breakout Is Nonetheless in Sight

As sell-side stress features, XRP dangers plunging to $2.71. If this assist ground fails to carry, the altcoin may witness a steeper fall to $2.50.

Then again, a breakout above the $3 value degree stays potential if shopping for momentum strengthens. A profitable transfer previous this threshold may pave the way in which for a rally towards $3.39.

Disclaimer

In step with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.