Key Takeaways

- USDe provide rose 70% and USDS rose 23% because the GENIUS Act, regardless of its prohibition on issuer-yield choices.

- Yield-bearing stablecoins like sUSDe (10.86% APY) and sUSDS (4.75% APY) are attracting traders.

- General stablecoin provide could strategy $300B by 12 months’s finish if developments proceed.

Surprisingly, yield-bearing stablecoins have flourished regardless of the GENIUS Act banning direct token yield choices within the U.S.

Buyers are turning to platforms like Ethena’s USDe and Sky’s USDS, staking their holdings for prime returns inside respective protocols.

GENIUS Act Winners Emerge in Stablecoin Progress

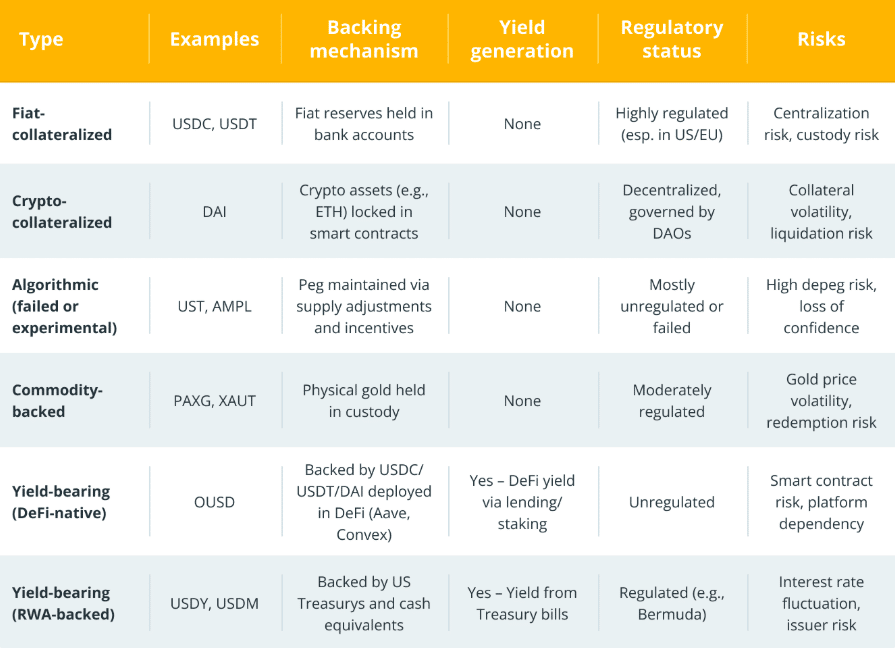

The regulation aimed to limit direct crypto yields, however decentralized platforms pivoted by providing yield by three major mechanisms.

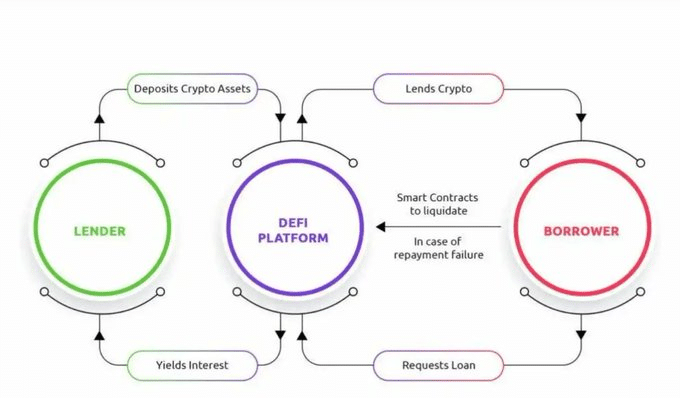

- Lending protocols, akin to Aave and Compound, permit customers to earn curiosity by supplying stablecoins to a liquidity pool, with charges fluctuating based mostly on provide and demand.

