- DOGE slid 5% in 24 hours, right down to $0.20, however quantity spiked to 1.25B DOGE throughout the drop.

- Technicals nonetheless favor a long-term uptrend, with whales shopping for the dip.

- A breakout above $0.23 might shift momentum quick—$0.265 could be the subsequent cease.

Dogecoin took a reasonably sharp hit previously 24 hours—sliding almost 5% from round $0.22 to the touch $0.20. That’s the largest intraday drop for DOGE this month. It had been flirting with $0.23 earlier however couldn’t maintain the road, operating into some heavy resistance and aggressive sellers. Over the past week, it’s down about 10%, and the market cap has dropped to $31 billion. However regardless of the dip, some chart watchers aren’t too apprehensive simply but.

Quantity Spikes as Liquidations Hit

Bizarre factor is, though the worth dropped, DOGE’s on-chain quantity went wild. Exercise spiked to over 1.25 billion DOGE—largely round midnight. Analysts suppose it was attributable to a wave of liquidations and stop-losses getting triggered unexpectedly. That cascade could have set off a series response, with bots and merchants all hitting the exits on the similar time.

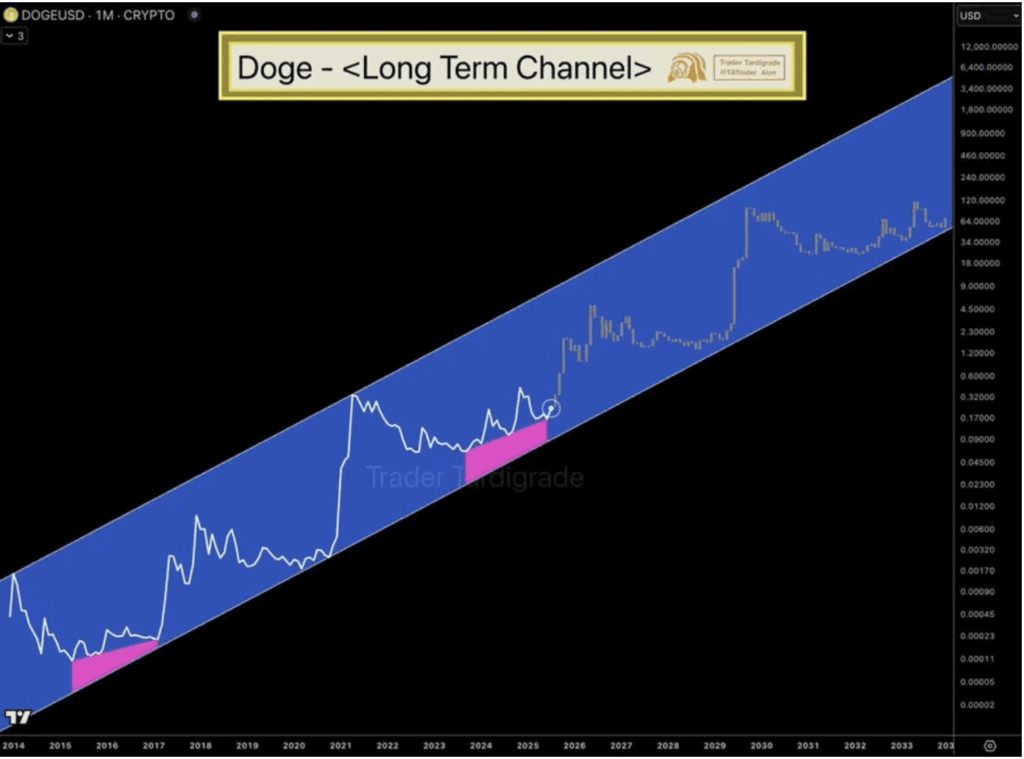

Lengthy-Time period Channel Nonetheless Holding Up

In line with Dealer Tardigrade, DOGE continues to be cruising inside its long-term upward channel—the one which dates all the best way again to 2014. That channel has acted like a springboard previously, particularly close to its decrease edge. Proper now, Dogecoin’s hanging out within the lower-mid zone of that channel, which has traditionally meant “accumulation earlier than lift-off.”

