President Trump’s tariff insurance policies are creating stagflation dangers within the US financial system. This threatens each conventional markets and cryptocurrency costs because the Federal Reserve faces troublesome coverage selections.

The brand new US tariff order underneath President Donald Trump appears to be reaching its last stage. Nonetheless, indicators of stagflation are rising within the American industrial sector.

Financial Information Reveals Warning of US Stagflation

The Institute for Provide Administration reported disappointing companies information on Tuesday. The US Companies PMI for July got here in at 50.1, under expectations of 51.5. Whereas nonetheless above the 50 enlargement mark, which means that the companies sector is increasing, it dropped 0.7 factors from June’s 50.8.

In brief, the US service financial system continues to be rising, however a lot slower than anticipated, and it’s dangerously near shrinking.

The employment index fell to 46.4, down 0.8 factors from the earlier month. When this goes under 50, it implies that companies are chopping jobs, and it marks the bottom stage since March. Conversely, the value index jumped 2.4 factors to 69.9—the very best since October 2022. When this goes above 50, it implies that costs are rising quick.

This mixture creates stagflation, the place fewer jobs exist whereas costs rise concurrently. For normal individuals, it’s more durable to seek out work whereas every thing prices extra. Policymakers face an inconceivable selection between combating unemployment and controlling inflation.

For central banks, combating inflation requires price hikes, whereas stimulating progress calls for price cuts. Each issues can’t be solved concurrently. In stagflation, central banks might wrestle to decrease charges decisively.

Extra Indicators of Stagflation Will Crush the Crypto Market

This backdrop weighed closely on the US monetary markets on Tuesday. The Dow Jones fell 61.90 factors (0.14%) to 44,111.74. The S&P 500 dropped 30.75 factors (0.49%) to six,299.19. The Nasdaq declined 137.03 factors (0.65%) to shut at 20,916.55. Bitcoin additionally fell by roughly 1%.

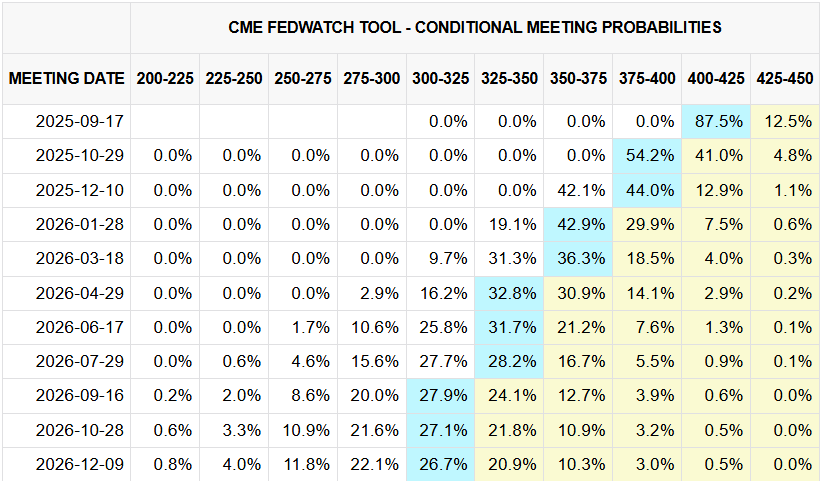

After the July jobs report, expectations modified for Federal Reserve coverage. Markets now count on two price cuts this 12 months as an alternative of three. In line with CME Group’s FedWatch device, markets count on 25-basis-point cuts in September and October.

The chance hole between a price maintain and lower in December is simply 2%. Nonetheless, if stagflation alerts strengthen, this hole will probably widen.

This subject might considerably impression crypto costs. Since Congress handed the GENIUS Act on July 18, Bitcoin has proven growing sensitivity to financial information. Most altcoins have been monitoring Bitcoin’s motion accordingly.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.