PEPE’s worth hit a brand new all-time excessive on November 13, after it was listed on Coinbase. It has been up 105% prior to now month, although it’s down practically 10% within the final seven days. Indicators like RSI and MVRV recommend additional corrections might happen as bullish momentum weakens.

A possible demise cross within the EMA traces might push PEPE to key helps at $0.0000139 or decrease. Nevertheless, a development reversal might see PEPE testing resistances at $0.0000228 and aiming for a brand new all-time excessive at $0.000030.

PEPE Isn’t Oversold But

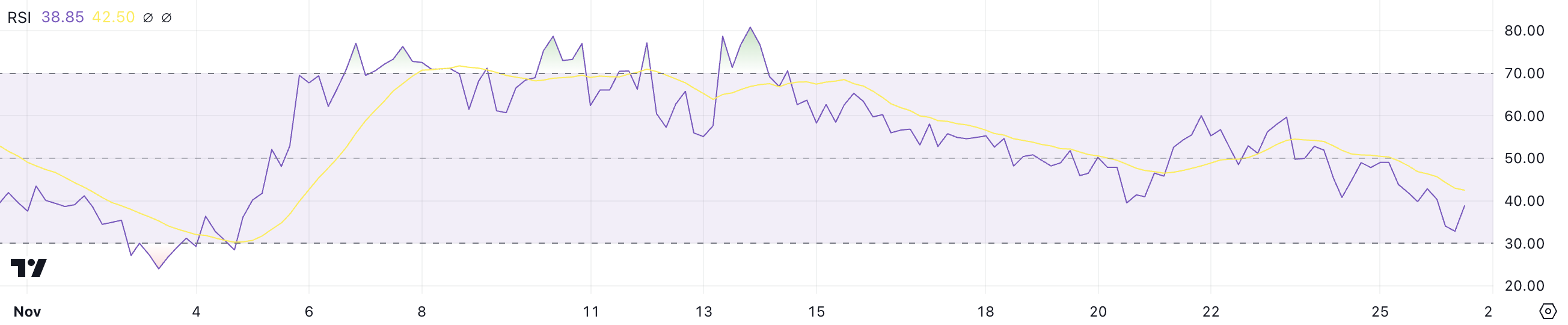

PEPE RSI has fallen to 38.8 from 60 within the final three days, indicating weakening bullish momentum. The RSI, or Relative Energy Index, measures worth momentum on a scale of 0 to 100, with values above 70 signaling overbought circumstances and beneath 30 indicating oversold ranges.

The drop displays rising promoting strain, however the present RSI suggests PEPE is just not but oversold.

At 38.8, PEPE’s RSI is close to a key degree, because it hasn’t dropped beneath 30 since November 3. This means the worth might stabilize quickly if historic patterns maintain. The latest drop didn’t change the truth that PEPE is the third greatest meme coin available in the market, beneath DOGE and SHIB.

Nevertheless, if the RSI dips additional beneath 30, it might set off stronger bearish momentum and result in additional worth corrections.

PEPE MVRV Ratio Exhibits The Correction May Proceed

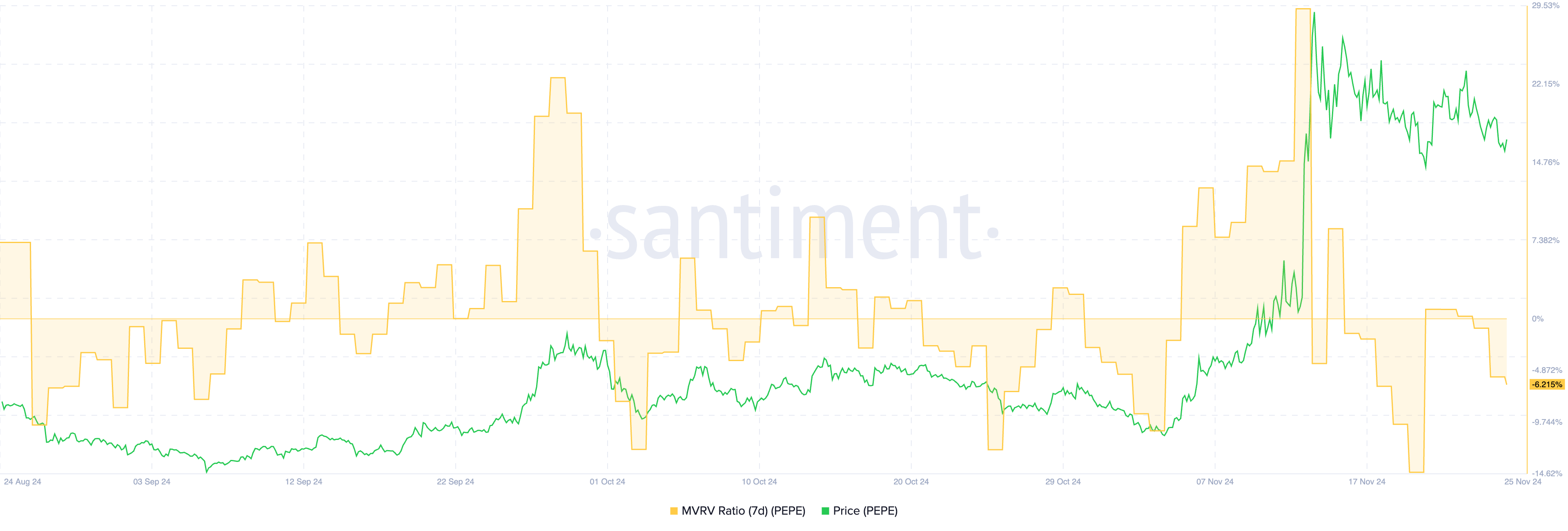

PEPE’s 7-day MVRV ratio is at present at -6.2%, signaling that latest holders are, on common, at a slight unrealized loss. The MVRV, or Market Worth to Realized Worth ratio, measures the revenue or lack of holders based mostly on the token’s market worth relative to the worth they paid.

Unfavourable MVRV ranges reminiscent of this recommend diminished promoting strain since holders are much less prone to promote at a loss.

Traditionally, PEPE has seen sturdy worth recoveries when its 7-day MVRV dropped beneath -9.7%, indicating the potential for additional correction earlier than one other upward surge.

This sample means that whereas the present MVRV degree hints at consolidation, a deeper dip might create circumstances for a bullish rebound. If the MVRV tendencies decrease, it might set the stage for renewed accumulation and a contemporary worth restoration.

PEPE Worth Prediction: New All-Time Highs Could Be Postponed For Now

PEPE’s EMA traces present a bearish sign, with a possible demise cross-forming, the place short-term EMA traces cross beneath long-term ones.

If this sample materializes, it might set off additional corrections. PEPE worth will probably take a look at help at $0.0000139 and $0.0000108. Ought to promoting strain intensify, PEPE might fall to $0.0000077.

However, if market confidence returns and the development reverses, PEPE worth might problem resistances at $0.0000228 and $0.000026.

Breaking above these ranges might push PEPE worth towards $0.000030, setting a brand new all-time excessive.

Disclaimer

In step with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.