SharpLink Gaming, a Nasdaq-listed firm, is within the highlight as one of many first public corporations to construct a treasury technique centered round Ethereum (ETH). On July 29, 2025, SharpLink disclosed that its Ethereum holdings reached a formidable 438,190 ETH. As well as, the corporate raised $279.2 million in internet proceeds by an at-the-market (ATM) providing in the course of the week of July 21-25, reinforcing its aggressive accumulation technique.

SharpLink’s transfer is seen by many analysts as a possible turning level for Ethereum’s institutional adoption. Whereas Bitcoin has lengthy dominated company treasury methods, SharpLink’s pivot towards Ethereum indicators a brand new narrative: utilizing ETH as a strategic reserve asset. This method is being intently watched by traders and public firms exploring blockchain integration and decentralized finance (DeFi) infrastructure.

Market commentators consider that SharpLink’s initiative might set a precedent for extra firms to undertake Ethereum as a core a part of their treasury methods, aligning with the broader shift towards tokenized monetary methods. As Ethereum’s position in real-world asset (RWA) tokenization and on-chain settlement expands, SharpLink’s accumulation might mark the start of a brand new institutional wave positioning ETH as a treasury asset for the longer term.

SharpLink Gaming Deepens Ethereum Guess

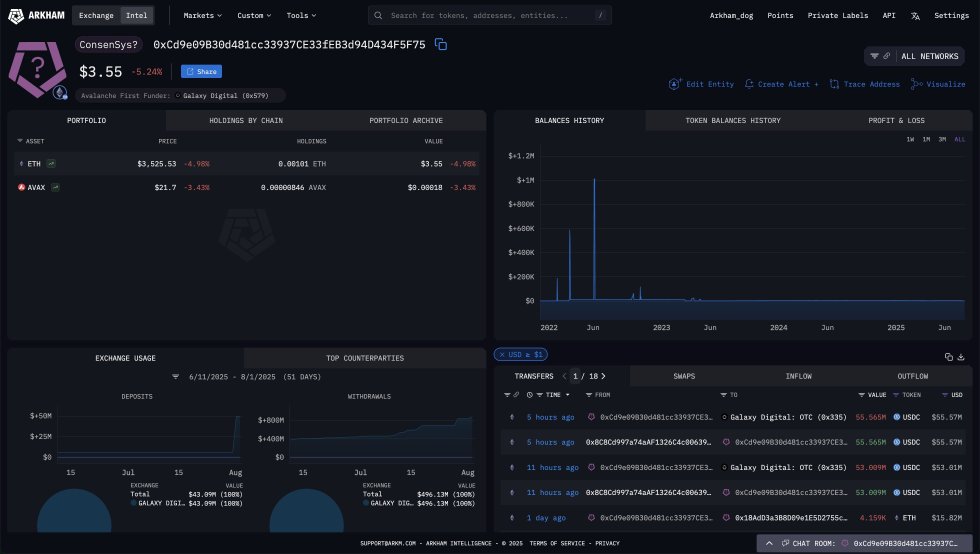

Based on Arkham, an American firm specializing in blockchain analytics, a SharpLink-associated account simply deployed one other $100 million to buy Ethereum (ETH). The pockets deal with, 0xCd9e09B30d481cc33937CE33fEB3d94D434F5F75, has now gathered roughly $800 million price of ETH on behalf of SharpLink Gaming, making headlines for its aggressive ETH treasury technique. Moreover, Arkham reviews that this account simply despatched $108.6 million in USDC to Galaxy Digital’s OTC desk, indicating additional imminent ETH purchases.

This continued shopping for spree has raised vital questions amongst analysts and traders: How lengthy can SharpLink hold shopping for ETH? And what does this sign for different public firms?

SharpLink’s actions are fueling hypothesis a few new pattern—Ethereum as a strategic treasury reserve asset. Whereas Bitcoin has traditionally dominated company crypto holdings, SharpLink seems to be pioneering a shift towards ETH, doubtless attributable to its utility in decentralized finance (DeFi), real-world asset (RWA) tokenization, and sensible contract infrastructure.

As Ethereum’s position in institutional finance grows, SharpLink’s accumulation might act as a blueprint for different corporations, showcasing how public firms would possibly combine ETH into long-term capital methods. The broader implication? Ethereum could quickly take heart stage alongside Bitcoin in company treasuries, reshaping the institutional crypto panorama.

ETH Value Motion Particulars: Setting Recent Lows

Ethereum (ETH) is presently buying and selling at $3,406, persevering with its downward motion after failing to interrupt above the $3,860 resistance zone. The chart reveals a transparent breakdown from the earlier consolidation vary, with ETH dropping momentum after weeks of bullish worth motion. The value has now fallen under the 50-day ($3,730) and 100-day ($3,691) easy shifting averages (SMA), signaling rising bearish stress within the brief time period.

Quantity has spiked in the course of the current decline, indicating energetic promoting, however the present worth sits close to a key help area. The subsequent vital degree to observe is the 200-day SMA at $3,222, which might act as a essential protection line for bulls. If Ethereum fails to carry this zone, a retest of the $2,852 degree is probably going, which marks the earlier breakout level from early July.

Regardless of the present bearish sentiment, many analysts contemplate this correction a wholesome pullback inside a broader uptrend, particularly with sturdy accumulation tendencies on-chain. A reclaim of the $3,600-$3,700 vary is critical to regain bullish construction. For now, Ethereum stays in a susceptible place, and the approaching periods will probably be essential to find out whether or not bulls can defend key help and try one other breakout.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.