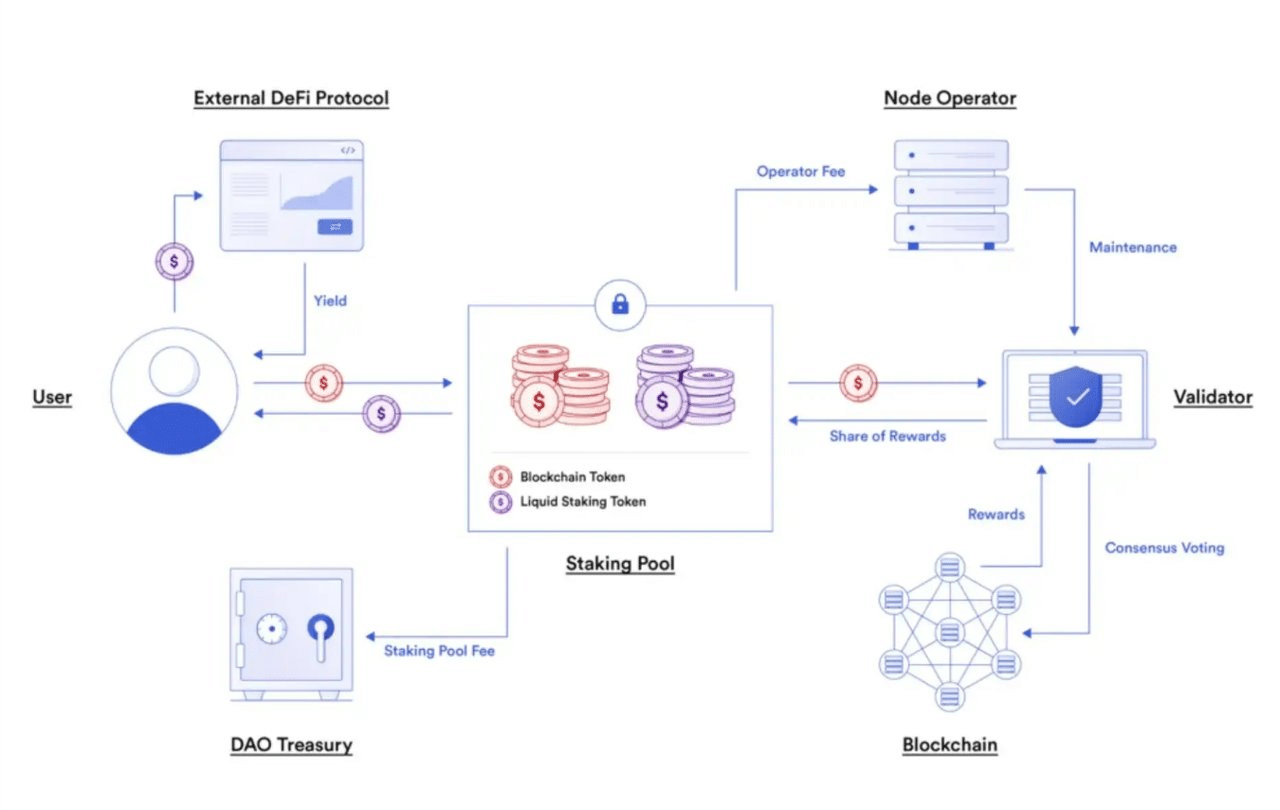

- Staking and liquidity protocols, together with yield farming and aggregators, supply rewards and buying and selling charges to customers who lock their stablecoins.

