Following the US GENIUS Act, capital is pouring into yield-bearing stablecoins, with Ethena’s USDe main the cost.

Nonetheless, with explosive progress comes rising concern, with overhanging fears about whether or not this can be the subsequent breakthrough or the subsequent UST.

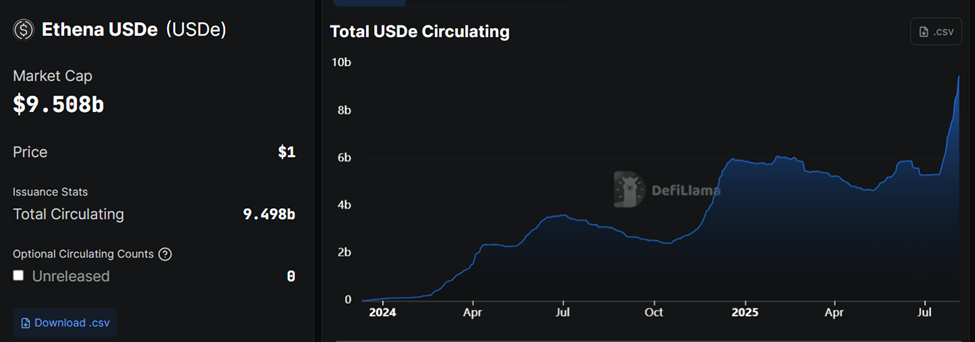

USDe Provide Surges to $9.5 Billion, Now Third-Largest Stablecoin

Ethena’s USDe stablecoin is on an unprecedented progress streak. Over the previous month, its circulating provide has jumped by 75%, reaching roughly $9.5 billion, in line with DefiLlama.

This dramatic enlargement makes USDe the third-largest stablecoin by market cap, trailing solely Tether’s USDT and Circle’s USDC.

Tom Wan, Head of Information at Entropy Advisors, famous that the mixed market cap of USDe and USDtb has surpassed $10 billion. This places Ethena among the many prime 5 DeFi protocols by TVL.

“Excluding the double rely, Ethena nonetheless has $9.4B TVL, and can quickly grow to be one in every of solely 5 DeFi protocols with $10B+,” Wan said.

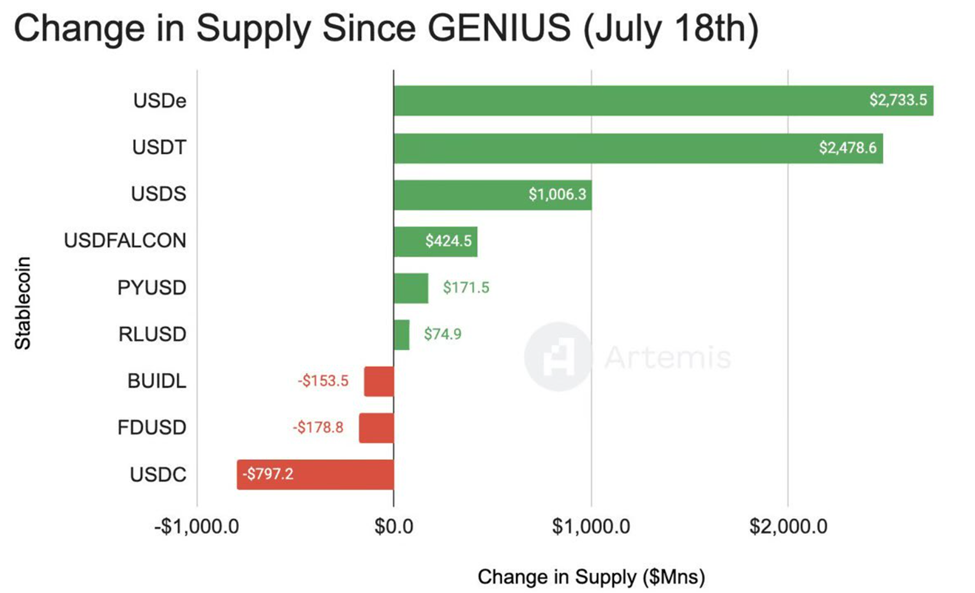

The rise comes after the GENIUS Act handed on July 18, catalyzing capital inflows into yield-bearing stablecoins.

In accordance with David Arnal, a researcher at Sentora (previously IntoTheBlock), USDe added $2.7 billion in internet new provide, essentially the most amongst all stablecoins post-GENIUS.

Tether additionally noticed sturdy inflows of $2.4 billion, whereas USDC skilled outflows of practically $800 million, suggesting shifting market confidence.

“…yield-generating stablecoins are now not only a development however a brand new structural aspect of DeFi,” Arnal noticed.

Analysts Warn USDe Progress Might Be Fragile

Whereas the numbers are spectacular, not everyone seems to be satisfied USDe is on stable floor. Crypto analyst Duo 9 warns that USDe continues to be untested in a real bear market.

“This foundation commerce artificial token stays unvalidated. Till it passes a correct bear market, it’s only a idea. Its ballooning market cap will increase threat when bears return,” he cautioned.

Echoing that concern, one other analyst, Alan the Yield Farmer, drew a pointy parallel to the notorious UST-LUNA collapse, calling Ethena’s USDe and ENA the potential UST/LUNA of this crypto cycle.

He identified that USDe gives a comparatively modest 3.5% APY, whereas options like USDS and USDY yield over 4.5%. That would strain Ethena’s AUM, particularly in unstable markets.

Nonetheless, others argue this comparability is overblown. On-chain analyst Yuki highlighted that USDe efficiently challenged USDT and USDC dominance with out the de-peggable mechanics that doomed Terra’s UST.

In the meantime, Bunjil emphasised an important distinction: USDe is backed by staked ETH and brief hedges, not a hyperinflationary token like LUNA.

“In the event that they began collateralizing with $ENA, I’d run,” Bunjil warned, clarifying that Ethena has averted that mistake.

Ethena Labs Founder Reveals Threat Controls and DeFi Integration

To deal with de-peg considerations, Man Younger, founding father of Ethena Labs, pointed to key integrations that mitigate liquidation dangers.

“…Necessary to notice USDe oracle on Aave now set to USDT eradicating liquidation threat for any non permanent USDe deviation from $1.00 50% APY on USD with multi-billions of capability Solely potential in DeFi, and solely potential with Aavethena,” Younger said.

Yield-bearing stablecoins transcend being only a development and are shaping as much as be a structural pillar of the subsequent section of DeFi.

Nonetheless, as USDe approaches the $10 billion milestone, questions stay. Can Ethena’s artificial stablecoin climate a full market cycle with out unraveling? Or will historical past rhyme with a distinct stablecoin—and a well-recognized catastrophe?

The submit USDe Booms Submit-GENIUS Act, However Is Ethena’s Stablecoin the UST of This Cycle? appeared first on BeInCrypto.

₍^. .^₎⟆ (@0xyukiyuki)

₍^. .^₎⟆ (@0xyukiyuki)