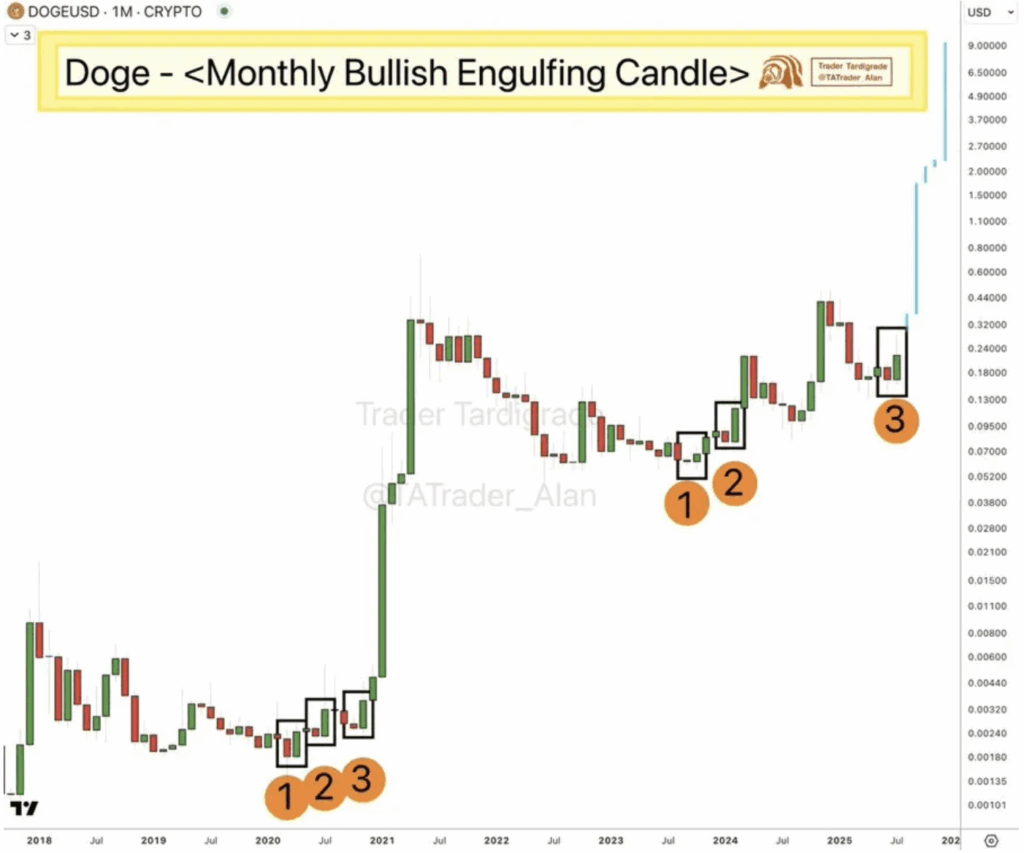

Much more attention-grabbing? The previous couple of month-to-month candles have all been bullish engulfing ones. Tardigrade known as this a doable setup for the subsequent breakout, jokingly dubbing it the trail “to Valhalla.” So yeah, issues aren’t all doom and gloom.

Falling Wedge Might Flip the Brief-Time period Script

Zooming into the short-term, Ali Martinez noticed one thing else—a falling wedge sample on DOGE’s 1-hour chart. That’s usually a bullish setup. If DOGE can break above the $0.229 to $0.230 zone, it might goal for $0.265. But when it falls by way of $0.215 or worse, $0.210? Would possibly get a bit messier earlier than it will get higher.

In the meantime, massive wallets appear unfazed. Some whales purchased the dip, scooping up over 310 million DOGE. Bit Origin, a significant digital asset agency, even dropped in for 40 million of these cash as half of a bigger $500 million diversification transfer.

A Deeper Accumulation Part?

The broader crypto market’s been on edge these days, due to inflation jitters and inventory market wobbles. Nonetheless, DOGE’s caught to its long-term pattern, and institutional curiosity doesn’t appear to be slowing. If something, this correction would possibly simply be one other reload earlier than the subsequent leg up.