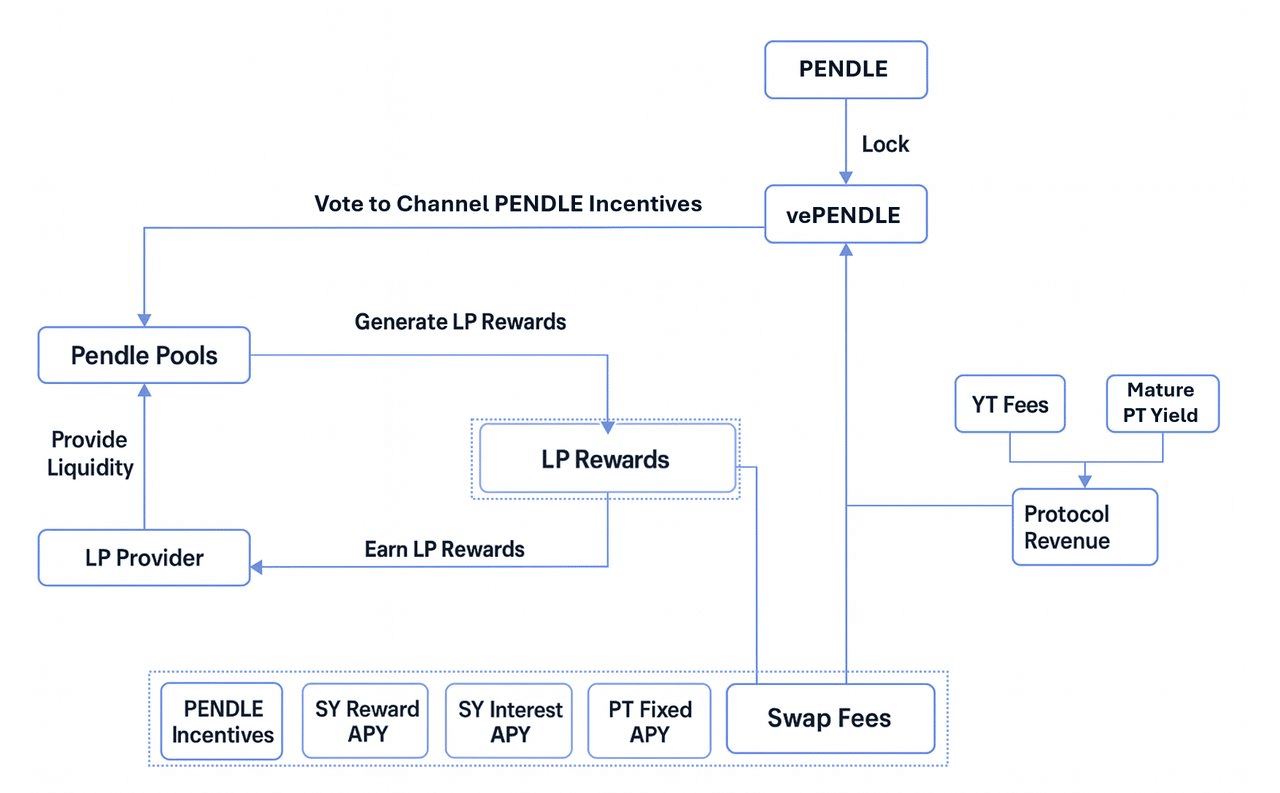

- Lastly, derivatives protocols like Pendle allow extra complicated methods by permitting customers to tokenize and commerce the long run yield of an asset.

Navigating Yield and Regulation

The pursuit of yield-bearing stablecoins is a high-stakes experiment, pushed by consumer demand however more and more difficult by regulation. Frameworks just like the U.S. GENIUS Act and the EU’s MiCA are proscribing direct curiosity choices, forcing tasks to innovate with compliant alternate options.

This creates a important balancing act: delivering returns for customers whereas navigating a fancy regulatory panorama.

Stablecoins Face Conventional Finance Competitors

The stablecoin market has grown considerably this 12 months, with its capitalization nearing $300 billion. Nonetheless, this progress faces a serious headwind from conventional finance.

Banks and establishments are rolling out their very own regulatory-safe tokenized alternate options, a transfer some are labeling “Operation Chokepoint 3.0.”

This technique might see conventional finance hindering stablecoin progress by charging excessive charges for information and transfers, and even blocking crypto functions outright.

Remaining Ideas

Yield-bearing stablecoins have emerged as sudden beneficiaries following regulatory adjustments. The GENIUS Act inadvertently spurred staking-based returns that appeal to capital—however upcoming competitors from tokenized monetary devices could form how lengthy this momentum lasts.

Continuously Requested Questions

Aren’t stablecoin yields banned now?

Sure—however yield is being generated by staking, not direct token issuance.

Can yields beat inflation?

Sure. sUSDe and sUSDS supply inflation-adjusted returns of ~8.16% and ~2.05%, respectively.

Might progress sluggish quickly?

Presumably. Tokenized conventional finance merchandise could siphon demand away.