The SEC Chair’s newest determination concerning liquid staking has introduced additional readability to one of many extra difficult elements of DeFi. By treating Liquid Staking Tokens (LSTs) not as securities however as possession receipts, there’s a shift in notion.

As a substitute of viewing LSTs as Wall Road-style contracts, they’re now seen as warehouse slips. It’s a loud and clear message from the SEC, emphasizing that not all the things new ought to be feared.

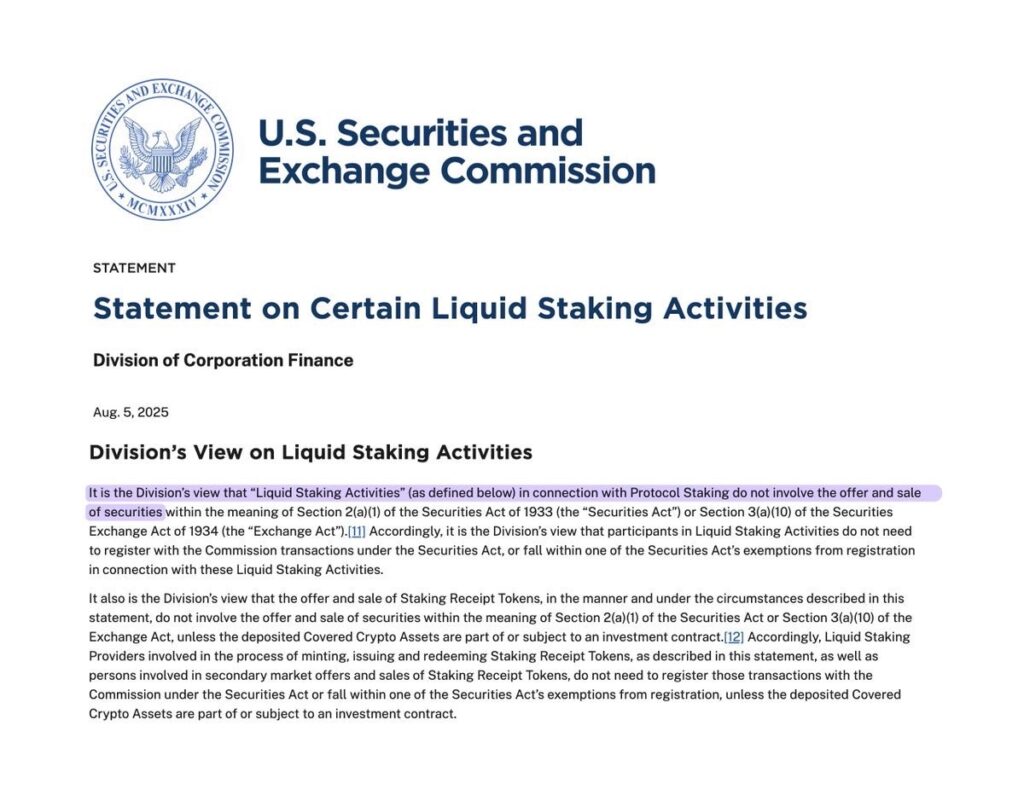

💥The SEC’s Division of Company Finance says liquid staking — when performed as described — doesn’t represent securities exercise.

No registration required.

Large readability win for Ethereum, LST protocols, and stakers. pic.twitter.com/T6zINKMgR7— CryptoPotato Official (@Crypto_Potato) August 6, 2025

Commissioner Hester Peirce additionally supported this view, evaluating LSTs to conventional instruments that preserve traders’ belongings secure with out pointless guidelines or issues.

This latest improvement didn’t hit the brakes; as a substitute, it opened the door. And with that, the U.S. has given crypto innovators a purpose to breathe once more. For potential traders watching the tides flip, this could be the second to search out one of the best crypto to purchase now.

SEC: Liquid Staking Tokens Like Warehouse Receipts, Not Securities

A much-needed step has been taken by the U.S. Securities and Trade Fee towards regulatory readability within the cryptocurrency house.

An up to date view on liquid staking preparations below protocol staking has been launched in statements by SEC Chair Paul Atkins and Commissioner Hester Peirce.

This demonstrates the company’s dedication to evolving digital asset laws and positioning the U.S. as a possible international chief in crypto innovation.

Moreover, the Division of Company Finance issued a clarification stating that liquid staking actions don’t represent the provide or sale of securities below present federal legal guidelines.

Liquid staking actions seek advice from conditions the place customers stake belongings by means of a protocol, delegate, or third get together.

Why is that this distinction necessary? As a result of it supplies larger readability concerning Liquid Staking Tokens (LSTs).

When individuals lock up their cryptocurrency, they obtain LSTs in return. These tokens function proof that they nonetheless personal the unique crypto belongings, somewhat than representing funding contracts or securities.

LSTs let individuals use or transfer the worth of their locked crypto with out having to unlock it first. The SEC in contrast this to issues like warehouse receipts or transport paperwork, which additionally present possession of one thing with out really shifting it.

