A governance proposal inside Curve Finance is inflicting a stir within the DeFi neighborhood, as one contributor requires a pause within the protocol’s growth into Ethereum Layer 2 networks.

On July 31, a CurveDAO member submitted a proposal arguing that Curve’s Layer 2 deployments generate little income and divert assets from extra helpful initiatives like its native stablecoin, crvUSD. Layer 2 networks are designed to enhance Ethereum’s scalability and have turn into more and more widespread over time.

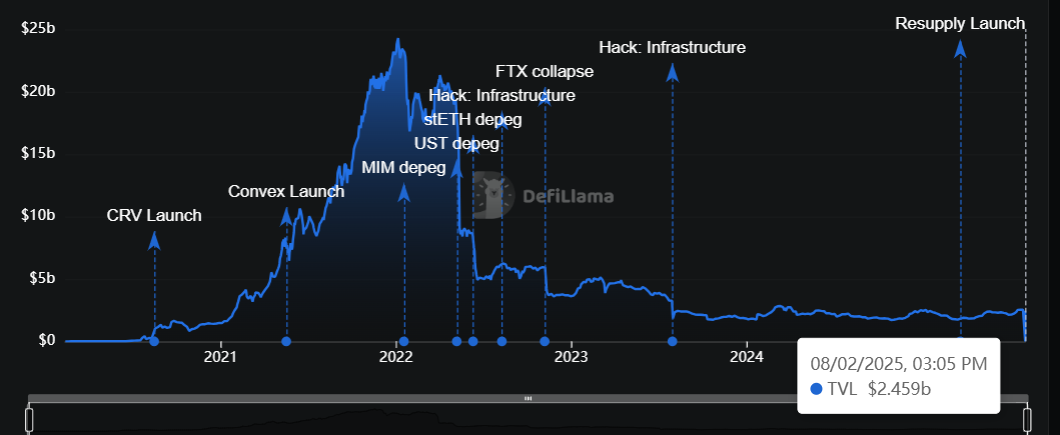

Curve Earns Extra From Ethereum in a Day Than 450 L2s Mixed

The proposal highlighted Curve’s disappointing income technology throughout 24 Layer 2 networks. In accordance with the proposal, the protocol earns roughly $1,500 every day throughout all these Layer 2 chains, equating to simply $62 per community.

Contemplating this, the proposal acknowledged that such returns don’t justify the engineering prices and long-term maintenance required to assist these fast-moving blockchain networks.

“Bringing Curve to L2s has been tried now, however the stats converse for themselves. Little or no returns whereas consuming a lot of developer time to develop, whereas additionally having principally a lot increased upkeep value as a consequence of their quick paste, brief lived, nature,” the writer famous.

Compared, Curve’s Ethereum mainnet stays a much more profitable supply of revenue.

The protocol reportedly earns round $28,000 per day from its Ethereum swimming pools—greater than 18 instances the mixed every day income from its Layer 2 ventures.

“Curves’ Ethereum Swimming pools generate on a gradual day 28,000$ of income, the equal of roughly 450 L2s, given their common income,” he famous.

That is unsurprising contemplating over 90% of Curve’s complete worth locked (TVL) stays on the blockchain community, in line with DeFiLlama knowledge.

As such, the proposal urged the protocol to chop all growth on layer-2 networks and deal with Ethereum.

“Every of these chains require a minimum of the identical care as Ethereum, whereas giving again solely little or no. By chopping all growth on this route, Curve can regain the head-space to push into extra fruitful instructions,” the writer wrote.

In the meantime, the proposal’s radical place has sparked dialogue inside the DeFi protocol’s neighborhood concerning the multi-chain growth strikes.

DeFi analyst Ignas famous that Aave, one other outstanding DeFi protocol, is experiencing comparable challenges.

In accordance with him, Aave’s growth throughout a number of chains has confirmed unprofitable and displays the problem many DeFi protocols face when deploying throughout quite a few Layer 2 networks.

Ignas instructed that the challenges stem from an absence of consumer traction throughout most Layer 2 networks, indicating that the Ethereum Layer 2 ecosystem could also be approaching saturation.

“We reached an L2 saturation level…Actual powerful time for undifferentiated L2s,” Ignas acknowledged.

Information from L2Beats helps this viewpoint, revealing that solely a handful of Ethereum Layer 2 networks—resembling Polygon, Arbitrum, and Optimism—are seeing substantial exercise.

In the meantime, Curve’s core staff distanced itself from the proposal, stating that it doesn’t mirror their present roadmap.

“To be clear: this publish doesn’t come from the staff at present engaged on Curve, and nobody within the staff agrees with it (so we in all probability will NOT take that route),” the protocol acknowledged.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.