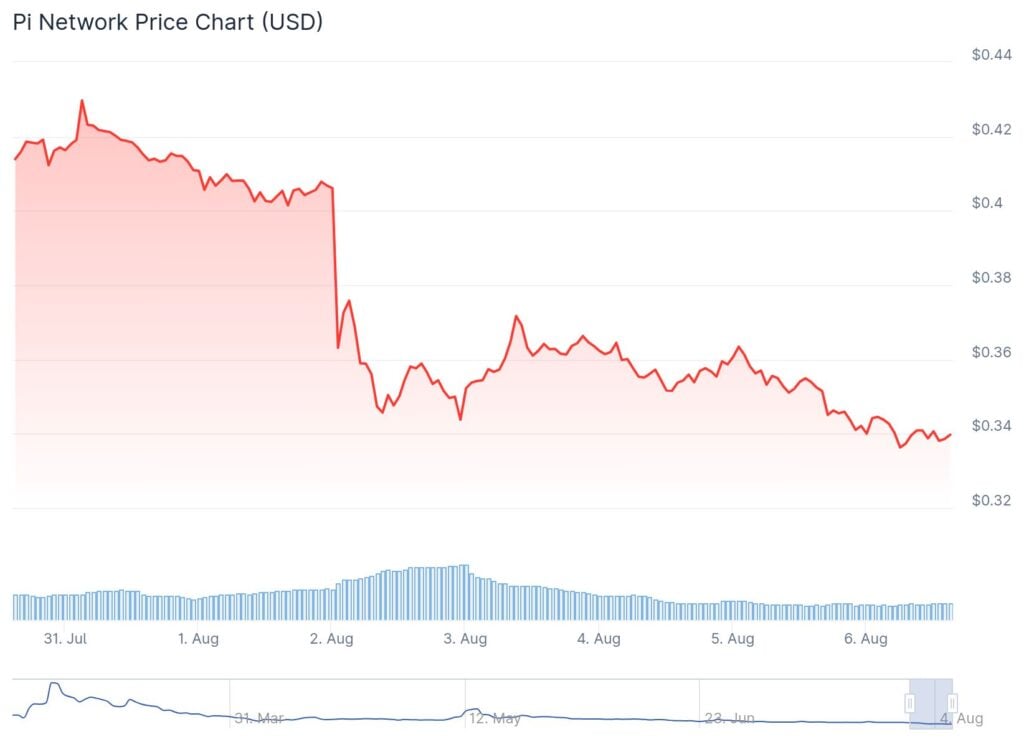

File loss for PI Coin within the final week, which noticed its worth plummet by 20.2% in seven days, the worst efficiency among the many prime 100 cryptocurrencies in response to CoinGecko.

What occurred to Pi Coin within the final week?

The worth of PI has skilled one of many worst weeks of 2025. The asset has dropped by 4.5% within the final 24 hours, shedding a complete of 20.2% in seven days, with a lack of 28.7% within the earlier two weeks and a month-to-month decline near 27%. This destructive development has been confirmed by CoinGecko knowledge, which positions PI because the cryptocurrency with the biggest decline among the many prime 100 tasks by market capitalization.

The downward development is a part of a common correction context of your complete crypto market. Whereas many belongings have skilled slight setbacks, the autumn of PI has been extra pronounced and symptomatic of a rising mistrust amongst buyers in the direction of tasks thought-about “excessive threat”.

Why is Pi Coin crashing greater than different cryptocurrencies?

The latest strikes of the US financial coverage have contributed to this heavy downturn. Particularly, over the last FOMC assembly on July 30, the president of the Fed Jerome Powell halted the rate of interest cuts, however the price of cash stays excessive. Consequently, many market operators have shifted in the direction of belongings thought-about safer, resembling gold and authorities bonds, penalizing rising belongings like PI.

“When credit score tightens, the flight from threat is inevitable”,

some analysts touch upon X.

CoinGecko reviews that sensitivity to macro bulletins and restricted liquidity make cryptocurrencies like PI much more susceptible.

Complicating the image for Pi Coin can be the local weather of uncertainty fueled by the latest industrial tariffs imposed by the Trump administration. These measures have contributed to triggering a broader sell-off within the US inventory market, scaring each institutional and retail buyers who’re making an attempt to restrict their publicity to threat.

What are the implications for individuals who personal Pi Coin?

The worth of PI had reached an all-time excessive (ATH) of 2.99 {dollars} on the finish of February, coinciding with the mainnet launch and a peak of curiosity across the challenge. Nevertheless, after the bull rally, the worth progressively fell, recording a complete lack of 88.6% in comparison with the file ranges by mid-June.

Within the face of this volatility, buyers are confronted with a high-risk state of affairs:

- Sluggish and unsure restoration: within the absence of latest catalysts, the return to earlier ranges appears troublesome

- Improve in promoting strain: those that file vital losses may liquidate, additional weighing on the worth

- Local weather of rising mistrust: the sturdy corrections scale back the propensity to carry PI within the short-medium time period

What occurs now: dangers and doable situations for Pi Coin

The present correction section might proceed if each the macroeconomic uncertainty and the wait-and-see perspective of the Federal Reserve persist. Moreover, the renewed commerce tensions generated by Trump’s tariffs threat fueling a threat aversion development that penalizes much more the non-established cryptocurrencies like PI.

Within the quick time period, with out vital information on the event of the Pi Community challenge or new viral tendencies (as occurred with some memecoins), it’s doubtless that the worth will stay beneath strain from sellers. Then again, new customers or partnership bulletins might provide some perception, even in a context of excessive volatility and little readability on the actual utility of PI as an asset.

Can Pi Coin get better from the present disaster?

The way forward for PI will depend upon the workforce’s capacity to relaunch the challenge and regain belief. Within the weeks following its all-time excessive, the neighborhood had proven indicators of enthusiasm due to the developments of the mainnet. Nevertheless, the lack of momentum and the market correction have dampened these drives, making a transparent relaunch plan a precedence.

The expertise of PI demonstrates as soon as once more that, with out stable foundations and actual development in demand, even the most well-liked cryptocurrencies might be overwhelmed by volatility and investor worry.

What impression does the crash of Pi Coin have on the remainder of the cryptocurrencies?

The PI case matches right into a framework of widespread gross sales: after Trump’s tariffs and the Fed fee freeze, even Bitcoin skilled a decline, whereas sustaining better stability in comparison with rising belongings. The flight from threat notably impacts tasks with much less clear prospects or which can be perceived as “bets”.

Observing the conduct of buyers, it turns into evident that in phases of financial turbulence confidence focuses on most important belongings, whereas secondary tasks endure probably the most extreme penalties.

Conclusions: what to anticipate and how one can navigate

The collapse of Pi Coin represents a warning sign for your complete high-risk crypto sector. The mix of a cautious Fed and Trump tariffs has put strain on PI and related belongings, resulting in double-digit losses in only a few days. Restoration within the quick time period shouldn’t be assured, however the evolution of the crypto market stays unpredictable.

For these holding PI, it stays important to watch information from the workforce, any updates, and macro dynamics.