Ethereum is exhibiting indicators of renewed power after a unstable week, gaining over 13% since final Sunday’s native low across the $3,350 stage. After going through promoting strain and fears of a deeper correction, bulls have stepped again in, pushing the worth greater and regaining management of short-term market momentum. The uptick in volatility has introduced recent consideration to ETH, with analysts watching intently because the asset makes an attempt to reclaim key resistance zones.

The broader image stays basically robust. Institutional curiosity in Ethereum continues to develop, with giant purchases reported in current days. On-chain exercise can also be climbing, suggesting rising demand and person engagement throughout DeFi, NFTs, and Layer-2 ecosystems. Moreover, Ethereum’s position in real-world asset tokenization and good contract infrastructure reinforces its long-term worth proposition.

As ETH navigates its manner by resistance ranges, the following few periods will likely be essential. A profitable consolidation above $3,700 might verify bullish continuation, whereas a rejection could open the door for one more pullback. Both manner, Ethereum’s current efficiency and underlying fundamentals recommend that investor confidence is returning—probably setting the stage for a sustained transfer greater within the coming weeks.

Ethereum Whale Accumulation Alerts Lengthy-Time period Confidence

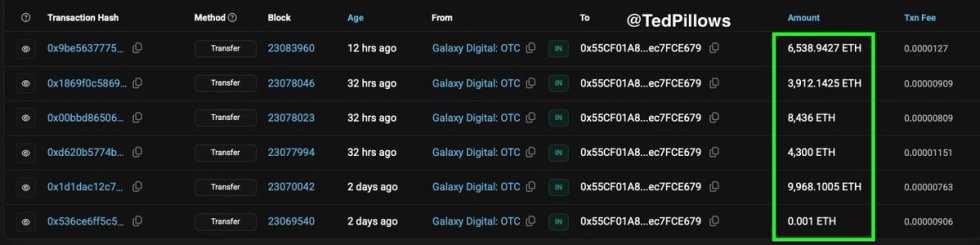

In line with high analyst Ted Pillows, a mysterious whale or institutional participant has bought $122,955,634 value of ETH over the previous two days. This large accumulation comes as Ethereum rebounds from current lows and makes an attempt to reclaim the important $3,800 stage. The transfer is being interpreted by many analysts as a powerful sign that good cash is quietly making the most of the current dip to construct long-term positions.

The size and timing of this purchase recommend strategic intent—seemingly a mirrored image of confidence in Ethereum’s underlying fundamentals and its broader position within the evolving digital financial system. As TradFi (conventional finance) cash continues to circulate into crypto, Ethereum is rising as a core asset for institutional portfolios because of its programmability, strong developer ecosystem, and rising use instances in tokenization and DeFi.

Regardless of Bitcoin exhibiting indicators of overheating and lots of altcoins nonetheless buying and selling beneath key ranges, Ethereum’s relative power stands out. Whereas the broader market stays cautious, this accumulation pattern highlights how knowledgeable buyers are trying previous short-term volatility and positioning for multi-year highs.

Value Motion Particulars: ETH Retests Key Resistance

Ethereum (ETH) has surged over 13% since final Sunday and is now testing the important resistance stage at $3,860, as proven on the 4-hour chart. After forming a neighborhood backside close to $3,350, ETH has steadily climbed with growing quantity, signaling renewed purchaser curiosity and bullish momentum.

The current breakout above the $3,700 mark got here with robust inexperienced candles, supported by rising quantity and a reclaim of the 50, 100, and 200 easy transferring averages (SMAs). This alignment of SMAs beneath the present worth strengthens the bullish outlook, as ETH establishes assist zones between $3,630 and $3,685.

Nonetheless, the $3,860 resistance stage stays a key impediment. It marked earlier rejection zones in late July and has but to be flipped into assist. A confirmed breakout above this vary, adopted by sustained quantity and consolidation, might open the door for ETH to problem the $4,000–$4,200 area within the brief time period.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.