Atkins aimed for the wholesome improvement of the market by guiding it below his management to foster innovation whereas defending traders.

Peirce supported the Division’s conclusion that liquid staking isn’t the identical as promoting securities. As a substitute, she likened it to a standard system the place somebody entrusts their items to an agent, and in return receives a receipt that proves they nonetheless personal the products.

Greatest Crypto to Purchase Now

With the SEC now treating Liquid Staking Tokens as non-securities, they’re clearly laying down “guidelines of the street,” boosting investor confidence in navigating staking protocols. This method goals to unlock new yield alternatives whereas lowering compliance danger.

Snorter

As regulatory readability units in, traders usually tend to gravitate towards tokens like Snorter, which supply an edge in buying and selling and staking.

AI meme cash are revolutionizing the crypto sector by mixing meme tradition with synthetic intelligence. One such coin is Snorter.

With unmatched velocity, it’s remodeling meme coin buying and selling into lightning-fast decision-making. In brief, it brings institutional-style technique to retail merchants.

Meme cash had been as soon as purely speculative tokens primarily based on jokes and viral tendencies. However with the mixing of AI, they’re now providing much-needed utility.

Constructed on Solana for ultra-fast execution, the Snorter Bot is a Telegram-based AI buying and selling bot. It empowers customers to snipe meme coin launches straight from chat, with built-in velocity and danger safety.

Holding $SNORT can profit merchants, because it fees a low price of 0.85%, giving lively customers an actual edge over bots and whales.

What about safety? Snorter makes use of AI sample recognition to guard towards honeypots and rug pulls. Furthermore, with MEV and front-running safety, it stands out as a complete answer for high-risk meme coin buying and selling.

The conclusion is straightforward and clear: Snorter represents the confluence of memes, utility, and buying and selling effectivity that outline fashionable crypto alternatives.

TOKEN6900

Because the SEC supplies readability concerning LSTs, the step is far wanted. Nonetheless, within the case of TOKEN6900, all the things is uncooked and clear as crystal.

Launched as an Ethereum-based meme coin, TOKEN6900 comes with a simple narrative. That’s, it has no utility or roadmap targets, aside from creating vibes within the crypto universe.

A real meme coin, TOKEN6900 opens a brand new dimension for high-risk, high-return crypto traders. And it’s backed by a quick rising neighborhood together with a large advertising push.

Missing any ties to decentralized actions or cultural significance, its whitepaper is refreshingly trustworthy about its lack of route. This token affords no use instances or outlined objective.

Typically thought of a cousin of SPX6900, TOKEN6900 is loosely impressed by each the S&P 500 and SPX6900, combining parts of each below the T6900 model to create one thing distinctive.

The TOKEN6900 staff plans to promote 80% of the full provide in the course of the presale, retaining the remaining 20%. The overall provide is capped at 930,993,091 tokens.

In accordance with the well-known crypto YouTuber ClayBro, TOKEN6900 is among the greatest cryptos to purchase proper now. And it’s embracing the chaotic and hilarious nature that meme cash are supposed to possess.

It’s a well-thought-out technique designed to stop extra tokens from coming into circulation and to guard presale individuals from the danger of dilution.

Greatest Pockets Token

Using the wave of regulatory readability, Greatest Pockets Token stands out as a gateway for seamless staking and custody, providing traders a user-friendly interface by means of its cell app.

It connects customers to meme cash, ICOs, utility tokens, and far more. As a number one Web3 non-custodial pockets, it has already raised over $14 million in its presale.

Spanning over 330 decentralized protocols and greater than 30 cross-chain bridges, Greatest Pockets affords aggressive costs throughout over 60 supported chains.

It stands out as a best choice within the crypto house as a consequence of its dedication to constantly bettering its options and transactional capabilities.

Greatest Pockets serves over 250,000 month-to-month lively customers who profit from its sturdy transaction infrastructure.

With swaps powered by Rubic, buying and selling on Greatest Pockets is a seamless expertise by means of its in-app buying and selling module.

This is only one side of Greatest Pockets’s broader give attention to cost-efficient transactions. It has far more in retailer, together with plans to introduce gas-free transactions that can additional optimize commerce execution.

And it additionally employs instruments like Upcoming Tokens, which not solely meet the wants of quick and handy buying and selling but additionally place it on the middle of what continues to drive crypto adoption.

Conclusion

The SEC’s newest steerage on liquid staking marks a watershed second for U.S. crypto regulation. It’s a step towards clearing the fog round LSTs, exhibiting that they don’t seem to be securities however somewhat a sensible proof-of-ownership mechanism.

By distinguishing staking receipts from funding contracts, Chair Atkins and Commissioner Peirce have ushered in a extra mature regulatory panorama. This displays the push to stability innovation with investor safety. As liquid staking protocols achieve legitimacy, now could be the strategic second to reassess asset allocations and determine one of the best crypto to purchase now.