Crypto possession within the UK has elevated to 12% of adults, up from 10%, based on the Monetary Conduct Authority’s (FCA) newest analysis printed on Nov. 26. Consciousness of cryptocurrencies additionally grew, reaching 93% of the grownup inhabitants.

The FCA’s examine revealed that the common worth of crypto holdings per individual rose from £1,595 to £1,842. Household and associates emerged as the commonest supply of data for many who have by no means bought digital belongings, whereas just one in ten consumers admitted to doing no analysis earlier than investing.

Roughly a 3rd of respondents believed they might file a grievance with the FCA in case of points, in search of recourse or monetary safety. Nevertheless, digital belongings stay largely unregulated within the UK and are thought of high-risk; buyers are cautioned that they might lose all their cash with none regulatory safeguards.

FCA crypto method hampering progress

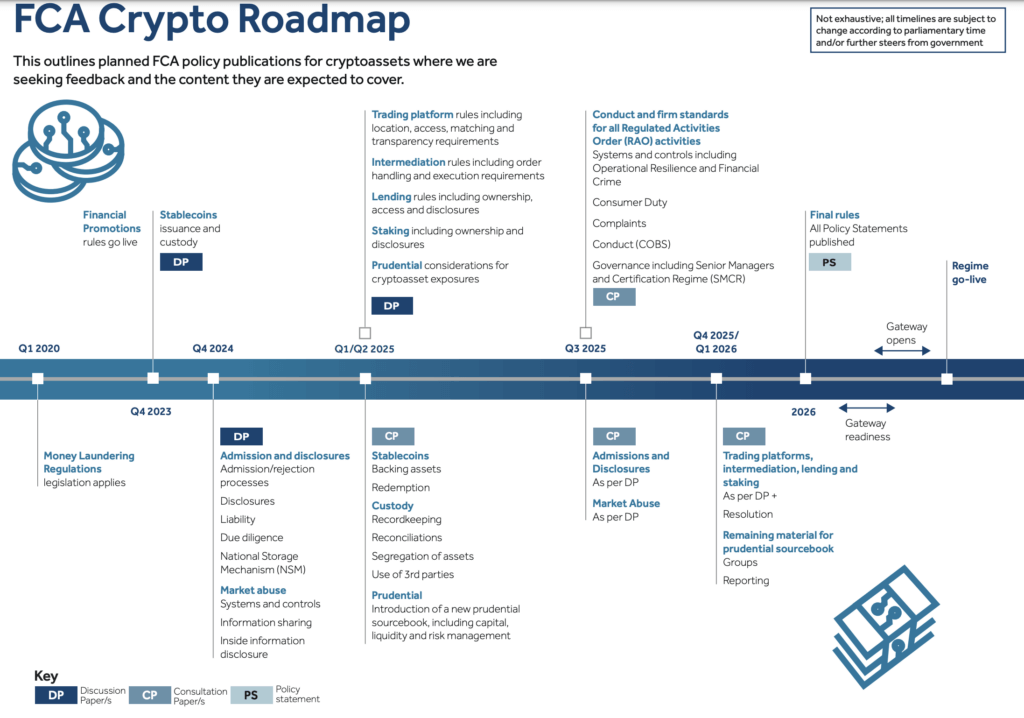

The FCA has begun outlining its method to regulating digital belongings, publishing an indicative roadmap of key dates for the event and introduction of the UK’s crypto regulatory regime. The roadmap particulars a sequence of centered consultations aimed toward fostering transparency and engagement in coverage improvement.

Arun Srivastava, fintech and regulation accomplice at Paul Hastings, informed CryptoSlate

“The UK was at risk of changing into an outlier, with the EU’s MiCA regulation coming into full drive on the finish of this 12 months and the change within the US Administration within the US heralding a recent and crypto-friendly method within the US.

The brand new guidelines will materially change the present regulatory framework within the UK, which operates underneath anti-money laundering laws centered on monetary crime.”

The analysis additionally indicated shifts in client conduct. Extra people are contemplating crypto as a part of a broader funding portfolio, with affect from family and friends cited as a major motive for buy by 20% of contributors. The usage of long-term financial savings to purchase crypto elevated from 19% in 2022 to 26% in 2024, whereas buying with bank cards or overdrafts rose from 6% to 14% over the identical interval.

The FCA’s evaluation means that current occasions have affected client demand for digital belongings, together with the crypto market crash in 2022, the cost-of-living disaster, prison fees towards CEOs of main exchanges, and rising crypto valuations for the reason that finish of 2023.

Notably, 26% of non-crypto customers indicated they’d be extra more likely to make investments if the market and actions had been regulated. The FCA acknowledges that regulation can affect client conduct and is contemplating the way to mitigate dangers related to digital belongings via its coverage work.

FCA crypto roadmap by 2026

Per the FCA’s roadmap, the deliberate regulatory framework for digital belongings contains a number of phases spanning from 2023 to 2026. Key milestones contain implementing monetary promotion guidelines, regulating stablecoin issuance and custody, introducing prudential requirements, and establishing complete guidelines for buying and selling platforms, intermediation, lending, and staking.

Matthew Lengthy, director of funds and digital belongings on the FCA, said:

“Our analysis outcomes spotlight the necessity for clear regulation that helps a protected, aggressive, and sustainable crypto sector within the UK. We need to develop a sector that embraces innovation and is underpinned by market integrity and client belief.”

Following legislative modifications, the FCA has been liable for regulating digital asset promotions since October 2023. Within the first 12 months underneath this regime, the FCA has issued 1,702 alerts, taken down over 900 rip-off crypto web sites, and eliminated greater than 50 apps to fight unlawful promotions concentrating on UK shoppers.