A rising variety of publicly listed corporations are altering how they handle company reserves — and for a lot of, that now consists of holding Bitcoin and Ethereum alongside money and conventional property.

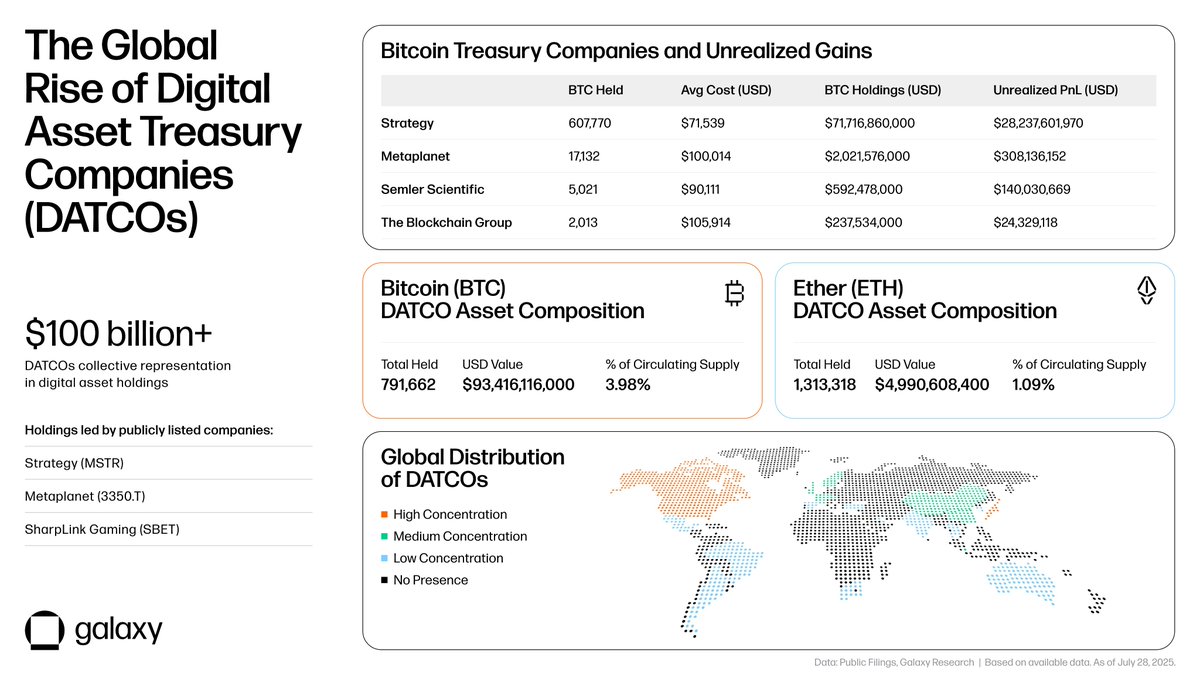

In line with Galaxy Analysis, over $100 billion in digital property is at present held on the stability sheets of what are actually being referred to as Digital Asset Treasury Corporations (DATCOs). Collectively, these corporations management almost 792,000 BTC (valued at roughly $93 billion) and 1.31 million ETH (price round $4 billion).

This marks a serious evolution in monetary technique. A few of these firms deal with crypto as a core reserve asset, just like gold, whereas others are taking a extra lively method — staking Ethereum to earn yield or elevating capital by way of fairness gross sales or SPAC mergers particularly to amass extra tokens.

Whereas many of those corporations are based mostly within the U.S., due to simpler entry to public markets, the DATCO mannequin is quickly gaining floor globally. This enlargement is including liquidity to crypto markets but in addition rising publicity to volatility. In a number of instances, firm inventory costs commerce at multiples of their crypto holdings, a premium that would vanish rapidly if markets appropriate or regulatory scrutiny intensifies.

Galaxy’s information reveals round 160 public firms now maintain BTC, with over 35 corporations managing digital asset positions price greater than $120 million every. As crypto’s position on company stability sheets grows, so do issues about valuation dangers and potential regulatory shifts that would reshape how digital property are handled in monetary reporting.