Bitcoin (BTC) is hovering round $114,000 at present, with merchants cut up on the place it’s headed subsequent. Some imagine August could possibly be the month Bitcoin breaks to an all-time excessive of $125,000, whereas others assume the coin might slip to $100,000.

The market is caught in a tug-of-war between each of those camps, however one factor’s clear: establishments haven’t stopped pouring money into the OG crypto.

And if we do see Bitcoin push larger, regulate smaller initiatives like Bitcoin Hyper (HYPER). This new Bitcoin Layer-2 community is getting numerous buzz as buyers focus on its potential to profit from a BTC breakout.

Bitcoin Appears Shaky Amid Ongoing Consolidation Interval

Bitcoin is down about 1% previously day and 4% for the previous week. It’s nonetheless up over the past 30 days, however the latest pullback has worn out a strong chunk of good points.

The coin’s market cap has taken successful too, slipping to about $2.26 trillion, and merchants aren’t precisely piling into leveraged positions – open curiosity in perpetual futures has been steadily declining.

However regardless of this cool-off, some analysts aren’t apprehensive but. Crypto Rand, for example, lately identified that underlying demand for Bitcoin is fairly robust. Based on his tweet, patrons maintain stepping in throughout these dips, which generally means there’s bullish momentum beneath the floor.

Even so, should you’re checking the charts every day, you’ve in all probability observed that technical indicators are combined. There’s no clear short-term development, and Bitcoin’s simply bouncing round, ready for a catalyst to drive worth in both route.

Is BTC Headed for $100K or $125K This August?

Let’s speak in regards to the huge query: is Bitcoin extra more likely to drop to $100,000 or surge towards $125,000 this month? Dropping to $100,000 would imply a 12% decline from the place we’re at now, placing BTC at its lowest stage since June. In the meantime, a rally to $125,000 can be a ten% climb – and it will mark a recent all-time excessive.

Proper now, the upside goal has loads going for it. That’s as a result of Bitcoin’s every day chart remains to be trending upward. It retains forming larger highs and better lows – traditional bull market conduct.

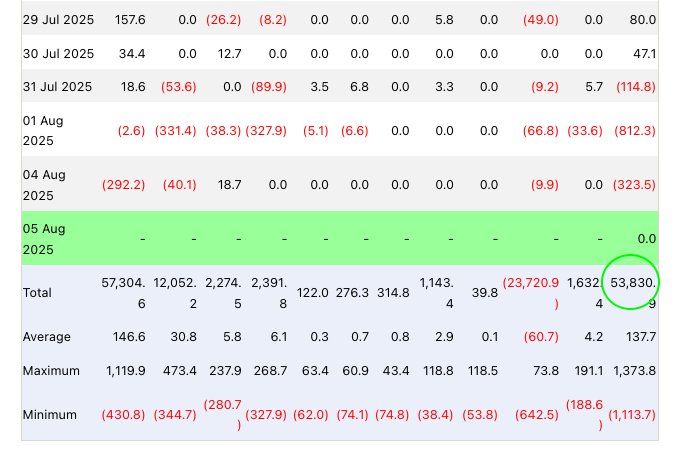

You then’ve bought establishments throwing their weight behind Bitcoin. Spot BTC ETFs have raked in over $19 billion in inflows this 12 months alone, and $53 billion since they went reside, that means these funds now personal roughly 6.8% of all Bitcoin in circulation. Massive cash retains pouring in, and that’s usually an indication that BTC will maintain rising.

Plus, the Fed would possibly lend a serving to hand. If inflation information is available in weaker than anticipated, the prospect of a fee reduce in September will increase, making a risk-on setting. When contemplating all this, it’s much more probably that Bitcoin pushes larger this month than breaks down.

Bitcoin Hyper Set to Profit If BTC Breaks Increased as Presale Hits $7M Milestone

If Bitcoin does make a transfer upward this month, initiatives tied to it – like Bitcoin Hyper – might see a surge in curiosity. Bitcoin Hyper is a brand new Layer-2 community aiming to resolve a few of Bitcoin’s most irritating issues: sluggish transactions, excessive charges, and a scarcity of smart-contract capabilities.

However not like different scaling options you’ve seen earlier than, Bitcoin Hyper takes an uncommon strategy. It makes use of ZK-rollups and integrates the Solana Digital Machine (SVM), permitting builders to create quick, versatile apps much like these discovered on Solana.

You are taking your BTC, bridge it trustlessly onto the Bitcoin Hyper community, after which it may be used throughout DeFi, NFTs, staking, and even gaming apps. If you’re performed, your BTC can simply bridge again out – no worries about shedding custody.

Bitcoin Hyper’s presale has already raised $7 million, exhibiting actual pleasure from early buyers. And it is smart why: the extra Bitcoin’s worth rises, the extra beneficial the BTC bridged into Bitcoin Hyper’s ecosystem turns into.

Increased costs imply extra customers, extra liquidity, and stronger demand for the HYPER token itself. It’s a optimistic suggestions loop that YouTuber Borch Crypto thinks might result in “100x” returns for presale buyers.

Finally, if we see one other BTC breakout, merchants might be searching for low-cap altcoins that would capitalize – particularly ones linked to Bitcoin. HYPER matches that invoice completely, making it a intelligent play if BTC stays bullish.